Share

|

Getting your Trinity Audio player ready...

|

Wholesale price increases in the United States slowed sharply last month as food and energy costs declined, a sign that inflationary pressures may be easing.

From January to February, the government’s producer price index fell 0.1%, after a 0.3% rise from December to January, which was revised sharply lower. Compared with a year ago, wholesale prices rose 4.6%, a big drop from the 5.7% annual increase in January.

A significant driver of last month’s wholesale inflation slowdown was a huge drop in the prices of eggs, which plummeted 36.1% just in February. Egg prices had previously surged after a widespread outbreak of avian flu.

Excluding volatile food and energy costs, so-called core wholesale prices were unchanged from January to February. The core measure can provide a better read of longer-term inflation trends.

Services prices at the wholesale level declined last month, slipping 0.1%. A substantial 1.1% drop in shipping costs pushed down overall services prices.

Energy prices dropped 0.2%, with the costs of heating oil, natural gas and diesel fuel all declining. Food prices dropped 2.2% from January to February, the third straight decline. That drop suggests that grocery store prices, which have been growing at a slower pace, could ease further in coming months.

The producer price data reflects prices charged by manufacturers, farmers and wholesalers, and it flows into an inflation gauge that the Federal Reserve closely tracks. It can provide an early sign of how fast consumer inflation will rise.

The figures follow a report Tuesday on consumer prices that showed that inflation is still rising faster than the Federal Reserve would prefer. Core prices, which exclude volatile food and energy costs and are seen as a better gauge of long-term inflation, rose 0.5% from January to February, the highest such rate since September. That is a far higher pace than is consistent with the Fed’s 2% annual target.

Bank Failures Complicate Picture

But the failure of two large banks since Friday has raised fears about financial instability and has complicated the Fed’s upcoming decisions about how high and how fast to raise interest rates to fight inflation. Despite chronically high inflation, some economists expect the central bank to suspend its year-long streak of interest rate hikes when it meets next week.

Many other analysts foresee only a modest quarter-point rate increase next week rather than the half-point Fed hike they had previously expected. The Fed, for now, may focus on boosting confidence in the financial system before it resumes its long-term drive to tame inflation.

That would be a sharp shift from just a week ago, when Chair Jerome Powell suggested to a Senate committee that if inflation didn’t cool, the Fed could raise its benchmark interest rate by a substantial half-point at its meeting March 21-22. When the Fed raises its key rate, it typically leads to higher rates on mortgages, auto loans, credit cards and many business loans.

The next day, testifying to a House committee, Powell cautioned that no final decision had been made about what the Fed would do at the March meeting.

RELATED TOPICS:

Categories

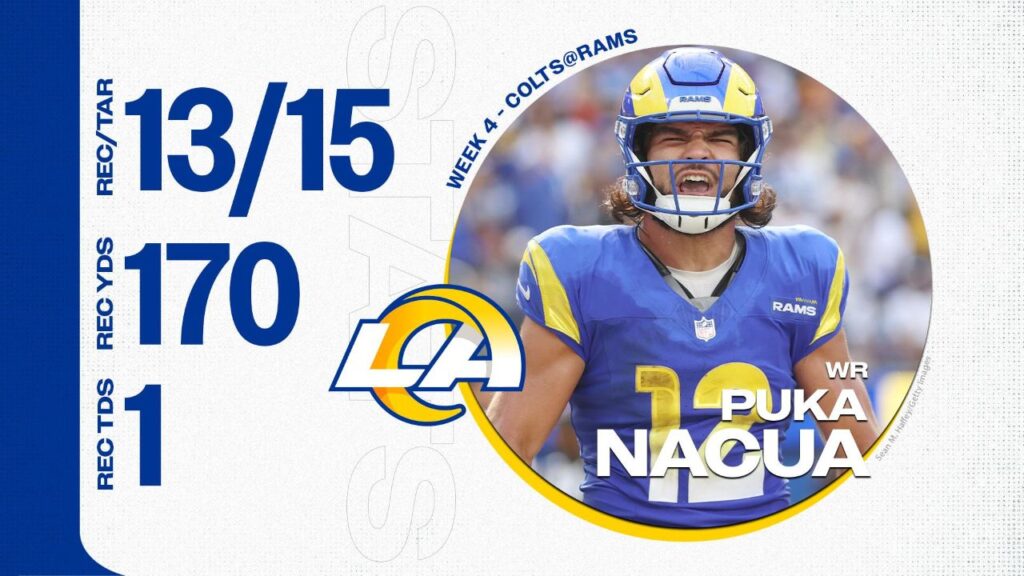

Studs and Duds From Rams’ 27-20 Victory Over Colts