Share

California’s $500 million dollar small business COVID-19 grant program website went live Wednesday morning.

Grants range from $5,000 to $25,000 based on annual revenue documented in the business’ latest tax return. Funds do not need to be repaid as long as they are used for approved purposes including salary,

Isabel Guzman, Director of California’s Office of the Small Business Advocate shared the news about the opening of applications on Twitter.

“The grants were announced by Governor Newsom and the Legislature on November 30th and provide financial relief to highly impacted small businesses, for profit, and non-profit,” said Guzman. “Applications open December 30th through January 8th so you will have time to apply and it should be a relatively easy process.”

Lendistry has been designated by the state to act as the intermediary for the program to disburse the grant funds. Applicants will receive notifications from Lendistry on the status of their application and requests for business information and supporting documents, including their business bank account information.

Businesses will be notified directly by email about approvals, wait listing or if they are not selected.

#California $500M #SmallBusiness grant program website is live! Learn eligibility requirements, prepare business documents, and get ready to apply beginning Wed 12/30 and through Fri 1/8! #CAReliefGranthttps://t.co/ZKY9SXdDip pic.twitter.com/BpteaiW3jl

— CA Office of the Small Business Advocate (CalOSBA) (@CaliforniaOSBA) December 23, 2020

Deadlines

The application period for the first round of grants opens at 8am December 30 and runs through January 8.

According to the website, “Applicants who submitted their application and submitted all documentation in the first round do not need to reapply; qualified applications will be automatically rolled over into the next funding round for consideration.”

Round 2 is the final application window for the program, but no timeframes have been announced yet.

Necessary Documents

Here is the list of documents business owners need to have available when applying.

- A government issued photo Id/ Latest filed tax returns – 2018 or 2019.

- A copy of the business’ official filing with the California Secretary of State, if applicable, or local municipality for the business such as one of the following: articles of incorporation, certificate of organization, fictitious name of registration or government-issued business license.

Applying through multiple organizations will delay applications from being processed, officials said.

Owners of multiple businesses, franchises, locations, etc. will be considered for only one grant and are required to apply for the business with the highest revenue.

Grant Determination

Applications will be reviewed to determine whether the applicant meets the eligibility requirements.

Eligible businesses will then be scored based on COVID-19 impact factors incorporated into the program’s priority criteria so that distribution can take into account various factors, including:

1. Geographic distribution based on COVID-19 health and safety restrictions following California’s Blueprint for a Safer Economy and county status and the recent regional stay at home order;

2. Industry sectors most impacted by the pandemic; and

3. Underserved small business groups served by the state supported network of small business centers (i.e., businesses majority owned and run on a daily basis by women, minorities/persons of color, veterans and businesses located in low-to-moderate income and rural communities).

Categories

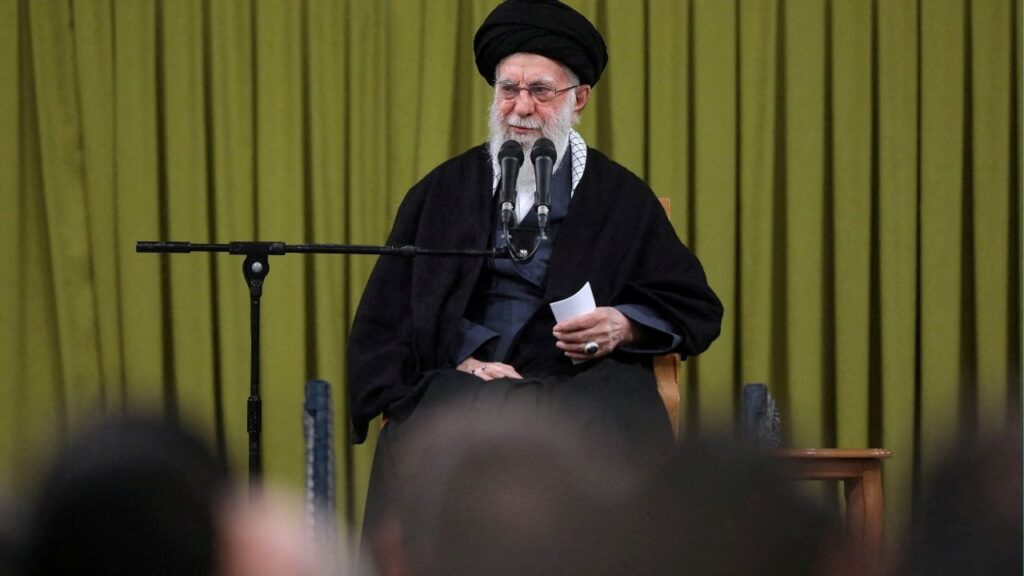

Who Could Take Over for Ayatollah Ali Khamenei?

Why Have You Started This War, Mr. President?