Share

|

Getting your Trinity Audio player ready...

|

The Federal Reserve’s preferred inflation gauge eased further in December, and consumer spending fell — the latest evidence that the Fed’s series of interest rate hikes are slowing the economy.

Friday’s report from the Commerce Department showed that prices rose 5% last month from a year earlier, down from a 5.5% year-over-year increase in November. It was the third straight drop.

Consumer spending fell 0.2% from November to December and was revised lower to show a drop of 0.1% from October to November. Last year’s holiday sales were sluggish for many retailers, and the overall spending figures for the final two months of 2022 were the weakest in two years.

The pullback in consumer spending will likely be welcomed by Fed officials, who are seeking to cool the economy by making lending increasingly expensive. Still, the decline in year-over-year inflation matches the Fed’s outlook and isn’t likely to alter expectations that the central bank will raise its key rate by a quarter-point next week.

On a monthly basis, inflation ticked up just 0.1% from November to December for a second straight month. Energy prices plunged 5.1%, and the overall cost of goods also fell.

“Core” prices, which exclude volatile food and energy costs, rose 0.3% from November to December and 4.4% from a year earlier. The year-over-year figure was down from 4.7% in November, though still well above the Fed’s 2% target.

Friday’s figures are separate from the better-known inflation data that comes from the consumer price index. The CPI, which was released earlier this month, has also shown a steady deceleration.

The Fed has been seeking to slow spending, growth and the surging prices that have bedeviled the nation for nearly two years. Its key rate, which affects many consumer and business loans, is now in a range of 4.25% to 4.5%, up from near zero last March. Though inflation has been decelerating, most economists say they think the Fed’s harsh medicine will tip the economy into a recession sometime this year.

Fed in Delicate Position

The Fed is in an increasingly delicate position. Chair Jerome Powell has emphasized that the central bank plans to keep boosting its key rate and to keep it elevated, potentially until the end of the year. Yet that policy may become untenable if a sharp recession takes hold.

Friday’s data may heighten concerns that the economy’s primary driver, the American consumer’s willingness to keep spending freely, is starting to crack under the weight of higher prices and interest rates.

On Thursday, the government reported that the economy grew at a healthy clip in the final three months of last year but with much of the expansion driven by one-time factors: Companies restocked their depleted inventories as supply chain snarls unraveled, and the nation’s trade deficit shrank.

By contrast, consumer spending in the October-December quarter as a whole weakened from the previous quarter, and business investment dropped off sharply. Overall, the economy expanded at a 2.9% annual rate in the October-December quarter, down slightly from a 3.2% pace in the previous quarter.

If consumers remain less willing to boost their spending, companies’ profit margins will shrink, and many may cut expenses. That trend could lead eventually to waves of layoffs. Economists at Bank of America have forecast that the economy will grow slightly in the first three months of this year — but then shrink in the following three quarters.

More frugal consumers would threaten to send the economy into a recession. But they can also help reduce inflation. Companies can’t keep raising prices if Americans won’t pay the higher costs.

Last week, the Federal Reserve’s beige book, a gathering of anecdotal reports from businesses around the country, said: “Many retailers noted increased difficulty in passing through cost increases, suggesting greater price sensitivity on the part of consumers.”

A raft of big companies, mostly in the technology sector, have announced sweeping layoffs in recent months, fueling concerns that a recession might be nearing. But those job cuts haven’t yet been enough to raise the unemployment rate, which remains at a half-century low.

In fact, the number of people seeking unemployment benefits — a proxy for layoffs — declined last week to 186,000, a very low level historically. And Walmart, the nation’s largest employer, said it would raise its minimum wage, from $12 to $14 an hour, to help it keep and attract workers.

RELATED TOPICS:

Trump Says He Will Order Voter ID Requirement for Every Vote

3 hours ago

Greta Thunberg Joins Flotilla Heading for Gaza With Aid

3 hours ago

Chicago Mayor Says Police Will Not Aid Federal Troops or Agents

3 hours ago

Post-War Gaza Plan Sees Relocation of Population, ‘Digital Token’ for Palestinian Land: Washington Post

3 hours ago

Labor Day Quiz: Do You Know What a Knocker-Upper Is?

4 hours ago

Judge Blocks Pillar of Trump’s Mass Deportation Campaign

23 hours ago

Visalia Driver Arrested for DUI After Multiple Crashes and Pedestrian Injured

1 day ago

Fresno County Garnet Fire Grows to 18,748 Acres in Sierra National Forest

3 hours ago

Categories

Fresno County Garnet Fire Grows to 18,748 Acres in Sierra National Forest

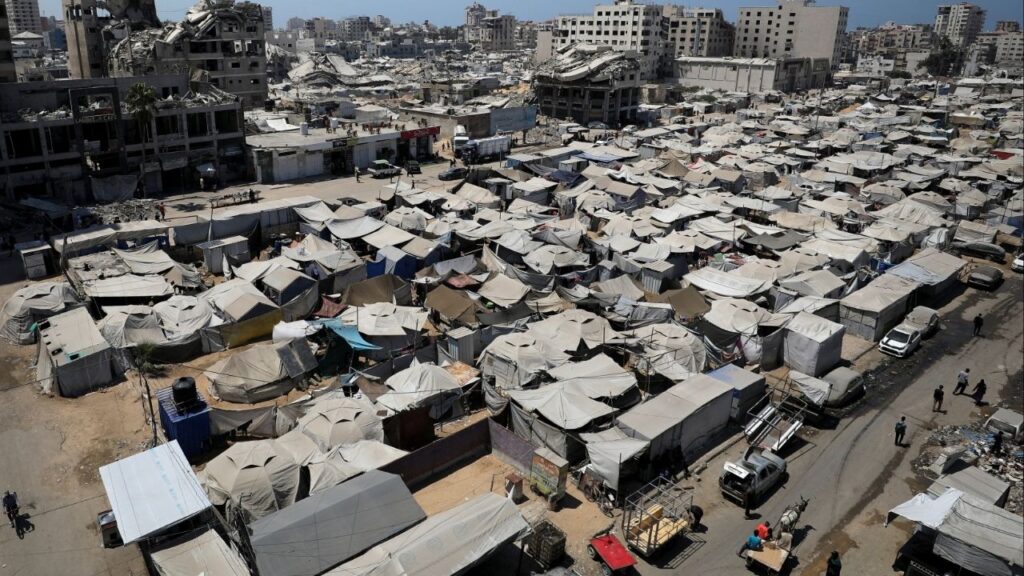

Israel Pounds Gaza City Suburbs, Netanyahu to Convene Security Cabinet

Trump Says He Will Order Voter ID Requirement for Every Vote

Greta Thunberg Joins Flotilla Heading for Gaza With Aid

Chicago Mayor Says Police Will Not Aid Federal Troops or Agents

Post-War Gaza Plan Sees Relocation of Population, ‘Digital Token’ for Palestinian Land: Washington Post