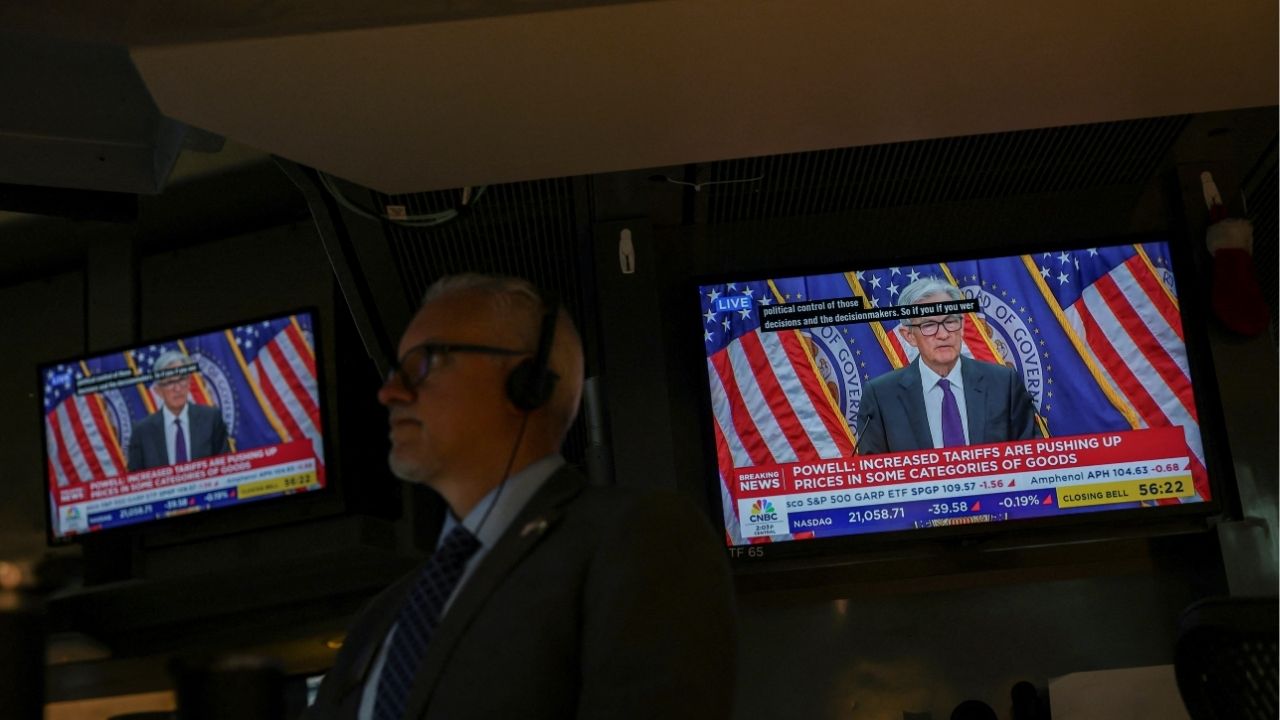

A trader works, as screens broadcast a press conference by U.S. Federal Reserve Chair Jerome Powell following the Fed rate announcement, on the floor of the NYSE in New York, U.S., July 30, 2025. (Reuters File)

Share

|

Getting your Trinity Audio player ready...

|

The S&P 500 and the Nasdaq inched lower on Tuesday in thin trading volumes, as technology stocks came under pressure for a second day, while declines in financial stocks weighed on the Dow.

Tech stocks fell 0.2%, with Nvidia and Apple down 0.6% and 0.4%, respectively, and are set to extend their declines from Monday. Gains in these heavyweight stocks had lifted the S&P 500 to a record high last week.

Meta Platforms gained 1.4%, boosting the communication services sector by 0.4%. The Instagram parent said on Monday it would acquire artificial intelligence startup Manus.

However, trading volumes were thin in the holiday-truncated week, with U.S. markets closed on Thursday for New Year’s Day.

“Heading into the new year, you may have some repositioning… I wouldn’t try to make too much out of anything that happens in a holiday-shortened week and very light trading volume,” said Art Hogan, chief market strategist at B Riley Wealth.

Losses in Goldman Sachs and American Express weighed on the Dow.

Main Markets Fall

At 10:13 a.m. ET, the Dow Jones Industrial Average fell 85.11 points, or 0.18%, to 48,376.82, the S&P 500 lost 6.72 points, or 0.10%, to 6,897.46 and the Nasdaq Composite lost 35.43 points, or 0.15%, to 23,438.92.

All three major indexes remain on track for robust monthly gains in December, with the S&P 500 and the Dow set for their eighth consecutive month of gains, their longest monthly winning streak since 2017.

The benchmark S&P 500 index had stayed within 1% of the historic 7,000-point mark last week, with some investors eyeing a “Santa Claus rally”, a seasonal phenomenon in which the S&P 500 typically posts gains over the last five trading days of the year and the first two trading days of January, according to the Stock Trader’s Almanac.

Focus will remain on minutes from the Federal Reserve’s December 9-10 meeting, where the central bank delivered an expected 25-basis-point cut and took a cautious stance on further reductions until there was more clarity on the health of the U.S. labor market.

However, mild economic data since then and expectations of a new dovish Fed chair have fueled optimism around further U.S. interest rate cuts in 2026.

The S&P 500 has added about 17% so far this year, as the frenzy to capitalize on artificial intelligence helped the U.S. benchmark edge ahead of Europe’s STOXX 600, despite investors diversifying away from U.S. stocks earlier in the year dominated by trade disputes and an uncertain central bank outlook.

Geopolitical tensions could also remain a risk to market sentiment as Russia said it would toughen its negotiating stance after accusing Kyiv of attacking a Russian presidential residence, days after U.S. President Donald Trump indicated progress in peace talks.

The fading hopes of a peace deal supported oil prices, allowing S&P’s energy sub-index to outperform its peers with a 0.7% rise.

T1 Energy rose 1% after the solar firm announced it had completed a $160 million sale of Section 45X production tax credits to a leading, investment-grade buyer of tax credits.

Advancing issues outnumbered decliners by a 1.13-to-1 ratio on the NYSE and by a 1.32-to-1 ratio on the Nasdaq.

The S&P 500 posted 3 new 52-week highs and one new low while the Nasdaq Composite recorded 21 new highs and 121 new lows.

—

(Reporting by Purvi Agarwal and Nikhil Sharma in Bengaluru; Editing by Krishna Chandra Eluri)