Share

|

Getting your Trinity Audio player ready...

|

The Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation.

Yet top Fed officials have made clear that any such pause may be brief — more of a “skip” — with another rate hike likely as soon as their next meeting in late July.

Fed Chair Jerome Powell and other top policymakers have also indicated that they want to assess how much a pullback in bank lending might be weakening the economy. Banks have been slowing their lending — and demand for loans has fallen — as interest rates have risen.

Some analysts have expressed concern that the collapse of three large banks last spring could cause nervous lenders to sharply tighten their loan qualifications and worsen the drop in lending. Economists at Goldman Sachs have estimated, though, that such damage will be modest.

For the Fed, “skipping” a rate hike at this week’s meeting may be the most effective way for Powell to unite a fractious policymaking committee. The 18 committee members appear split between those who favor one or two more rate hikes and those who would like to leave the Fed’s key rate where it is for at least a few months and see whether inflation further moderates. This group is concerned that hiking too aggressively would heighten the risk of causing a deep recession.

A government report Tuesday on inflation offered some ammunition to both camps, with overall price increases sharply slowing but some measures of underlying inflation remaining high. Consumer prices as a whole rose a modest 4% in May from 12 months earlier, the smallest such rise in more than two years and way below April’s 4.9% annual increase.

Yet much of that drop reflected sharply lower gas prices and slowdown in food inflation. Excluding volatile food and energy costs, uncomfortably high inflation persisted: So-called core prices rose 5.3% year over year, down from 5.5% in April but far above the Fed’s 2% annual target.

At the same time, the gradual but steady decline in overall inflation suggests that the Fed’s rate hikes have had some success. The central bank has jacked up its key rate by a substantial 5 percentage points since March 2022.

Those hikes have led to much higher costs for mortgages, auto loans, credit cards and business borrowing. The Fed’s goal is to achieve the delicate task of slowing borrowing and spending enough to cool growth and tame inflation, without derailing the economy in the process.

Rents and Used Car Prices Remain High

Tuesday’s inflation data showed that most of the rise in core prices reflected high rents and used car prices. Those costs are expected to ease later this year.

Wholesale used car prices, for example, fell in May, raising the prospect that retail prices will follow suit. And rents are expected to ease in the coming months as new leases are signed with milder price increases. Those lower prices, though, will take time to feed into the government’s measure.

Some economists have suggested that if those measures start to fall and reduce core inflation, the Fed might end up keeping its key rate unchanged for the rest of the year. Or the policymakers might decide to raise their key rate one last time in July, to about 5.4%, and keep it there.

“We think next month’s increase is probably the last of the cycle,” said Alan Detmeister, an economist at UBS.

On Wednesday, Fed officials will also update their quarterly economic projections, including a forecast of what their key rate will be at year’s end. Most economists expect that rate to tick up from the current 5.1% to 5.4%. That would signal that the central bank doesn’t think it has yet curbed inflation. If inflation were to remain chronically high in the months ahead, the Fed might decide to continuing raising rates.

The economy has fared better than the central bank and most economists had expected at the beginning of the year. Companies are still hiring at a robust pace, which has helped encourage many people to keep spending, particularly on travel, dining out and entertainment.

As a result, the Fed’s updated forecasts Wednesday may reflect its expectation that economic growth will pick up, albeit modestly. Analysts say the policymakers will likely project that the economy will expand 1% this year — a sluggish figure but up from a forecast in March of an anemic 0.4%.

Fed officials will also likely forecast a lower unemployment rate than they did three months ago, perhaps to 4.1% by year’s send, compared with their forecast in March of 4.5%. (The current jobless rate is 3.7%.)

In addition, they will likely raise their inflation estimate, with year-over-year core inflation envisioned to reach 3.8% by the end of this year, up from a forecast of 3.6% in March.

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

1 day ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

1 day ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

1 day ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

1 day ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

1 day ago

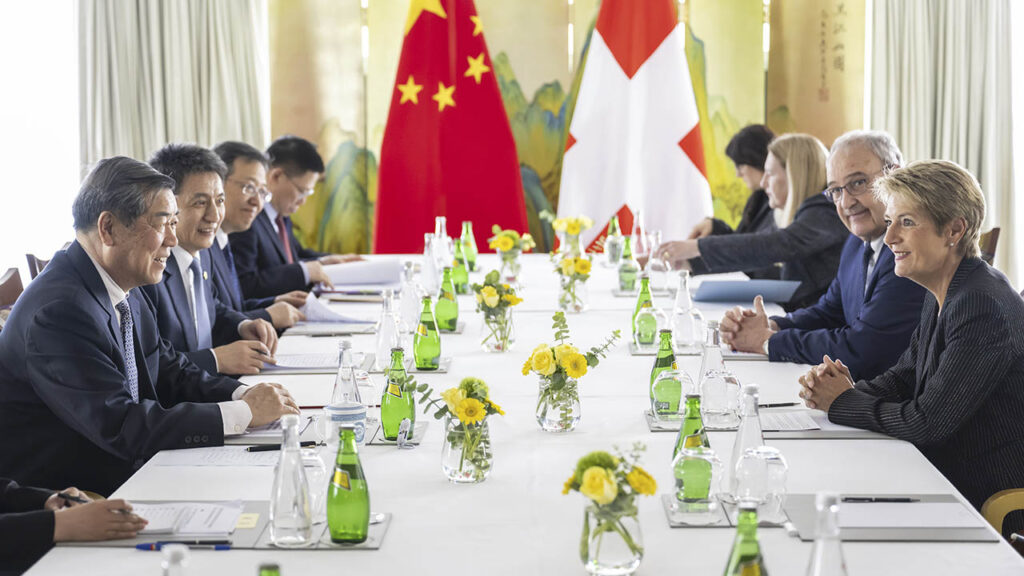

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick