Econoday Economic Report: October

Share

[aggregation-styles]

Econoday

Econoday

Consumer sentiment bounced sharply higher in October, to a much stronger-than-expected 96.0 that easily exceeds Econoday’s consensus range. The assessment of current conditions is the strong point in October’s report, up nearly 5 points to 113.4 in what is a positive indication for consumer spending this month. Expectations are also higher, up 1.4 points to 84.8 and together with the jump in current conditions, suggest that the impeachment inquiry of President Trump is not having a significant impact on the consumer. In fact, the report notes that the ongoing GM strike was mentioned by respondents nearly twice as much as the impeachment.

Also of note is that consumers see higher income gains at the same time that they see inflation on the decline, a combination that points to gains for real income where expectations are now at a two decade high. Yet the decline in inflation expectations will not be a positive at all for the Federal Reserve especially when they see a 3 tenths drop in year-ahead expectations to 2.5 percent and a 2 tenths drop in 5-year expectations to 2.2 percent. Both of these readings are unusually low and will raise talk that inflation expectations, Jerome Powell’s central focus when it comes to achieving price goals, may be at risk of becoming unanchored.

Also of note is that consumers see higher income gains at the same time that they see inflation on the decline, a combination that points to gains for real income where expectations are now at a two decade high. Yet the decline in inflation expectations will not be a positive at all for the Federal Reserve especially when they see a 3 tenths drop in year-ahead expectations to 2.5 percent and a 2 tenths drop in 5-year expectations to 2.2 percent. Both of these readings are unusually low and will raise talk that inflation expectations, Jerome Powell’s central focus when it comes to achieving price goals, may be at risk of becoming unanchored.

By Econoday | 13 Sept 2019

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

Local /

6 hours ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

Science /

7 hours ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

Politics /

7 hours ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

Politics /

7 hours ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

World /

7 hours ago

Oh Ohtani! Dodgers Star Hits 3-Run Homer in Late Rally Victory Over Diamondbacks

Sports /

7 hours ago

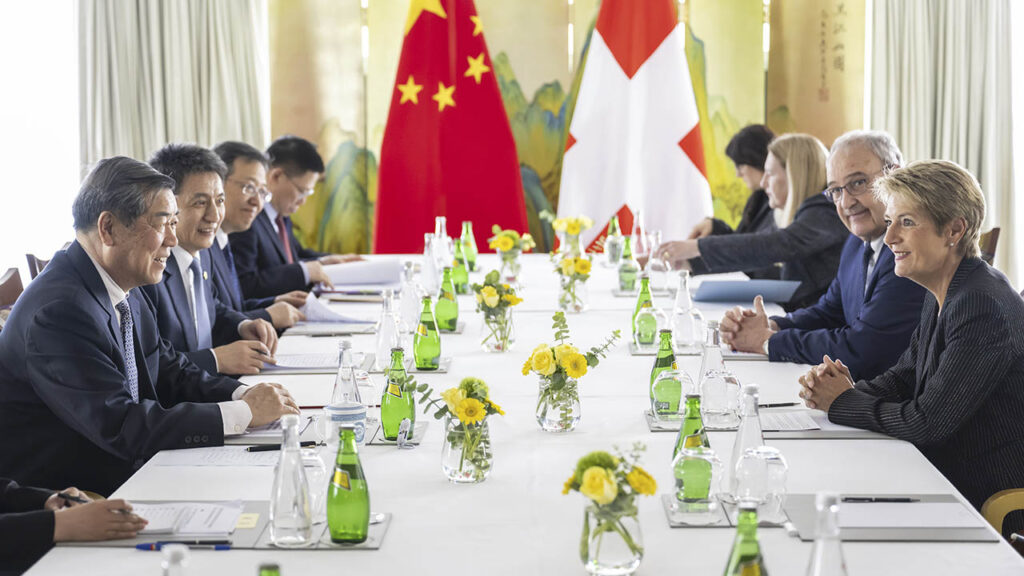

Tariff Talks Begin Between US and Chinese Officials in Geneva

Economy /

7 hours ago

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

GENEVA — Sensitive talks between U.S. and Chinese delegations over tariffs that threaten to upend the global economy ended after a day of pr...

Economy /

3 minutes ago

Categories

Latest

Videos

Economy /

3 minutes ago

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Local /

6 hours ago

Two Teens Charged in Shooting Death of Caleb Quick

Science /

7 hours ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

Politics /

7 hours ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

World /

3 days ago