Share

The Wall Street JournalPresident Biden has said his tax proposals would make big business and wealthy investors pay their fair share.

His package would also likely deliver a blow to American farm owners by limiting a longstanding tax break. The provision allows landowners to defer paying capital-gains tax when they sell investment property and put the proceeds toward the purchase of other real estate.

Farmers for generations have used the tax break to cheaply and quickly relocate farm operations to lands with better soil, diversify the crops they grow and consolidate land holdings. Some have used it when exiting the farming business at retirement. Farm owners in 2012 held 915 million acres, about 40% of the land in the continental U.S.

Farmers and land brokers said the latest proposal, capping the profits from land sales that can be tax-deferred at $500,000, would add another burden on farming.

By Will Parker | 06 May 2021

RELATED TOPICS:

Tatum to Miss Remainder of Playoffs After Achilles Tendon Surgery

1 hour ago

Fresno Police Seek Public’s Help Identifying Shooting Suspect

1 hour ago

MLB Reinstates Pete Rose and Shoeless Joe Jackson, Making Them Hall of Fame Eligible

1 hour ago

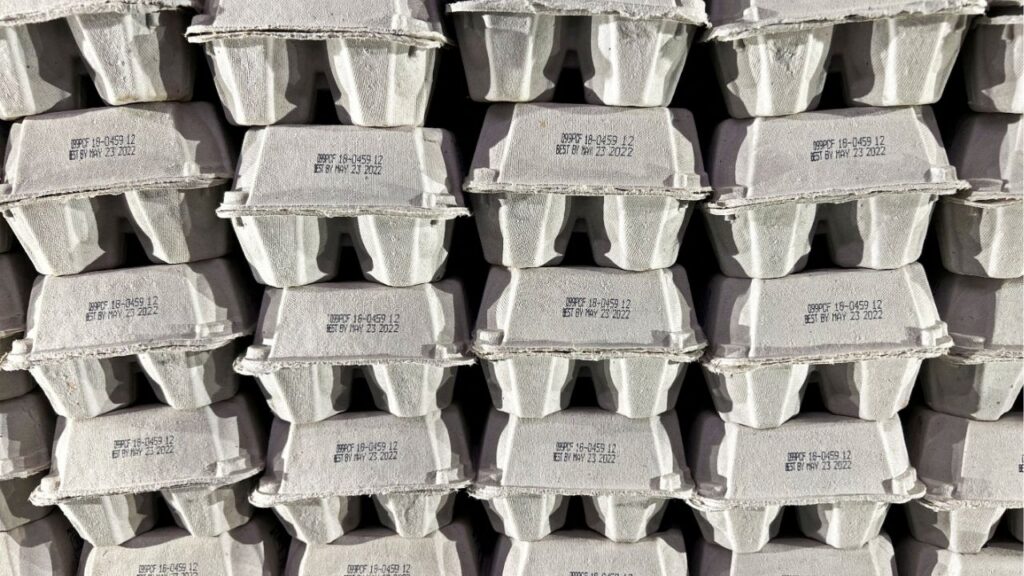

Global Eggs Completes Acquisition in US, Closes New Deal in Europe

4 hours ago

‘I Never Said He Called My Son the N-Word.’ Fresno Unified Trustee Thomas Tries to Erase Accusation Against Former Bullard Coach

5 hours ago

Caltrans’ Response to Homeless Encampments Is Lagging, Cities Complain

6 hours ago

Democrats Seeking California Governorship Strut Their Stuff for Union Leaders

6 hours ago

Fresno County DA Wants Teens Tried as Adults in Caleb Quick Murder

19 minutes ago

Categories

Fresno County DA Wants Teens Tried as Adults in Caleb Quick Murder

Tatum to Miss Remainder of Playoffs After Achilles Tendon Surgery

Fresno Police Seek Public’s Help Identifying Shooting Suspect

MLB Reinstates Pete Rose and Shoeless Joe Jackson, Making Them Hall of Fame Eligible