Share

An anything-is-possible attitude enveloped post-World War II America, fueling ambitious undertakings such as a nationwide network of freeways, nuclear power so inexpensive that it wouldn’t need to be metered, and exploring outer space.

Opinion

Dan Walters

CALmatters Commentary

California’s version of redevelopment hinged on the novel notion of “tax increment financing.” Local governments, cities mostly, could deem neighborhoods as “blighted,” borrow money through bonds to improve housing and other services, and repay the loans from the property tax “increments” that those improvements generated.

For decades, those powers were gingerly used, although there were complaints that redevelopment projects disrupted ethnic neighborhoods and were architecturally and culturally sterile.

Everything changed when voters passed Proposition 13 in 1978, imposing tight limits on property taxes collected by schools and local governments and thus making the distribution of revenues a zero-sum game.

Redevelopment morphed into a way for cities to keep more of the property tax pot, so they expanded designated improvement zones, often stretching the meaning of “blight” to the breaking point, used bonds to subsidize hotels, auto malls and other commercial projects that would generate sales tax revenues, and siphoned off some revenue for general city services.

Housing Crisis Fuels New Push for Redevelopment

Unspent funds meant for housing would accumulate in city coffers, often due to local opposition to low-income housing projects. Some affluent cities were granted permission to spend low-income housing funds in other cities, so as not to disturb their upper-class residents.

Meanwhile, the interaction of redevelopment, Proposition 13 and Proposition 98, a school finance law passed in 1988, meant that incremental property taxes being retained by cities not only kept them away from counties and other local governments, but also from schools and the state had to make up the revenue shortfall to school districts.

Ultimately, about 10 percent of the total property pot was being retained by local governments – $5-plus billion a year – and the state was compelled to give schools about $2 billion to backfill their property tax losses.

It all came to a screeching halt seven years ago when the Legislature and Gov. Jerry Brown abolished redevelopment and compelled cities to disburse sequestered funds and other assets to schools and other local agencies.

Ever since, there have been efforts to bring back redevelopment in some form. Cities, for instance, were allowed to create Enhanced Infrastructure Financing Districts, but only three cities use them.

The state’s housing crisis has fueled a new push for redevelopment. City officials contend that if the state is compelling them to meet housing quotas, they need redevelopment to generate funds.

Investing About $7.7 Billion in Housing

However, the same bugaboo that led to redevelopment’s demise – the shift of incremental property taxes – still looms. Whatever tax funds redevelopment might generate for housing would come from other local agencies and the state would be on the hook again for the schools’ revenue losses.

He threw cold water on efforts to re-establish the program, saying, “I think we are doing even more” than redevelopment would contribute to solving the shortage of low- and moderate-income housing.

His rejection of redevelopment was coupled with a warning that if cities and other local governments didn’t meet housing quotas, they could see a loss of funds from the state’s new transportation program.

So it was a double whammy of sorts.

CALmatters is a public interest journalism venture committed to explaining how California’s state Capitol works and why it matters. For more stories by Dan Walters, go to calmatters.org/commentary.

Categories

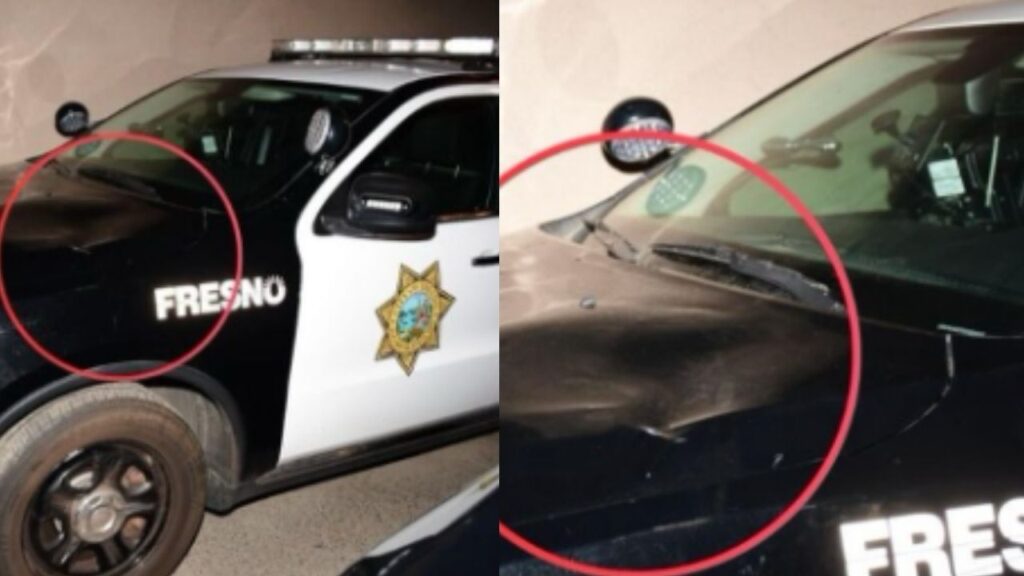

Fresno Police Arrest Three After Patrol Vehicle Vandalized

Ski. Breathe. Shoot. The Wonderful Chaos of Biathlon.

President Acknowledges That He Is Weighing Limited Strike on Iran