Futures-options traders work on the floor at the New York Stock Exchange's NYSE American (AMEX) in New York City, U.S., January 13, 2026. (Reuters/Brendan McDermid)

Share

|

Getting your Trinity Audio player ready...

|

Wall Street indexes inched lower on Wednesday as major banks reported earnings and investors surveyed a panoply of economic and political uncertainties which helped inflate prices for precious metals and oil.

Data showed U.S. retail sales increased more than expected and producer prices picked up slightly in November. This offered little reason to change broad expectations that the Federal Reserve will cut interest rates twice later this year.

Banner earnings releases from three of the largest U.S. banks showed rising profits from lending to credit-hungry consumers and businesses, and rising fees from a dealmaking rebound, but investors sold their stock anyway.

Bank of America shares fell more than 4%, Citigroup’s shed 2.5% and Wells Fargo stock slid 5%.

“Banks have had a very strong start to the year and markets are taking a little time to digest” the results, said Jake Johnston, deputy CIO, Advisors Asset Management.

“We’re seeing slight misses on some of the estimates, but these stocks had strong run-up into these reports, and it’s not unusual to see a little bit of a pullback.”

The Dow Jones Industrial Average fell 0.43%, to 48,981.98, the S&P 500 fell 0.73%, to 6,913.19 and the Nasdaq Composite fell 0.96%, to 23,482.44.

Banks stocks had jumped 25% in the 12 months before Wednesday’s slide.

‘Sell America’

Traders are grappling this week with questions over Federal Reserve independence, the U.S. desire to own Greenland and its implications for the NATO alliance, and whether the U.S. would attack Iran following a crackdown on historic protests there.

The mood remains positive towards equities, said Bradesco BBI head of equity strategy Ben Laidler, but “policy uncertainty, led by the U.S., has spiked, and that’s generated headlines around ‘sell America’.”

The dollar, meanwhile, is struggling to maintain a rally begun in late December, although expectations that the Fed will wait several months before re-starting rate cuts, along with geopolitical uncertainty, should support the currency.

The dollar index, which measures it against a basket of currencies including the yen and the euro, fell 0.17% to 99.02, with the euro up 0.09% at $1.1651.

The U.S. Supreme Court took one item off the day’s agenda when it did not issue a ruling on the legality of President Donald Trump’s global tariffs. Investors are still processing news that U.S. high-end department store conglomerate Saks Global filed for bankruptcy protection.

Paved With Gold?

Much market momentum was reserved for oil and precious metals.

Silver rose to $92 per ounce for the first time on Wednesday. It began 2025 under $30 an ounce, and has surged 29% in the first nine trading days of the year. [GOL/]

Gold hit yet another record high of $4,641.40 per ounce and was last seen 0.7% higher at $4,619.46 an ounce. Copper is also at unprecedented levels. [MET/L]

“All roads are leading to gold and silver,” said Alex Ebkarian, COO at Allegiance Gold, citing demand from diverse buyers and noting the market is in a structural bull phase.

Gold yields no interest and typically performs well when interest rates are low and uncertainty is high.

On the flip-side of the global uncertainty trade, concerns over Iranian supply disruptions sent oil prices higher for a fifth straight session. [O/R]

U.S. crude rose 0.98% to $61.75 a barrel and Brent gained 1.08% to $66.18 per barrel.

The oil price increase was contained by significant crude and product builds in the U.S., the American Petroleum Institute reported late on Tuesday.

—

(Reporting by Isla Binnie, Alun John, Ankur Banerjee in Singapore; Editing by Ed Osmond and Nick Zieminski)

RELATED TOPICS:

Categories

How the Iran War Is Choking Off the World’s Oil and Gas

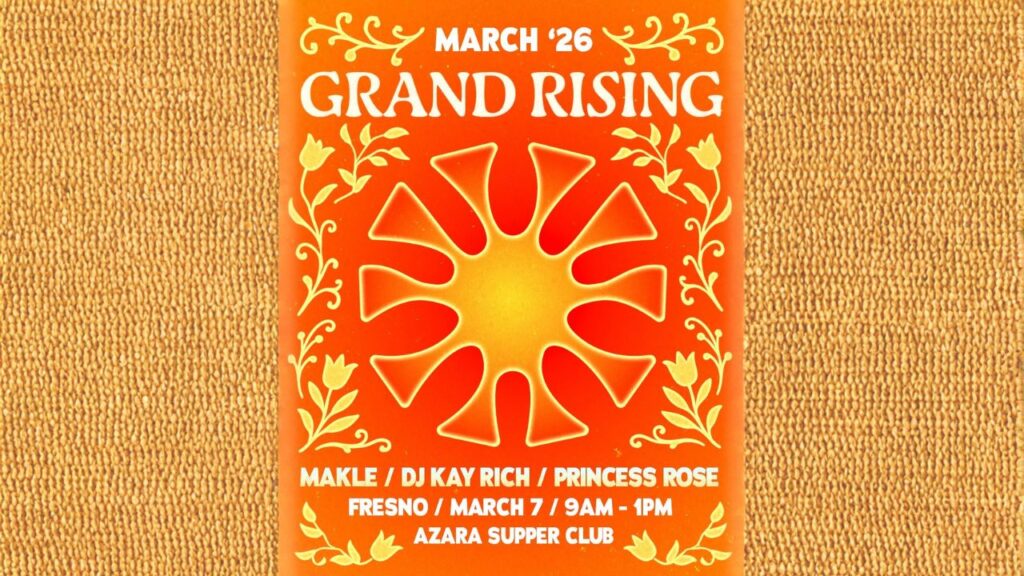

Fresno Man Killed After Being Struck by Vehicle Identified