Share

Auto insurers shortchanged California drivers on refunds ordered last year as crashes dropped during the coronavirus pandemic, the state’s insurance regulator said Thursday.

Traffic plummeted after California imposed the nation’s first stay-home order a year ago to slow the spread of the coronavirus. But insurers said dangerous driving trends have worsened even as the number of miles driven declined.

New Round of Insurance Refunds Ordered

Collisions dropped by 55% and injuries and deaths from traffic accidents fell 53% in the week after Gov. Gavin Newsom’s order, University of California, Davis, researchers found. Schools and most nonessential businesses closed for months and millions of employees lost their jobs or started working from home, leaving once-clogged highways virtually traffic-free even in famously crowded Los Angeles and San Francisco.

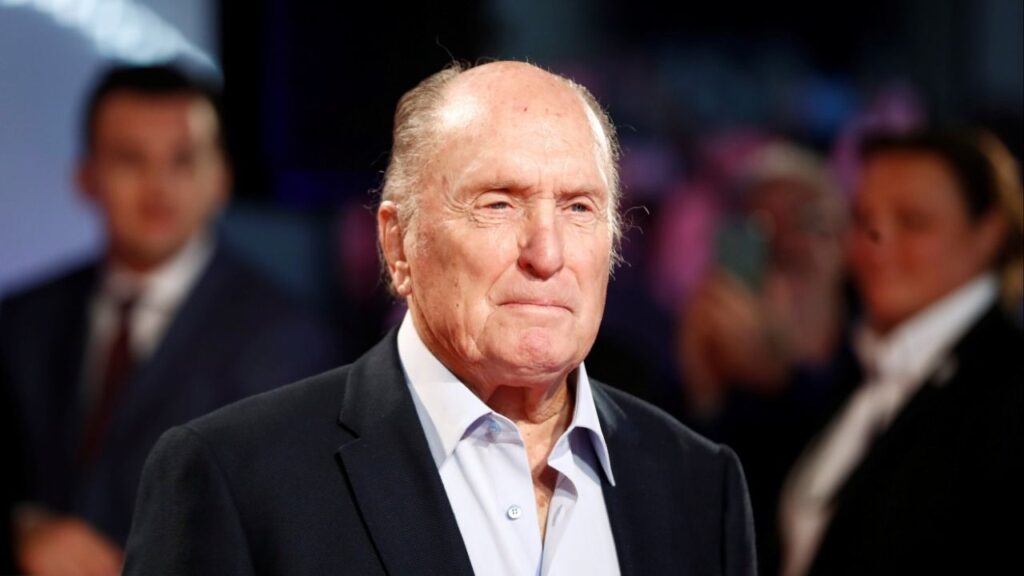

“Millions did your part, stayed home” and drivers now deserve lower insurance costs “as long as they continue to drive less and our roads are safer as a result,” California Insurance Commissioner Ricardo Lara said in a video as he ordered companies to calculate a new round of refunds.

Commuter traffic has rebounded as California gradually reopens, but Lara said insurers “continued to overcharge drivers.”

The top 10 companies, representing 80% of the auto insurance market, saw injury claims drop nearly 42% and property damage claims fall more than 40% from last March through September, compared with the same period in 2019, Lara said.

They returned about $1.75 billion to consumers, but he said that’s not nearly enough given their lower costs. Companies refunded about 9% of consumers’ insurance bills on average, but Lara said it should have been about 17%, or about $220 million more than they did just in April.

Allstate, Farmers, USAA, State Farm and CSAA Insurance Group are among the top 10 private passenger insurance groups. Lara’s office didn’t break down the figures by company but said there were significant differences in how much each refunded.

The American Property Casualty Insurance Association, which represents the industry, said insurers trimmed premiums when driving was reduced last year, continue to adjust policies as warranted by individual driving patterns and will cooperate with Lara’s latest order.

Traffic Dropped but Fatalities Increased, Industry Says

But it noted that fatalities increased nearly 5% in the first nine months of 2020 even as miles traveled dropped, according to the National Highway Traffic Safety Administration. The fatality rate went up as some drivers “engaged in riskier behavior” like speeding, driving under the influence and failing to wear seat belts, the agency said.

“Trends in reckless driving could prove even more fatal as traffic volume starts to return to pre-pandemic levels,” Mark Sektnan, vice president of the insurance association, said in a statement. He said those trends, combined with increased litigation and medical and auto repair costs, also affect prices.

Lara ordered each company to report by April 30 how it will return the rest of the funds he said are owed.

Number of Companies Providing Refunds Dropped

Every company offered relief ranging from 10% to 22% for March through May, Lara said, but by December, just four insurers were still offering any refunds even though most of California was under its most restrictive shutdown rules.

Insurance companies set rates using historical data to determine how much risk is involved.

California ordered the refunds under a 1988 voter-approved law saying insurers can’t charge rates that are excessive or unfairly discriminatory. New Jersey early in the pandemic also directed companies to return premiums because of their reduced risk.

State Farm Plans to Return About $100 to Each Policyholder

On Wednesday, insurer State Farm announced it will be returning $400 million to California policyholders. The company said customers can expect to receive checks averaging about $100 per policy covering the period from June 1 through December 31, 2020.

Tom Conley, a State Farm senior vice president described the company’s latest refunds as “another way we’re making adjustments based on driving behaviors to minimize impacts and help our customers.”

Consumer Watchdog founder Harvey Rosenfield, who wrote the insurance reform ballot measure, said Lara also should order each company to file a new rate plan to prevent future overcharges.

“They’ve been doing these kind of ballpark” estimates, Rosenfield said, while new rate plans would be “a more precise way of targeting who owes what to whom.”

Commercial Insurance Reports Also Ordered

That could be a two-edged sword, based on how quickly the economy is projected to recover and what lifestyle and workplace changes become permanent as the pandemic eases.

“A lot of people have lost their jobs. It may be that in a few months’ time, with everybody getting vaccinated, all the cars will be out of quarantine like the people,” Rosenfield said. On the other hand, “it may never go back to the way it used to be.”

Lara also ordered commercial insurance companies to provide data about their losses as many businesses shut down during the pandemic.

This story has been updated to include information about new customer refunds being issued by State Farm.

RELATED TOPICS:

Categories

What to Know About the Homeland Security Shutdown