Share

Precision isn’t always possible when it comes to retirement planning. That doesn’t mean you have to wing it and hope your savings don’t expire before you do.

Looking at the income, living expenses and life spans of today’s retirees can help you make the right financial moves so your golden years aren’t tarnished by an unexpected shortfall.

What’s an ‘Average’ Retirement Cost?

Government and Gallup data reveal a lot about what retirement is like for Americans today.

Your mileage may vary based on things such as your work (accountant versus rodeo clown, for example), diet, family health history and participation in extreme sports leagues.

The average budget for a retiree, according to Bureau of Labor Statistics data, provides even more color on what to expect when you’re expecting to retire. Older households, defined as ones headed by someone 65 or older, spend $46,000 annually, versus the $57,000 average spent by all U.S. households combined. The top three monthly expenses for those 65 and older are housing ($1,322), health care ($500) and food ($484).

On average, about half of a retired household’s income comes from Social Security and private and government pensions, according to the BLS, with personal savings and investment and rental income providing 6.9 percent.

Find out How Long Money Will Last?

An online retirement calculator can project a more accurate picture of your retirement readiness. It will use your current saving, spending and investment profile and some rules of thumb about historical investment returns, reasonable withdrawal rates and, yes, life expectancy. (Most calculators assume people will live into their 90s.)

What if the calculator shows that at the rate you’re going, you’ll outlive your retirement savings? If you’re not yet retired, one of the best moves is postponing your retirement party. This strategy is especially valuable for those in their peak earning years.

Besides reducing the number of years you’ll need to live off your savings, working longer allows more time for your investments to grow. Plus, the additional time contributing to Social Security could mean a bigger benefits paycheck down the road. Every year you postpone filing for Social Security after your full-benefit retirement age (66 or 67 for most people), your future monthly benefits check grows by as much as 8 percent per year until you turn 70.

How to Pad Your Paycheck in Retirement

If you’re already retired and un-retiring or waiting to file for Social Security aren’t feasible, there are other ways to make up for the shortfall between retirement income and expenses:

— Shop for an immediate annuity. Although annuities are complex instruments, they’re essentially investments baked into an insurance policy. Paying a lump sum upfront to get a guaranteed monthly payment for life may provide the income stability you need.

— Withdraw less money during down years. A common rule of thumb among financial pros is the 4 percent rule, which is based on research in all market conditions that shows a retiree can withdraw that amount annually from a portfolio invested half in stocks and half in bonds without depleting their financial reserves before they die. If you can be flexible and withdraw less, for example, when market returns are lower than expected or you’ve got reserves from previous years’ withdrawals, you can make your money last longer.

— Seek assistance. There are government, nonprofit and for-profit programs that provide benefits to struggling seniors. The National Council on Aging (NCOA.org) helps the 60-plus set navigate things such as Supplemental Security Income, Medicaid, debt management programs and subsidized housing.

RELATED TOPICS:

Categories

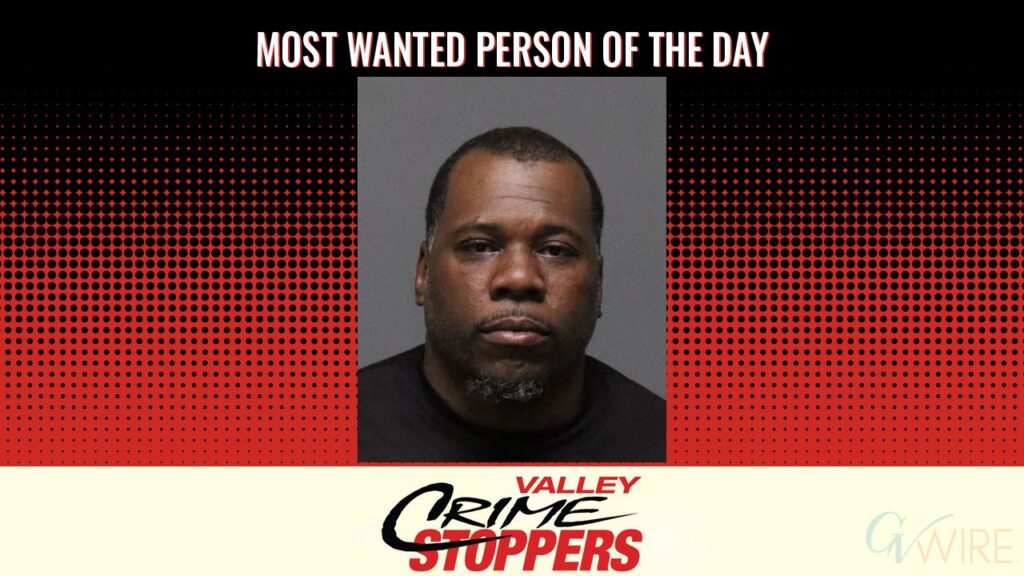

Valley Crime Stoppers Seeks Domestic Violence Suspect

US Consumer Confidence Improves in February

Pentagon Races to Spend $153 Billion in Added Funds for Military