Share

As we watch Britain going through the paroxysms relating to Brexit, it is easy to view its decision to leave the European Union as an act of foolishness, a self-inflicted wound that will impoverish Britons for years to come. Europe is Britain’s largest market, taking in almost half of the country’s exports. Losing special access to it is a high price to pay for some symbolic gains in sovereignty.

Opinion

Fareed Zakaria

EU Wandering Off Course

For the last three decades, the European project has been wandering off course. What began as a community of nations cooperating to create larger markets, greater efficiency and political stability became obsessed with two massive issues that have undermined its central achievements.

The first was — in the wake of the Soviet Union’s collapse — the rapid integration of many new countries that were far less economically and socially developed than the EU’s original members. Since 1993, it has expanded from 12 countries to 28. Originally focused on opening up markets, streamlining regulations and creating new growth opportunities, the EU soon became a “transfer union,” a vast scheme to redistribute funds from prosperous countries to emerging markets. Even in today’s strong economic environment, spending by the EU accounts for more than 3 percent of Hungary’s economy and almost 4 percent of Lithuania’s.

Immigration Fueled Nationalist Rise

This gap between a rich and poor Europe with open borders inevitably produced a migration crisis. For example, as Matthias Matthijs pointed out in Foreign Affairs, from 2004 to 2014, about 2 million Poles migrated to the UK and Germany and about 2 million Romanians moved to Italy and Spain. These movements put massive strains on the safety nets of destination countries and provoked rising nationalism and nativism. The influx into Europe of more than 1 million refugees in 2015, mostly from the Middle East, must be placed in the context of these already sky-high migrant numbers. And as can be seen almost everywhere, from the United States to Austria, fears of immigration are the rocket fuel for right-wing nationalists, who then discredit the political establishment that they deem responsible for unchecked flows.

The second challenge consuming the European Union has been its currency, the euro. Launched more with politics than economics in mind, the euro has embodied a deep structural flaw: It forces a unified monetary system on 19 countries that continue to have vastly different fiscal systems. So when a recession hits, countries do not have the ability to lower the value of their currency, nor do they get large additional resources from Brussels (as American states do from Washington when they go into recession). The results, as could be seen for years after 2008, were economic stagnation and political revolt.

Rethinking European Union

Europe is foundering. While some Americans seem to delight in this prospect, it is bad for our country.

“By the middle of the century you’re going to live in a multi-polar world,” Blair said. “In those circumstances, the West should stay united and Europe should stand alongside America, because in the end … we’re countries that believe in democracy and freedom and the rule of law. … Otherwise we’re going to find that as this century progresses and my children and grandchildren work out where they stand in the world, the West is going to be weaker. And that’s bad for them, and bad for all of us.”

About the Author

Fareed Zakaria writes a foreign affairs column for The Post. He is also the host of CNN’s Fareed Zakaria GPS and a contributing editor for the Atlantic. His email address is comments@fareedzakaria.com.

Categories

Ilhan Omar Condemns Arrest of State of the Union Guest

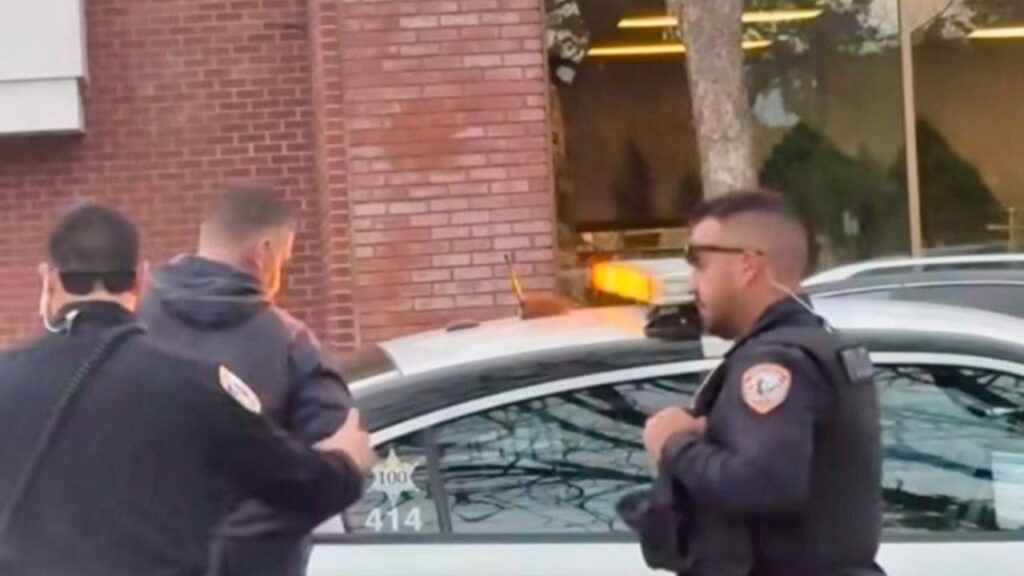

Visalia Police Arrest Man on Indecent Exposure Charge

Israelis Are Waiting for War With Iran, Again