Share

|

Getting your Trinity Audio player ready...

|

Although McClatchy’s 30 newspapers, including The Fresno Bee, have yet to report on it, the chain’s owner, hedge fund Chatham Asset Management, and its founder, Anthony Melchiorre, have settled a dispute with the Securities and Exchange Commission for $19.3 million.

Chatham and Melchiorre also agreed to prohibitions from serving in certain positions in the investment industry, pursuant to the Investment Company Act, the SEC said in a news release.

Had they gone to trial and been convicted, the Investment Advisers Act of 1940 provides courts with the authority to impose imprisonment of up to five years.

SEC Alleged Chatham Improperly Traded Securities

Before the settlement, the SEC alleged that New Jersey-based Chatham improperly traded fixed-income securities. Under the settlement, Chatham and Melchiorre consented to the SEC’s order without admitting or denying its findings.

You can learn about the specific charges the SEC made against Chatham and Melchiorre from the finance trade publication Pensions & Investments.

Sanjay Wadhwa, deputy director of the SEC’s enforcement division, said in a statement to the publication that Chatham’s trading in American Media Inc. bonds had the effect of “increasing the prices of those generally illiquid securities in a way that was disconnected from economic reality.”

American Media Inc. is a Chatham-owned tabloid company that publishes “Star,” “InTouch,” and “US Weekly.” AMI is now known as A360 Media, LLC.

Mum’s the World In McClatchy Land

Meanwhile, Miami New Times reported this week, “It appears that none of McClatchy’s 30 newspapers covered the charges. … (But) a Chatham-owned Canadian outlet, the National Post, ran syndicated Reuters coverage of the allegations.”

Chatham acquired the McClatchy Company on Sept. 4, 2020, in a deal valued at $312 million after the family-run newspaper chain filed for Chapter 11 bankruptcy.

What Chatham Says About Settlement

Chatham issued this statement to Pensions & Investments: “Chatham sought, received, and followed advice from an independent compliance consultant about the manner of executing the trading in question. The consultant reviewed Chatham’s trading annually for compliance with applicable laws and did not alert the firm to any issues. Importantly, the trading occurred more than four years ago in funds that have since been closed. The matter has been resolved and we are focused on generating returns for our investors.”

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

1 day ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

1 day ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

1 day ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

1 day ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

1 day ago

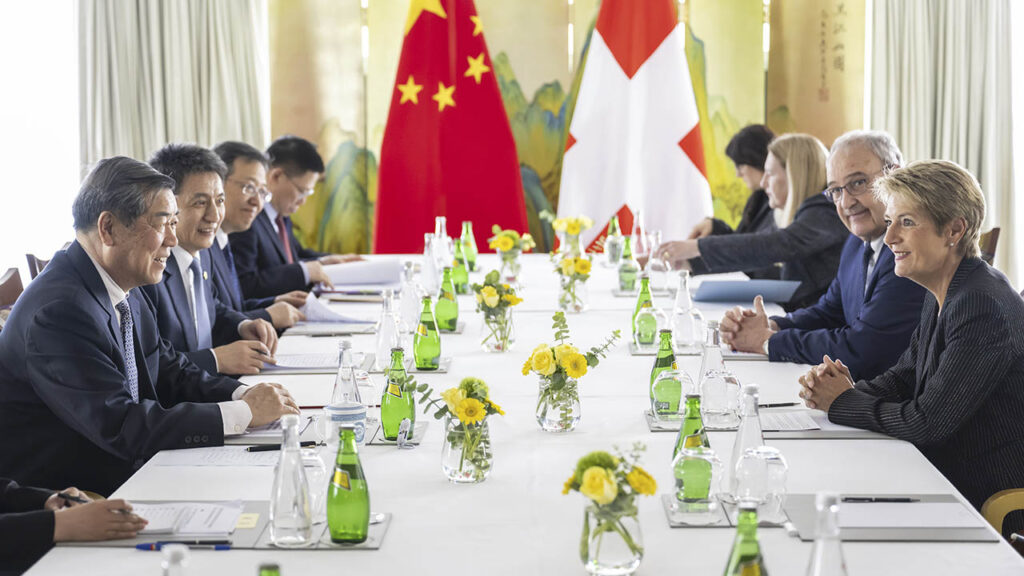

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick