Share

Exact details of Fresno’s zero-interest business loan program are still being worked out, according to City Hall.

The city council unanimously approved the program for small businesses on March 25, but members are working with city staff to fill in the blanks.

“There are no details on the loan program at this time. Council directed the administration to develop the program and then get back to them in one week,” city spokesman Mark Standriff wrote via email.

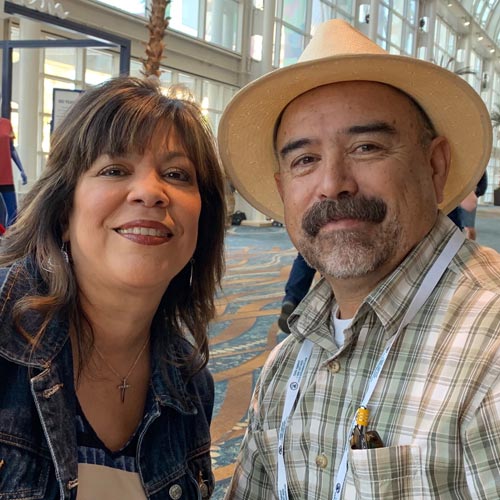

Fresno Embroidery Business Eager for Answers

Gonzales is one of many businesses that reached out to GV Wire wanting to know how the program works, where to apply and if they qualify for a loan from the city. She said her businesses would earn thousands a month.

Fresno State is one Agape’s top clients.

“We have no business,” Gonzales said. “There’s no school right now. So they don’t need any t-shirts. They don’t need any promotional products. So we’re pretty slow right now.”

With Agape’s business slowed down, Gonzales started a new job today — data entry for Bitwise. While it is full-time, it is only a temporary assignment. Her husband already works full-time as well.

County Resort Operator Hopes to Be Eligible

Currently, only businesses within the city limits are allowed to receive the loans.

Larry Ronneberg co-owns Mercey Hot Springs, a resort in western Fresno County.

Before he had to shut his business down because of COVID-19, several of his customers came from the city of Fresno. He says that should make his business qualify for the loans.

But, he understands he may have to look elsewhere for help.

“Because we don’t qualify, it just means we have to go other place to get funding for this. We’re closed right now. So are many other businesses. It would help us immensely if we were qualified,” Ronneberg said.

[covid-19-tracker]

Federal Funds Available Soon

Last week, Congress passed a $2 trillion economic aid package to help the country through the coronavirus pandemic.

The rescue package provides for Small Business Administration loans to companies as well as to sole proprietors and freelancers. The loans can be used for payroll, mortgages, rent and utilities, with those amounts forgiven and payments deferred. It will also supply small loans that can, depending on an owner’s credit score, be approved quickly. Employers can receive tax credits for retaining workers, though not if they have obtained one of the SBA loans.

Treasury Secretary Steven Mnuchin has said the small loans would be available starting Friday, and in an interview with the Fox Business Network, Mnuchin said he hoped to release loan forms later Monday.

Questions and Answers

Here is what is known so far, through the language establishing the program, and its funding source.

Who is eligible to apply?

— Businesses that are located within the city of Fresno with 25 or fewer employees. Twenty percent of the funds ($150,000) will go to businesses of five or fewer employees.

How much is available?

— $750,000 will come from city funds, and matched dollar-for-dollar with private contributions. Details of the matching program are not yet available.

Does the business have to be impacted by COVID-19?

— Yes. Businesses that closed or reduced hours because of the city’s emergency order are eligible if they “demonstrate a loss of 25% or more of revenue due to COVID-19.”

What is the nature of the loan?

— It will be a 0% interest loan, requiring the business owner to offer a personal guarantee. The city will forgive the loan after one year if the business is in continuous operation.

Does the business have to be in good standing?

— Yes. Businesses “must not have any unpaid judgments or tax liens”, and have a valid business license for one year prior to March 4, 2020 (the date Gov. Gavin Newsom declared a statewide COVID-19 emergency) and operate for one year prior to March 4 as well.

Where is the money coming from?

— Of the $750,000, $500,000 comes from funding reserved for a senior center, and $250,000 comes from the city attorney’s budget.

Will other financial institutions be involved?

— The ordinance calls for the city’s Economic Development Department to work with banks and other financial institutions “to create a microloan program for reasonable working capital expenses for small businesses impacted by COVID-19.”

Answers Being Worked On

Details still being worked out:

— How the application process will work.

— How much money each business could receive.

— If there will be a priority list for businesses to receive loans.

— How quickly the businesses will receive the money.

— What happens if the business does not fulfill its loan obligations.

— Whether businesses outside the city of Fresno will be eligible.

— Whether nonprofits are eligible.

— Whether small businesses with no employees other than the owner qualify.

— The role of other agencies, such as the Small Business Administration.

The ordinance gave city staff one week, which would be this Wednesday, for the answers.

RELATED TOPICS:

Categories