Share

|

Getting your Trinity Audio player ready...

|

The bankruptcy filing by Bitwise Industries sheds light on who it owes money to and how much.

The list published Wednesday in a Delaware federal court includes local and national investors, government agencies, and employees.

The local creditors include several well-known successful Fresnans and businesses. Among them: developer Ed Kashian, beverage magnate Lou Amendola, and property manager Brad Hardie.

And, in one of the most interesting nuggets from the filing, Bitwise appears to blame its management team for the financial carnage, citing a failure to keep accurate accounting records.

The bankruptcy filing came the same day GV Wire reported that federal and state investigators were probing Bitwise’s financial collapse.

Fresno Family Owed $230K

FTF Sales, Inc. is a Fresno sales consulting firm, run by Flavia Flores. Her husband Rogelio Flores said they were initial investors in Bitwise. Co-CEO Jake Soberal approached them for a loan this year.

Rogelio wondered if it was too good to be true. Soberal explained that Bitwise needed funds to help buy and sell property, known as arbitrage, Rogelio said.

“We knew Jake and his wife. We were friends,” Rogelio said.

After Flavia contacted Soberal, who reassured her that she would be paid back, Rogelio said he didn’t have the heart to tell her about subsequent reports of Bitwise’s financial problems.

“Was (Soberal) that desperate that he went to his friends and people he knew and swindled them? Or was he still trying to do the cash flow float? We kind of don’t know,” Rogelio said.

Bitwise owes FTF $230,000, according to the filing.

“This is obviously also retirement money for us,” Flores said.

$2.5 Million Owed to Employees

Bankruptcy filings also show that Bitwise owes $2.5 million to 214 different employees — including Soberal and fellow co-CEO Irma Olguin Jr. — for “reimbursements.”

It is unclear if that is for unpaid work time, bounced paychecks, absconded insurance premiums and 401(k) deposits, unpaid expenses such as mileage, or a combination thereof.

The filings list six secured creditors, meaning they hold a priority on recovering money from sold-off assets. They have liens on Bitwise property.

906 Ventures, LLC is at the top of the secured creditors’ list, owed $10 million. Although listed as based in Denver, there is no record of the company with the Colorado Secretary of State. The company did not respond to an email seeking comment.

Local Businesses Among the Unsecured Creditors

Several other Central Valley businesses appear in a listing of 122 unsecured creditors.

The reports leading up to Bitwise’s demise included descriptions of Soberal soliciting short-term, high-interest loans to apparently keep his company afloat. What Soberal was promising and claims made about the security of those loans have led to at least two lawsuits for fraud.

Both Catalyst Communications and Agri Capital filed lawsuits in Fresno County Superior Court, making them the only investors to publicly reveal a relationship with Bitwise.

Agri Capital, a Chowchilla-based firm, is owed $1.1 million, since April 26. Related company CA Ag says it is owed $560,000. Another entry, based on the lawsuit, is listed for an “undetermined” amount.

Bitwise owes Mark Astone/Catalyst $230,000 plus “undetermined,” according to their lawsuit.

Other Central Valley Creditors Include Brad Hardie, Ed Kashian

AHBH, LLC (Hardie) and Hardie Enterprises are connected to Fresno property manager Brad Hardie. They are owed $3.2 million in total, according to court documents.

Amendola Investments and the related Fresno Beverage Company are owed $3.6 million and $3 million, respectively, for debts incurred in April.

Farmer and businessman Donald Peracchi is owed $830,000 for two debts from April. A listing of Donald and Judith Paracchi seeks an additional $200,000, documents state.

Fresno developer Ed Kashian is seeking the return of $575,000 debt from a May 17 transaction with Bitwise.

Fresno real estate investment HGM Holdings is owed $480,000.

GV Wire reached out to several of the investors, and most did not want to respond on the record.

However, one replied for the record on condition of anonymity. That claimant questions the legitimacy of Bitwise’s bankruptcy filing.

“At this point, any communication or filing from Bitwise, the board, or their employees is likely false. Even their bankruptcy filing that was signed under penalty of perjury is riddled with verifiable inaccuracies and misrepresentations,” the investor said.

Several former employees are also listed as claimants, as well as Bitwise Industries, Inc. itself ($9.9 million), Soberal ($58,000), and Olguin ($720,000).

About the Bankruptcy Filing

In a brief news release, the company said “The filing follows an investigation conducted by the Board of Directors, which concluded it is in the best interest of the Company and its investors, creditors, former employees, and other interested parties to file for Chapter 7 relief.”

In the bankruptcy documents filed Wednesday, Bitwise listed $253 million in assets and $189 million in liabilities. It reported $276,491 cash on hand, deposited in multiple bank accounts. It is not yet clear if the assets are greater than the liabilities.

In the bankruptcy documents, the company seemingly placed the blame on its management.

“The books and records of the Company are substandard and materially incomplete. Further, significant irregularities also exist,” the filing, made Thursday in a Delaware federal court said.

The filing said the lack of well-kept books “hindered the Company’s ability to make such an estimation” of financial records.

‘Undetermined’ Amount Owed to Tax Agencies

Several government agencies are listed as creditors with priority unsecured claims. They are the IRS, and the tax departments for the state of Arizona, Colorado, Alabama, Florida, New York, Oklahoma, Pennsylvania, Texas, and Washington.

All of these claims are listed as “undetermined.”

RELATED TOPICS:

Categories

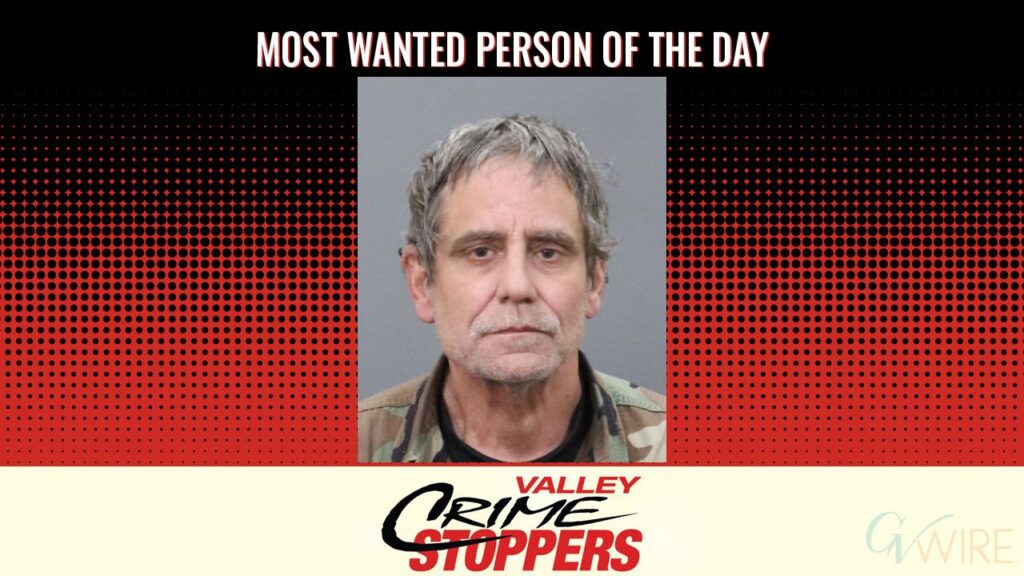

Valley Crime Stoppers Seeks Help in Locating Assault Suspect