Share

|

Getting your Trinity Audio player ready...

|

High earners in California are about to feel the effects of what the Wall Street Journal describes as a “stealth tax increase” that will hit the state’s upper-middle class especially hard.

Last year, Gov. Gavin Newsom approved legislation designed to fund an extension of the state’s paid family leave benefit. Senate Bill 951 eliminates the $145,600 wage limit on California’s 1.1% employee payroll tax for State Disability Insurance (SDI), meaning the tax will be collected on wages over that amount going forward.

The change goes into effect on Jan. 1, 2024.

This adjustment will primarily affect high earners whose SDI tax hit was capped due to the wage ceiling. The change translates into a rise in California’s top marginal tax rate to 14.4% from 13.3% for those earning over $1 million, according to the California public accounting firm HCVT.

“So California’s upper-middle class will pay more than millionaires in almost every state save New York, New Jersey, and Hawaii,” the Wall Street Journal said in an editorial last year.

Newsom signed the bill “on the sly,” the Journal said. “High earners won’t know what hit them until it does,” the editorial added.

Tax Will Expand Wage Replacement for Lower-Paid Workers

The expanded tax collection will fund an increase in the percentage of earnings that low-wage workers receive, up to 90%, while out on paid family leave or disability. Supporters of the bill said that under the current program, many of California’s lowest wage earners could not afford to go on parental or family leave if they received the current maximum of 70% of their wages while away from the job.

Newsom defended the tax expansion in a news release following his signing of SB 951.

“California families and our state as a whole are stronger when workers have the support they need to care for themselves and their loved ones,” the governor said. “California created the first Paid Family Leave program in the nation 20 years ago, and today we’re taking an important step to ensure more low-wage workers, many of them women and people of color, can access the time off they’ve earned while still providing for their family.”

The Wall Street Journal noted that the SDI payroll tax could potentially rise even higher in the coming years if the additional revenue does not sufficiently cover the cost of the expanded leave benefit.

Read more at The Wall Street Journal

RELATED TOPICS:

Categories

Oil Prices Jump on Possible Iranian Supply Disruption

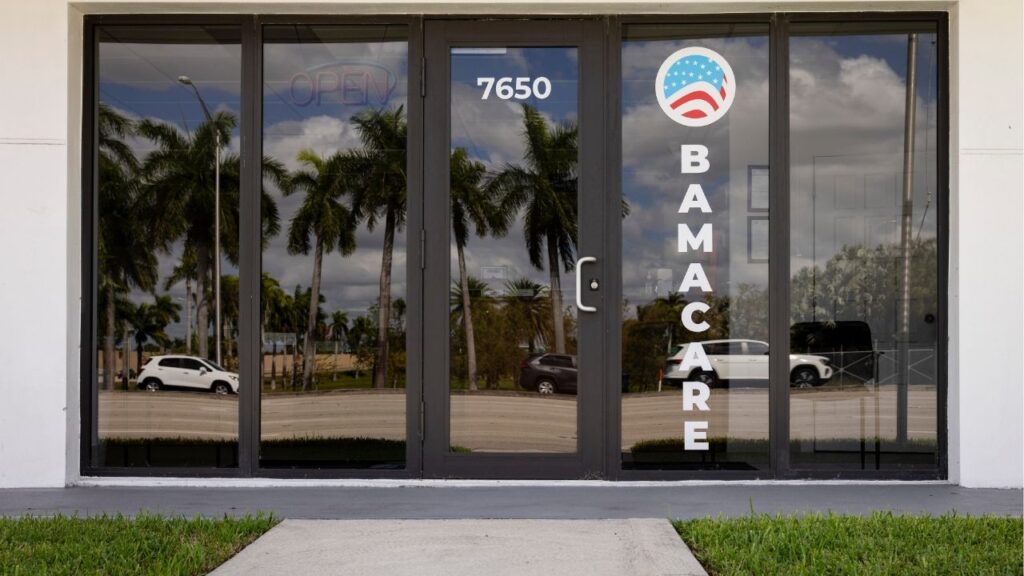

Initial Obamacare Enrollment Drops by 1.4 Million