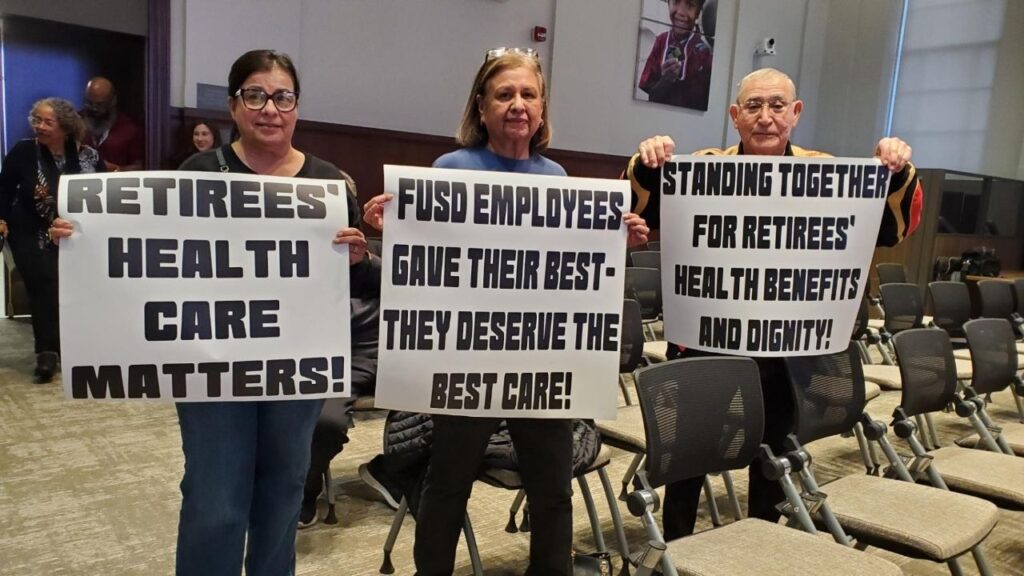

Attendees at the Wednesday, Jan. 14, 2026, Fresno Unified board meeting brought signs addressing concerns over retiree health insurance. (GV Wire/Jahziel Tello)

- Fresno Unified retirees attended the Wednesday night School Board meeting to share current healthcare concerns and celebrate expanded options.

- The Joint Health Management Board — responsible for negotiating health care plans — is meeting Thursday to discuss expanding options for retirees.

- Community Medical Centers has agreed to an extension of care, providing a short term solution for retirees needing care.

Share

|

Getting your Trinity Audio player ready...

|

Thousands of Fresno Unified retirees abruptly lost their health insurance this month, forcing many into limbo as they wait on decisions. Some retirees aired their concerns at Wednesday night’s School Board meeting, demanding answers, and welcoming news of a temporary coverage window and possible expanded options ahead.

The group of retirees harbored a central request: Bring back the option of traditional Medicare. And now, district personnel and union leaders are moving to do just that.

“We are going to vote to provide a second option for retirees,” Fresno Unified’s CFO Patrick Jensen said. “The district would become the secondary insurer after Medicare.”

The retirees seeking change are currently covered through Aetna’s Medicare Advantage Plan, which they feel has failed some of them.

Thousands Cut Off From Health Care

Recently, their concerns came to a head when contract disagreements between Community Medical Centers and Aetna caused thousands to be cut off from access to care.

About 6,250 Fresno Unified retirees and dependents are enrolled in the Medicare Advantage program, with approximately 1,500 receiving primary care through Community.

Now, Community agreed to an extension of retirees access clinic visits and prescription refills through Feb. 20 as negotiations continue. The system said it will provide all emergency services regardless of insurance status and will honor continuity-of-care provisions for patients in active treatment, including cancer care, Community’s president and CEO, Craig A. Wagoner said in a statement. For all other services, Community said it will seek approval from Aetna on a case-by-case basis to provide in-network care to FUSD retirees.

“We are working with Fresno Unified to help ensure FUSD retirees have access to our hospitals and providers during our negotiations with Aetna and minimize disruption in care,” Wagoner said.

Fresno Unified administrations and union leaders met with Community on Wednesday morning to discuss the matter, according to a statement from the district.

“Our retirees should never be treated as bargaining chips,” Superintendent Misty Her said.

Related Story: Thousands of Fresno Unified Retirees Cut Off From Health Care

Fresno Unified Expands Options

The Joint Health Management Board — responsible for negotiating employee and retiree health care plans — is meeting on Thursday to discuss expanding insurance options for retirees.

“I am happy with their willingness to do that and give us a choice,” retiree Emily Brandt said. Retirees Maureen Doyle and Dolores Alcaraz were also pleased with this outcome.

The current predicament between Aetna and Community is a central reason that JHMB is motioning to provide more options.

“One of the difficulties is we lose some direct control in the negotiating process. We have a negotiation between one of the big four national insurance companies and one of our local hospitals,” Jensen told GV Wire. “We’re not party to that negotiation. So that’s one issue for us.”

However, the district predicts many retirees will stay on the advantage plan, which provides low deductibles and more out-of-state options, according to Jensen.

The process will take six months to a year due to federal requirements and regulations.

Retirees are hoping for an expedited timeline or for expected care to resume at Community.

“It would be too late for me,” Brandt, who is currently undergoing cancer treatment, said.

Retirees Bring Their Complaints to the School Board

The group of retirees is hoping to remove themselves from what a restrictive advantage plan that they say pushes prior authorization for procedures, referral rules, denials, and insurer-run appeal — causing undue stress and longer wait times.

Prior to 2023, retirees could choose to use traditional Medicare with Fresno Unified providing a supplemental plan.

“It was perfect,” Brandt said. “It seems like nobody did any research on what might be bad about (Aetna’s Medicare Advantage plan).”

Currently, Aetna Medicare Advantage or Kaiser Permanente Medicare Advantage are the only options of retirees ages 65+.

These plans were negotiated by the JHMB — comprised of union representatives and district staff — and approved by the School Board.

“There are retirees who sit on the JHMB board who are part of their unions,” JHMB member Steven Shubin previously told GV Wire. “And the JHMB did meet with the FURA multiple times to review and discuss the plan changes in late 2022.”

However, many retirees felt blindsided by the decision, saying there was a lack of communication.

Related Story: Fresno Unified’s Health Insurer Creating Headaches for Some Retirees

Trustees Share Concerns

At the Dec. 17, 2025, School Board meeting, trustees unanimously agreed to renew the district’s contract with Aetna despite sharing concerns of their own.

“(JHMB) wouldn’t make any decision that they don’t think is in the best interest of our current employees and retirees,” Trustee Elizabeth Jonnasson-Rosas said. But she had heard frustrations about Aetna, some of which she attributes to the general state of health care in the United States.

The School Board first approved the contract on July 1, 2023.

“We were told that it was the exact same coverage, but that is turning out not to be the case for some,” Trustee Susan Wittrup said.

Now, they are focused on ensuring retirees maintain access to care offered by Community.

“I really hope that (Community and Aetna) are able to work out a contract,” Jonnasson-Rosas said. “Extensions are just uncertainty for people. When someone calls the doctor’s office or a specialists office, the appointments are months out.”

Wittrup is ready to escalate matters if permeant solutions aren’t found. She feels that stripping individuals from care during stalled negotiations should be illegal.

“I’m calling on California legislators and our attorney general,” Wittrup said, hoping to prevent a situation like this from happening again.

Fresno Unified Switch to Medicare Advantage

In 2023, JHMB and the School Board approved a switch from traditional Medicare to Aetna, a profit-driven private insurer.

During that time, Fresno Unified paid $450 per member per month and Aetna Medicare Advantage submitted a bid of $298 per member per month, according to documents obtained by GV Wire.

The school board approved three-year contract with Aetna, agreeing to pay $228 per month per employee. There were 7% rate increases in 2024 and 2025.

At the time, the switch created a net saving of around $16.5 million.

“But the primary reason (for the switch) was reduced deductibles, reduced co-pays, and the national network,” Jensen said. “Now, the landscape has changed over the last couple of years. And we’re finding the costs for (advantage plans) are increasing, so we’re saving less and less money per year.”

Now, the district extended its contract with Aetna, paying about $530 per member, increasing expenses by 85%, according to School Board meeting documents. Expenses will increase by 11.7% in 2027.

However, the new figure does not cost more than what would be paid with traditional Medicare, Shubin said.

Aetna Promised Increased Coverage

The advantage plan promised to exceeded coverage offered through traditional Medicare — expanding coverage and lowering expenses for retirees.

“Aetna’s Medicare Advantage Plan is giving our retirees enhanced benefits from our current plan which includes enhanced hearing benefits, Annual Healthy Home visits, non-emergency transportation, and Silver Sneakers fitness benefits,” the board documents state. “Elimination of the annual deductible and co-insurance payments which will help our retirees with less out of pocket cost.”

However, that has not been the experience of many retirees, who told GV Wire that Aetna’s Medicare Advantage plan made it harder to access care.

The sicker an individual becomes, the more likely Aetna is to block care, Brandt said. But she acknowledged that some retirees may want to stay with Aetna.

But Brandt and Doyle are both looking to get back to traditional Medicare.