Share

|

Getting your Trinity Audio player ready...

|

NEW YORK (AP) — The Justice Department accused Los Angeles-based City National Bank on Thursday of discrimination by refusing to underwrite mortgages in predominately Black and Latino communities, requiring the bank to pay more than $31 million in the largest redlining settlement in department history.

City National is the latest bank in the past several years to be found systematically avoiding lending to racial and ethnic minorities, a practice that the Biden administration has set up its own task force to combat.

The Justice Department says that between 2017 and 2020, City National avoided marketing and underwriting mortgages in majority Black and Latino neighborhoods in Los Angeles County. Other banks operating in those neighborhoods received six times the number of mortgage applications that City National did, according to federal officials.

The Justice Department alleges City National, a bank with roughly $95 billion in assets, was so reluctant to operate in neighborhoods where most of the residents are people of color, the bank only opened one branch in those neighborhoods in the past 20 years. In comparison, the bank opened or acquired 11 branches in that time period. In addition, no employee was dedicated to underwriting mortgages at that one branch, unlike branches in majority-white neighborhoods.

Redlining and Civil Rights Prosecutions a High Priority for Biden’s DOJ

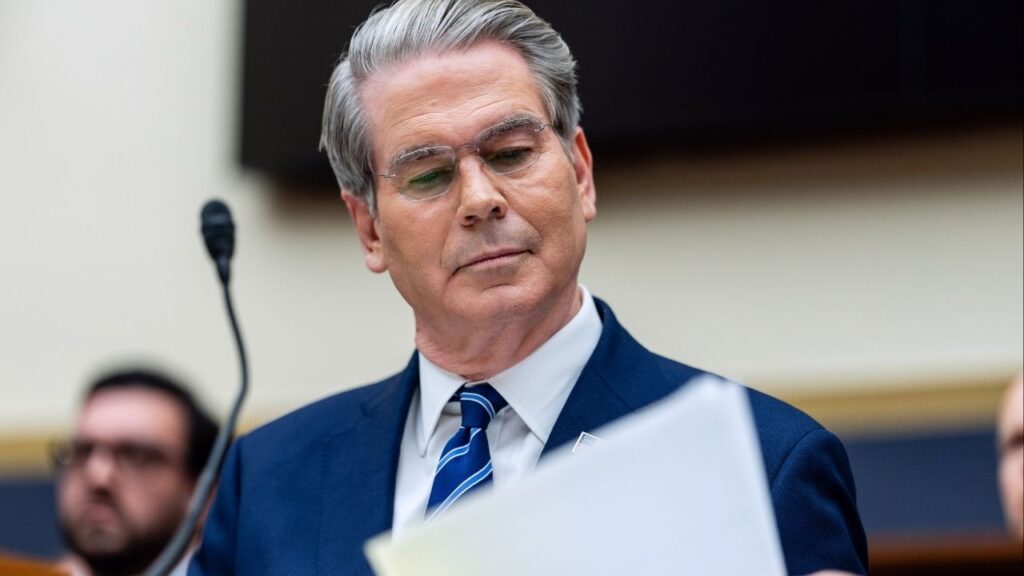

“This settlement should send a strong message to the financial industry that we expect lenders to serve all members of the community and that they will be held accountable when they fail to do so,” Assistant Attorney General Kristen Clarke, who leads the Justice Department’s civil rights division, said in a statement.

Attorney General Merrick Garland has prioritized civil rights prosecutions since taking the helm at the Justice Department in 2021 and the department, in the Biden administration, has put a higher priority on redlining cases than under previous administrations.

The Biden task force includes the Justice Department as well as bank regulators like the Comptroller of the Currency and the Consumer Financial Protection Bureau, and is focused not only on explicit forms of redlining but also cases where computer algorithms may cause banks to discriminate against Black and Latino borrowers.

Despite a half-century of laws designed to combat redlining, the racist practice continues across the country and the long-term effects are still felt to this day. The average net worth of a Black family is a fraction of a typical white household, and homes in historically redlined neighborhoods are still worth less than homes in non-redlined communities.

City National Bank Disputes DOJ Allegations

As part of the settlement, City National will create a $29.5 million loan subsidy fund for loans to Black and Latino borrowers, and spend $1.75 million on advertising, community outreach, and financial education programs to reach minority borrowers.

In a statement, City National said it disagreed with the Justice Department’s allegations, but that it will “nonetheless support the DOJ in its efforts to ensure equal access to credit for all consumers, regardless of race.”

The Justice Department said City National cooperated as part of the redlining investigation and is working to resolve its issues in other markets, as well.

Clarke announced the settlement Thursday morning at a historic Black Baptist church in South Los Angeles that was an important force in the civil rights movement and has been the venue for speeches by the Rev. Martin Luther King Jr., Malcolm X, and others.

The settlement with City National is the largest settlement with the Justice Department. A settlement with the Department of Housing and Urban Development with Associated Bank in 2015 involved the bank making a commitment to make $200 million in increased lending in minority-majority neighborhoods, along with a $10 million subsidy fund similar to the one agreed to by City National.

RELATED TOPICS:

Categories

Ferreira Completes His Halfpipe Set with Gold