UnitedHealthcare sign outside of its office building in Minnetonka, Minnesota, U.S., December 11, 2025. (Reuters File)

Share

|

Getting your Trinity Audio player ready...

|

Nearly 3 million people with Medicare Advantage plans – or about 10% of all enrollees in the privately-managed program – had to find alternative coverage in 2026, as health insurers exited markets and scaled back plan options, according to a study published in a medical journal on Wednesday.

Members in rural areas experienced plan disruptions at double the rate of those in urban areas, the JAMA study found, raising concerns about losing access to healthcare providers, specialty care and long-term treatments, Hannah James, policy researcher at think tank RAND Corporation, wrote in an editorial accompanying the study.

In seven states, more than 40% of Medicare Advantage enrollees were left scrambling as plans exited, including 92% of enrollees in Vermont. The others were Idaho, Wyoming, North Dakota, South Dakota, Maryland, and New Hampshire.

The government’s Medicare health program provides benefits to about 60 million people aged 65 and older or who have disabilities. About half of them enroll in Medicare Advantage plans run by major health insurance companies while the other half receive benefits from traditional government-run Medicare.

In 2025, health insurance companies reported shortfalls in plans after costs rose and government reimbursement declined and said they would pull out of or shift markets in 2026.

Unitedhealthcare, Aetna, Elevance All Shift

Enrollees of smaller insurance carriers represented half of those experiencing disruptions, the study found.

UnitedHealthcare, part of UnitedHealth Group accounted for nearly 14% of disruptions, followed by CVS Health’s Aetna, and Elevance at 8.65% and about 8%, respectively.

Plans that had provided consumers with greater choice in providers were most frequently terminated, the study also found.

The current model, in which the government pays insurers on a pre-negotiated basis incentivizes insurers to attract more profitable patients, James said in her editorial.

“Policymakers should consider whether the current program design adequately aligns plan incentives with beneficiary needs,” James said.

In 2025, UnitedHealthcare accounted for nearly a third of all Medicare Advantage plans, according to health policy firm KFF. Humana, CVS Health and Elevance accounted for 17%, 12%, and 7% of plans, respectively.

—

(Reporting by Amina Niasse in New York; Editing by Caroline Humer and Bill Berkrot)

RELATED TOPICS:

Categories

Wall Street Ends Higher, Lifted by Nvidia and Other AI Stocks

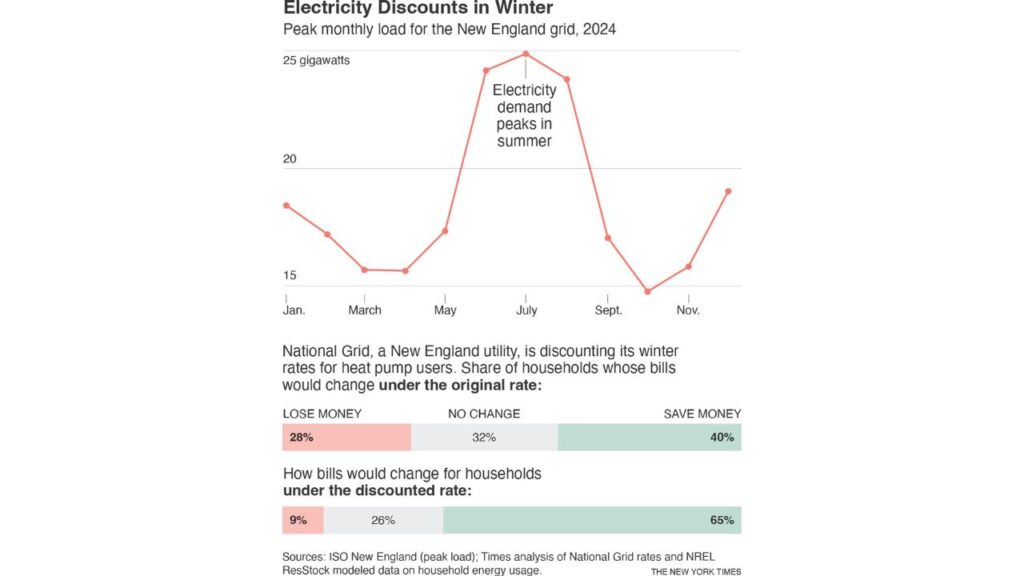

Why Some Cold States Are Making It Cheaper to Run a Heat Pump

Kentucky Derby Operator Accused of Regulatory ‘Freeloading’

US Withdrawing All Forces From Syria, WSJ Reports