Share

|

Getting your Trinity Audio player ready...

|

The Federal Reserve extended its year-long fight against high inflation Wednesday by raising its key interest rate a quarter-point despite concerns that higher borrowing rates could worsen the turmoil that has gripped the banking system.

“The U.S. banking system is sound and resilient,” the Fed said in a written statement released after its two-day meeting.

At the same time, the Fed warned that the financial upheaval stemming from the collapse of two major banks is “likely to result in tighter credit conditions” and “weigh on economic activity, hiring and inflation.”

The central bank also signaled that it’s likely nearing the end of its aggressive series of rate hikes. In a statement it issued, it removed language that had previously indicated that it would keep raising rates at upcoming meetings. The statement now says “some additional policy firming may be appropriate” — a weaker commitment to future hikes.

And in a series of quarterly economic projections, Fed officials forecast that they expect to raise their key rate just one more time – from its new level Wednesday of about 4.9% to 5.1%. That is the same peak level they had projected in December.

The latest rate hike suggests that Chair Jerome Powell is confident that the Fed can manage a dual challenge: Cool still-high inflation through higher loan rates while defusing the financial upheaval in the banking sector through emergency lending programs and the Biden administration’s decision to cover uninsured deposits at two failed U.S. banks.

The Fed’s decision to signal that the end of its rate-hike campaign is in sight may also soothe financial markets as they continue to digest the consequences of U.S. banking turmoil and the takeover last weekend of Swiss bank Credit Suisse by its larger rival.

Highest Rate in 16 Years

The Fed’s benchmark short-term rate has now reached its highest level in 16 years. The new level will likely lead to higher costs for many loans, from mortgages and auto purchases to credit cards and corporate borrowing. The succession of Fed rate hikes have also heightened the risk of a recession.

The Fed’s latest decision, after a two-day policy meeting, reflects an abrupt shift. Early this month, Powell had told a Senate panel that the Fed was considering raising its rate by a substantial half-point. At the time, hiring and consumer spending had strengthened more than expected, and inflation data had been revised higher.

In its statement, the Fed included some language that indicated that its fight against inflation is still far from complete. It said that hiring is “running at a robust pace” and noted that “inflation remains elevated.” It removed the phrase, “inflation has eased somewhat,” which it had included in its statement in February.

The troubles that suddenly erupted in the banking sector two weeks ago likely led to the Fed’s decision Wednesday to impose a smaller rate hike. Some economists have cautioned that even a modest quarter-point rise in the Fed’s key rate, on top of its previous hikes, could imperil weaker banks whose nervous customers may decide to withdraw significant deposits.

Silicon Valley Bank and Signature Bank were both brought down, indirectly, by higher rates, which pummeled the value of the Treasurys and other bonds they owned. As anxious depositors withdrew their money en masse, the banks had to sell the bonds at a loss to pay the depositors. They were unable to raise enough cash to do so.

After the fall of the two banks, the Swiss bank Credit Suisse was taken over by its larger rival UBS last weekend. Another struggling bank, First Republic, has received large deposits from its rivals in a show of support, though its share price plunged Monday before stabilizing.

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

17 hours ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

18 hours ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

18 hours ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

18 hours ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

18 hours ago

Oh Ohtani! Dodgers Star Hits 3-Run Homer in Late Rally Victory Over Diamondbacks

18 hours ago

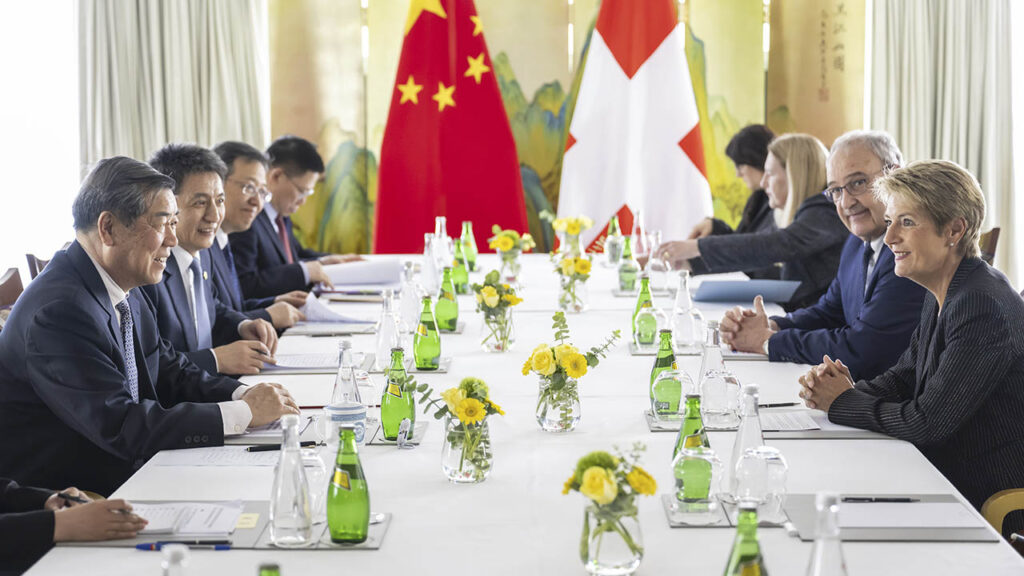

Tariff Talks Begin Between US and Chinese Officials in Geneva

18 hours ago

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

11 hours ago

Categories

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era