Share

|

Getting your Trinity Audio player ready...

|

It is truly amazing – and not in a good way – that California’s politicians cannot grasp a phenomenon that has plagued state finances for years, known as “volatility.”

Dan Walters

CalMatters

Opinion

It’s this: The state budget is extraordinarily dependent on personal income tax revenues, most of which comes from a relative handful of upper-income taxpayers whose incomes vary year to year because much of it comes from investments.

When the affluent make lots of money, the state treasury overflows with revenue, but when the economy falters, incomes and tax revenues fall. Unfortunately, because politicians have short attention spans, they tend to increase spending when revenues surge, only to face deficits when they inevitably decline.

The syndrome’s peaks and valleys have become more severe because dependence on the wealthy has increased, economic cycles have become more acute and windfalls tend to be spent on services that are politically difficult to adjust, such as public schools, health care and aid to the state’s poor families.

Actually, California politicians do grasp volatility. That was demonstrated 11 months ago when Gov. Gavin Newsom proposed a 2023-24 budget that addressed what he said was a $22.5 billion deficit just eight months after he had boasted of a $97.5 billion surplus.

“No other state in American history has ever experienced a surplus as large as this,” Newsom had bragged in May 2022, thus encouraging his fellow Democrats in the Legislature to sharply increase spending.

Newsom Blames ‘Boom and Bust’ Tax Structure

When Newsom acknowledged the looming deficit last January, he blamed revenue volatility, displaying a chart showing big swings in income taxes on capital gains and saying it “sums up California’s tax structure, sums up boom and bust.”

Gabe Petek, the Legislature’s budget analyst, revealed last week that accumulated deficits for the 2022-23, 2023-24 and the forthcoming 2024-25 fiscal years, based on spending commitments already made and current and projected revenue, are $68 billion.

“Largely as a result of a severe revenue decline in 2022‑23, the state faces a serious budget deficit,” Petek told the Legislature. “Specifically, under the state’s current law and policy, we estimate the Legislature will need to solve a budget problem of $68 billion in the coming budget process.”

Moreover, Petek’s office projects deficits in the neighborhood of $30 billion a year for the remainder of Newsom’s governorship.

So it’s not that Newsom and legislators don’t know about the corrosive effects of volatility – it’s that they, like their predecessors, are unwilling to do what’s necessary to counteract it: overhaul the revenue system.

When volatility first became a major problem during the Great Recession, then-Gov. Arnold Schwarzenegger and legislative leaders created a commission to suggest remedies. Chaired by businessman Gerald Parsky, the commission held months of hearings and finally, on a divided vote, recommended the state reduce its dependence on income taxes and shift to a revised form of sales tax.

The report was buried as soon as it reached the Legislature. When Jerry Brown returned to the governorship in 2011, he persuaded voters to create a “rainy day fund” that would absorb some revenues during boom times and cushion the impact of future downturns.

The fund now has about $24 billion and a separate school reserve has $8.1 billion. At best, reserves would cover less than half of the $68 billion deficit and none of the $90 billion in projected deficits for the three following years.

It’s certainly better to have those reserves than not, but they are incomplete responses to volatility and that a judicious, even gradual, overhaul of the tax system is still the best solution, as politically difficult as that may be for a Legislature dominated by left-leaning Democrats.

Procrastination will only make the problem worse.

About the Author

Dan Walters has been a journalist for nearly 60 years, spending all but a few of those years working for California newspapers. He began his professional career in 1960, at age 16, at the Humboldt Times. CalMatters is a public interest journalism venture committed to explaining how California’s state Capitol works and why it matters. For more columns by Dan Walters, go to calmatters.org/commentary.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to rreed@gvwire.com for consideration.

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

2 days ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

2 days ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

2 days ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

2 days ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

2 days ago

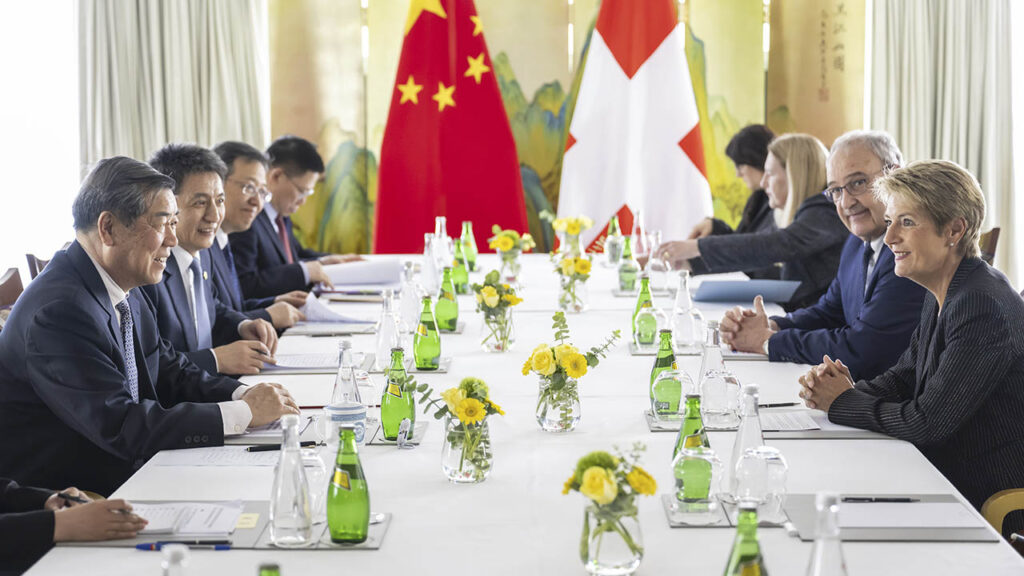

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick