Share

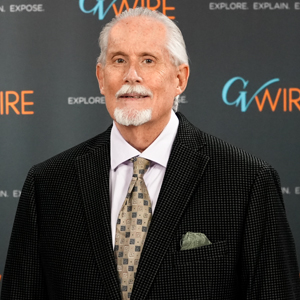

Count state Sen. Andreas Borgeas of Fresno among many Republican lawmakers seeking to modify or repeal Assembly Bill 5, the controversial law reclassifying independent contractors.

Borgeas recently introduced Senate Bill 967, which would exempt franchisors and franchisees from AB 5.

Listen to this article:

AB 5 “is a very real threat to the fifth-largest economy in the world.” — Sen. Andreas Borgeas (R-Fresno)

“Nearly two million Californians working as freelancers and independent contractors have lost their jobs due to AB 5,” Borgeas said. “This haphazard law has negatively impacted dozens of industries in our state and limits those who want to maintain a flexible work schedule. … This is a very real threat to the fifth-largest economy in the world.”

Borgeas said the franchisor-franchisee relationship often used by fast-food and convenience-store chains must be protected.

“Under AB 5, franchisors could be exposed to liability for labor laws violated by their franchisees,” said Senator Borgeas. “SB 967 would ensure that franchisees would not be considered an employee of the franchisor but instead an independent contractor.”

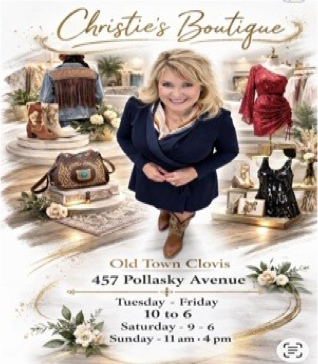

AB 5 Town Hall Panelists

Three panelists will take part in the town hall: Ian Wieland, an attorney for Sagaser, Watkins and Wieland PC; Laura Curtis, a policy advocate for the California Chamber of Commerce; and Tom Powell, CEO of Cal-Valley Insurance Services, Inc.

The forum begins at 5:30 p.m. RSVPs can be made at 559 243-8580 or online at this link.

AB 5 Disrupts California’s Economy

AB 5 became law last September. Assemblywoman Lorena Gonzalez (D-San Diego) wrote the legislation saying that companies were exploiting workers by classifying them as independent contractors instead of employees.

Her bill stemmed from a 2018 California Supreme Court decision brought by drivers for Dynamex, a package delivery service. The court ruled that Dynamex boosted its profits by illegally classifying workers at independent contractors.

Since Gov. Gavin Newsom signed the landmark law, it has inspired lawsuits, a ballot initiative by app-based service providers such as Uber and Postmates, and caused confusion in companies using independent contractors.

Earlier this month, a federal judge refused to exempt ride-hailing Uber and meal delivery service Postmates from AB 5 while she considers their lawsuit. As for the ballot initiative, those two companies are among several collecting signatures for a measure on the November ballot. That proposal would exempt them while giving drivers new benefits like health care and a guarantee of 120% of minimum wage.

The ‘ABC’ Test

To continue as independent contractors, workers must pass all three elements of an “ABC” test. The three questions:

(A) Does the worker operate independently?

(B) Is the work different from what the business does?

(C) Can the worker offer his or her services to other businesses or the public?

Carve-Outs for Certain Occupations

But there is much in play with AB 5, which narrowed the scope of the Dynamex decision by exempting lawyers, doctors, engineers, stockbrokers, and sales agents. The thinking behind the carve-outs by Democrats backing the bill was that these workers have considerable bargaining power over their pay and working conditions.

However, the bill’s critics said that lawmakers passing the legislation simply didn’t want to deal with well-funded opponents and were more interested in a law that would help low-pay workers organize into unions.

“The result was the Legislature arbitrarily picking winners and losers,” Borgeas said. “Individuals who pursue traditional career paths should be classified as employees. But, on the flip side, there is a significant part of the population who wants to have the ability to accept or reject work offers — software programmers, drivers, retirees who have projects they like to do on the side.”

Meanwhile, Gonzalez is working up a bill to exempt photographers, freelance writers, and musicians. Republican lawmakers want exemptions for myriad others — newspaper carriers, loggers, and physical therapists, to name a few. And, Senate Republican Leader Shannon Grove of Bakersfield has introduced a repeal-and-replace bill in SB 806.

“Independent contractors are being hurt by this anti-worker law and some have lost their ability to earn a living. This disastrous law must be repealed and replaced so Californians can once again have flexibility in the freelance economy,” Grove said.

AB 5 Enforcement

Newsom has proposed nearly $22 million in the 2020-21 budget for AB 5 enforcement. Penalties for misclassification of workers range from $5,000 to $25,000 and companies can be liable for back wages.

The state has set up a website with the answers to 22 frequently asked questions.