Share

WASHINGTON — The United States is delaying tariffs on Chinese-made cellphones, laptop computers and other items and removing other Chinese imports from its target list altogether in a move that triggered a rally on Wall Street.

But under pressure from retailers and other businesses, the agency said it would delay the tariffs to Dec. 15 on some goods, including cellphones, laptop computers, video game consoles, some toys, computer monitors, shoes and clothing.

The news sent the Dow Jones Industrial Average up more than 460 points in midmorning trading. Shares of Apple, Mattel and shoe brand Steve Madden shot up on the news.

The delay seemed timed to cushion the impact of tariffs on consumer goods until after the holidays. Hun Quach, vice president of international trade at the Retail Industry Leaders Association, welcomed the move, saying it “will mitigate some pain for consumers through the holiday shopping season.”

USTR is also removing other items from the list based “on health, safety, national security and other factors.”

Growing Concern About the Economic Fallout From the U.S.-China Trade War

Separately, China’s Ministry of Commerce reported that top Chinese negotiators spoke by phone with their U.S. counterparts, Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin, and plan to talk again in two weeks.

Together, the developments calmed investors who’d been worried about an escalation in a trade dispute that has rattled financial markets for more than a year and clouded prospects for the global economy.

The U.S. and China are fighting over American allegations that Beijing steals trade secrets and forces foreign companies to hand over technology. The tactics are part of China’s drive to become a world leader in advanced technologies such as artificial intelligence and electric cars.

Economists at Goldman Sachs on Sunday lowered their economic forecasts, citing the impending tariffs on consumer goods. And economists at Bank of America Merrill Lynch raised their odds of a recession in the next year to roughly 33%, up from about 20%.

“We are worried,” Michelle Meyer, head of economics at Bank of America Merrill Lynch, wrote Friday. “We now have a number of early indicators starting to signal heightened risk of recession.”

Goldman said all the tariffs on China have increased uncertainty for businesses, which will likely cause them to pull back on hiring and investing in new equipment or software. Trump’s duties on Chinese goods have also pushed stock prices lower, which could depress spending by wealthier Americans, Goldman found.

Categories

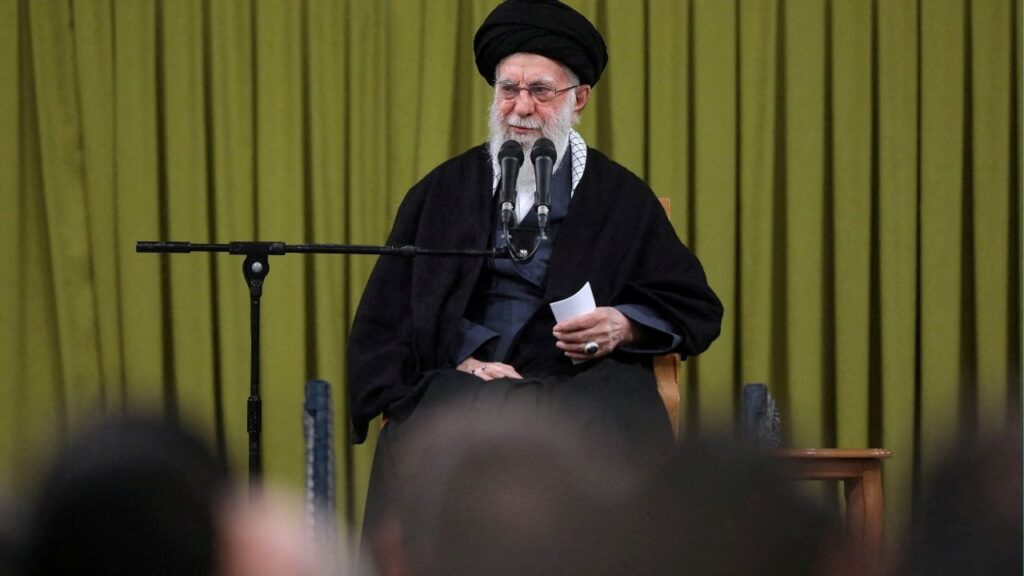

Who Could Take Over for Ayatollah Ali Khamenei?

Why Have You Started This War, Mr. President?