Share

WASHINGTON — Treasury Secretary Janet Yellen, responding to the recent sharp decline in the value of cryptocurrencies, said Thursday that additional federal regulation was needed to respond to the wave of speculative investment in the currency whose secrecy is an essential part of its appeal.

“We really need a regulatory framework to guard against the risks,” Yellen said of cryptocurrencies called stable coins, during a House committee hearing Thursday. Citing the rapid rise in use of digital assets, she added, “Really, we need a comprehensive framework so that there are no gaps in the regulation.”

Stable coins are a type of cryptocurrency pegged to a specific value, usually the dollar, another currency, or gold. Its parity with the dollar is what, in theory, makes it stable. However, volatility in the cryptocurrency market this week challenged that premise.

Terra Drops From $8 to 30 Cents

“We’ve had a real-life demonstration of the risks,” she said, referring to the meltdown of the TerraUSD beginning on Monday.

A run — or sale by a large number of owners — on the Terra stable coin, caused it to drop in value from roughly $8 to below 30 cents.

A Federal Reserve report released Monday outlines how stable coins are vulnerable to runs.

“Terra broke the buck and this morning and yesterday the largest stable coin Tether also broke the buck,” referring to another token that dropped below its dollar peg this week.

The entire cryptocurrency market recently lost $200 billion in a single day, according to The Motley Fool. The belief is that investors are abandoning risky assets as the Federal Reserve tightens its monetary policy.

Over the last 24 hours, the price of the world’s largest cryptocurrency, Bitcoin, fell about 2.5%. The world’s second-largest cryptocurrency, Ethereum, fell more than 9%, with the price of a token at around $2,000. And Dogecoin was trading at about 5% lower.

Fed Can Curb Inflation Without a Recession: Yellen

Yellen was also questioned at the hearing on the root cause of inflation, which has driven up prices, and how the administration plans to combat rising energy, housing, and food costs.

She said the administration is doing what it can to address supply chain issues and other contributors to inflation.

“We have a really good strong labor market, we have household balance sheets that are in good shape,” as well as a strong banking sector, Yellen said.

“All of those things suggest that the Fed has a path to bring down inflation without causing a recession,” she said.

(GV Wire contributed to this article.)

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

1 day ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

1 day ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

1 day ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

1 day ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

1 day ago

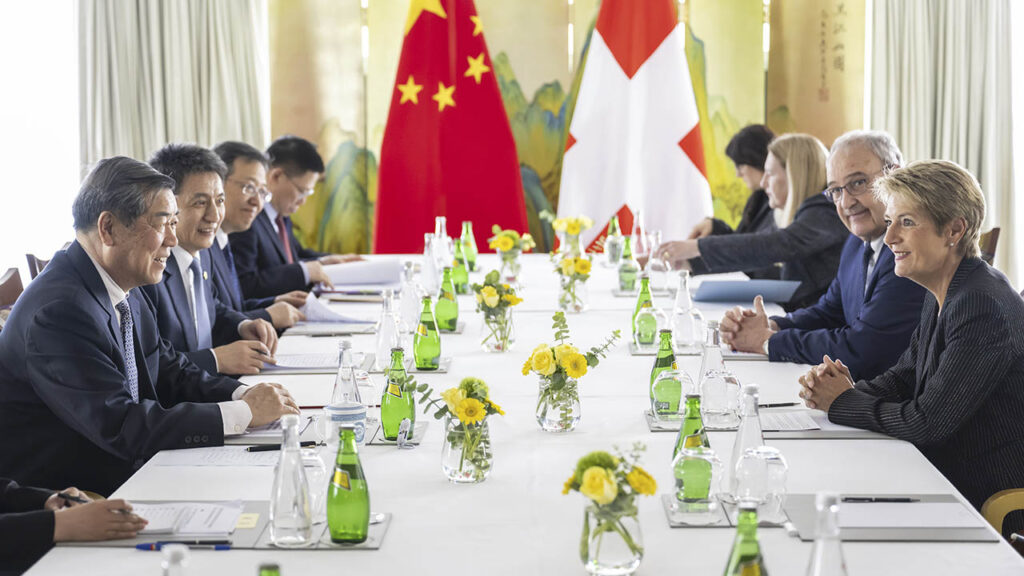

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick