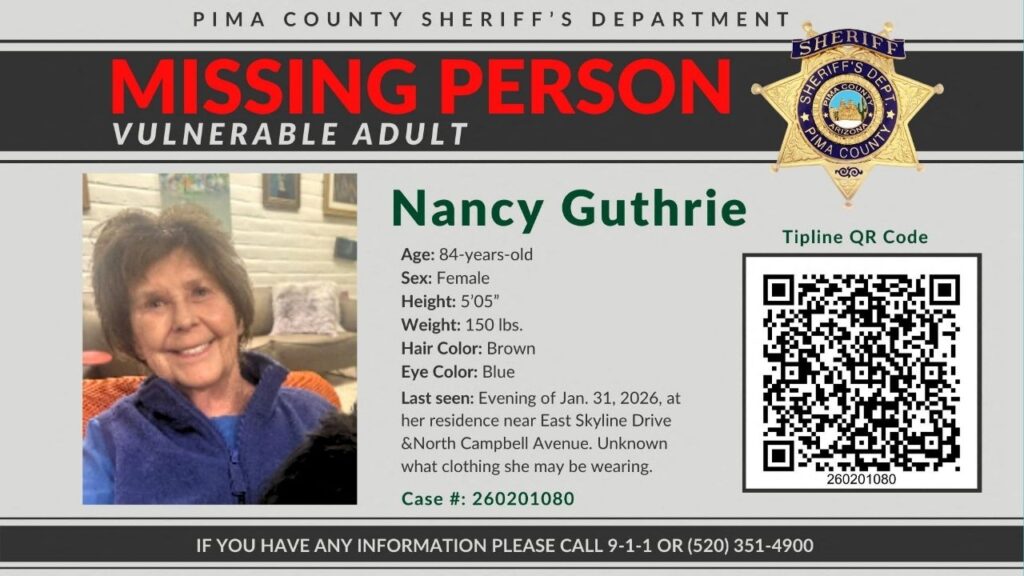

A salesperson shows a gold ring to customers at a jewelry showroom in Ahmedabad, India, October 8, 2025. (Reuters/Amit Dave)

Share

|

Getting your Trinity Audio player ready...

|

Gold prices edged lower on Wednesday, taking a breather after surging past the key $4,500-an-ounce mark earlier in the session, while silver and platinum trimmed some gains following their record-breaking rally.

Spot gold was down 0.4% at $4,468.96 per ounce at 10:04 a.m. ET (1504 GMT), after marking a record high of $4,525.18 earlier in the session.

U.S. gold futures for February delivery fell 0.2% to $4,497.90.

The gold market is seeing some chart consolidation and mild profit-taking after record highs, said senior analyst at Kitco Metals Jim Wyckoff.

Gold tends to do well in a low-interest-rate environment and thrives during periods of uncertainty.

U.S. President Donald Trump said on Tuesday he wants the next Federal Reserve chair to lower interest rates if markets are doing well. The U.S. central bank has cut rates three times this year and currently traders are pricing two rate cuts next year.

On the geopolitical front, the U.S. Coast Guard is waiting for additional forces to arrive before potentially attempting to board and seize a Venezuela-linked oil tanker it has been pursuing since Sunday, a U.S. official told Reuters.

Silver hit an all-time high of $72.70 but was last down 0.8% at $70.86 an ounce.

“The next upside target for gold market is $4,600/oz and for silver is $75/oz by the end of the year. The technicals remain bullish,” Wyckoff added.

Silver prices have surged 147% year-to-date on strong fundamentals, outpacing bullion’s gain of over 70% during the same period.

Platinum peaked at $2,377.50 before paring gains to stand 3.3% lower at $2,198.30. Palladium was down 9% at $1,692.43 an ounce, retreating after touching its highest in three years earlier.

Platinum and palladium, primarily used in automotive catalytic converters to reduce emissions, are up about 160% and more than 100%, respectively, year-to-date, on tight mine supply, tariff uncertainty, and a rotation from gold investment demand.

—

(Reporting by Sarah Qureshi in Bengaluru; Editing by Lisa Shumaker)

RELATED TOPICS:

Categories

What to Know About the Homeland Security Shutdown