If the Economy’s So Good, Why Is GDP So Low?

Share

[aggregation-styles]

Fortune

Fortune

There’s something missing in today’s so-called historically strong economy: blowout GDP numbers.

During the last half of the past century, the Department of Commerce released some pretty impressive GDP reports. Here are the highest annual real GDP readings during each decade from 1950 until 2000: 8.7% (1950), 6.6% (1966), 5.6% (1973 and 1978), 7.3% (1984), and 4.7% (1999). Those are hefty numbers compared to the 21st century. Between 2001 and 2010, the highest real GDP recorded was 3.8% (2004), and from 2011 until today the highest yearly rate was 2.9%, which happened twice (2015 and 2018).

With an economy as complex as the United States, it’s never one thing, but here are a few elements contributing to tamer numbers on the GDP front. “As we’ve matured as an economy, we consume 65% services,” says Marc Chandler, Chief Market Strategist with Bannockburn Global Forex. “Compare that to China, which has consumed more cement in the last 20 years than the U.S. has for the last 200 years.” That follows a pattern where economies will spend money on fixed capital first, which is a strong stimulus for growth. That includes roads, highways—and houses. “Let’s say you’re starting a family. First, you buy a house, then you buy furniture and TV’s. After that, you buy services.” And that brings us up to today: a largely service economy.

During the last half of the past century, the Department of Commerce released some pretty impressive GDP reports. Here are the highest annual real GDP readings during each decade from 1950 until 2000: 8.7% (1950), 6.6% (1966), 5.6% (1973 and 1978), 7.3% (1984), and 4.7% (1999). Those are hefty numbers compared to the 21st century. Between 2001 and 2010, the highest real GDP recorded was 3.8% (2004), and from 2011 until today the highest yearly rate was 2.9%, which happened twice (2015 and 2018).

With an economy as complex as the United States, it’s never one thing, but here are a few elements contributing to tamer numbers on the GDP front. “As we’ve matured as an economy, we consume 65% services,” says Marc Chandler, Chief Market Strategist with Bannockburn Global Forex. “Compare that to China, which has consumed more cement in the last 20 years than the U.S. has for the last 200 years.” That follows a pattern where economies will spend money on fixed capital first, which is a strong stimulus for growth. That includes roads, highways—and houses. “Let’s say you’re starting a family. First, you buy a house, then you buy furniture and TV’s. After that, you buy services.” And that brings us up to today: a largely service economy.

By Bob Sellers | 27 June 2019

RELATED TOPICS:

Trump Says He Will Order Voter ID Requirement for Every Vote

Politics /

12 hours ago

Greta Thunberg Joins Flotilla Heading for Gaza With Aid

World /

12 hours ago

Chicago Mayor Says Police Will Not Aid Federal Troops or Agents

U.S. /

12 hours ago

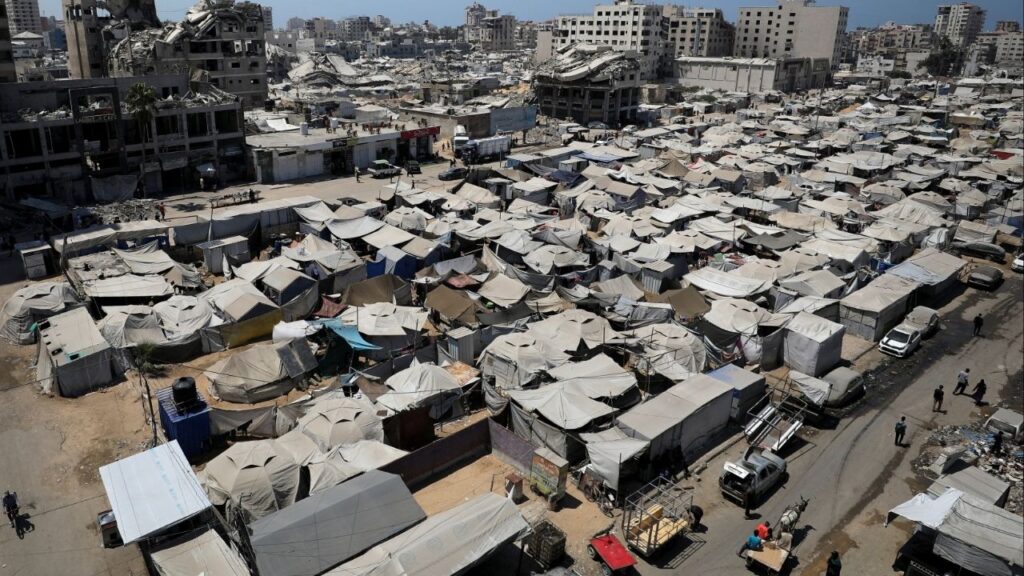

Post-War Gaza Plan Sees Relocation of Population, ‘Digital Token’ for Palestinian Land: Washington Post

World /

12 hours ago

Labor Day Quiz: Do You Know What a Knocker-Upper Is?

Opinion /

13 hours ago

Judge Blocks Pillar of Trump’s Mass Deportation Campaign

Latest /

1 day ago

Visalia Driver Arrested for DUI After Multiple Crashes and Pedestrian Injured

Crime /

1 day ago

Fresno County Garnet Fire Grows to 18,748 Acres in Sierra National Forest

A lightning-sparked wildfire, the Garnet Fire, in the Sierra National Forest has burned 18,748 acres in Fresno County and remains at 8% cont...

Local /

12 hours ago

Categories

Latest

Videos

Local /

12 hours ago

Fresno County Garnet Fire Grows to 18,748 Acres in Sierra National Forest

World /

12 hours ago

Israel Pounds Gaza City Suburbs, Netanyahu to Convene Security Cabinet

Politics /

12 hours ago

Trump Says He Will Order Voter ID Requirement for Every Vote

World /

12 hours ago

Greta Thunberg Joins Flotilla Heading for Gaza With Aid

U.S. /

12 hours ago

Chicago Mayor Says Police Will Not Aid Federal Troops or Agents

World /

12 hours ago

Post-War Gaza Plan Sees Relocation of Population, ‘Digital Token’ for Palestinian Land: Washington Post

Video /

2 days ago