A pump jack operates near a crude oil reserve in the Permian Basin oil field near Midland, Texas, U.S. February 18, 2025. (Reuters File)

Share

|

Getting your Trinity Audio player ready...

|

NEW YORK — Oil prices swung between gains and losses on Monday as analysts stuck to predictions that rising supply will outweigh demand in the months ahead, while hopes of progress in ending a U.S. government shutdown raised investors’ risk appetite.

Brent crude futures rose 26 cents, or around 0.4%, at $63.89 a barrel by 12:59 p.m. ET (1759 GMT), having dropped to as low as $63.32 earlier. U.S. West Texas Intermediate crude gained 23 cents, also 0.4%, to $59.98 a barrel. WTI futures were down as much 0.6% earlier in the session.

Both benchmarks fell about 2% last week, their second consecutive weekly decline, on expectations that crude oil supply will exceed demand in the months ahead due to higher OPEC+ production and record U.S. output.

Doubts over the effectiveness of the latest U.S. sanctions against Russia are also weighing on crude prices.

“Although the U.S. has stepped up direct sanctions on Russian oil producers Rosneft and Lukoil, it’s not clear how effective they will be in limiting Russian exports,” independent energy analyst Tim Evans said.

This month, OPEC+, or the Organization of the Petroleum Exporting Countries and allied producers, agreed to increase output slightly in December.

While the group also paused further hikes in the first quarter, that may not limit supplies enough to support prices.

“Even with the prospect of reduced Russian supply and the 1Q26 freeze on OPEC+ production quotas, the global crude oil market may run a smaller supply/demand surplus rather than a more supportive deficit,” Evans said.

Crude Inventories on the Rise

Crude inventories are also on the rise in the U.S. while the volume of oil stored aboard ships in Asian waters has doubled in recent weeks after tightening Western sanctions curtailed imports into China and India.

The oil market is split between rising volumes of crude stored at sea weighing on oil prices and limited availability of Russian products sustaining fuel prices, PVM analyst Tamas Varga said.

Russian oil producer Lukoil has declared force majeure at Iraq’s giant West Qurna-2 oilfield, four sources with knowledge of the matter said on Monday, after Western sanctions on the Russian oil major hampered its operations.

Lukoil’s operations faced mounting disruptions as a U.S. deadline for companies to cut off business with the Russian company looms on November 21 and after an agreement to sell the operations to Swiss trader Gunvor collapsed.

Risk Appetite Returns

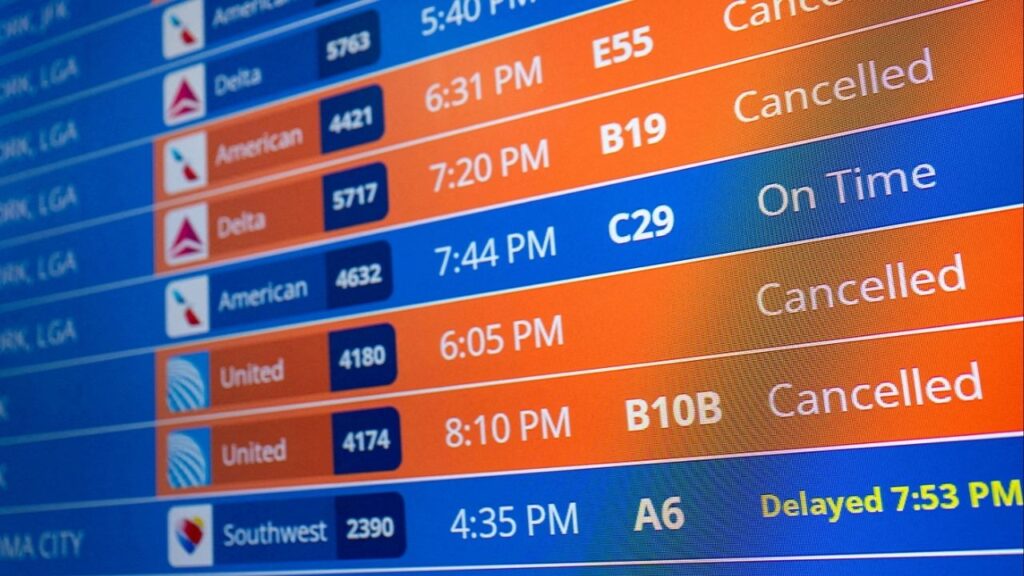

The U.S. Senate moved forward on Sunday on a measure aimed at reopening the federal government and ending a shutdown that has sidelined federal workers, delayed food aid and snarled air travel.

U.S. lawmakers’ first step toward ending the shutdown boosted investors’ risk appetite, PVM’s Varga said.

Energy analysts have expressed concerns that flight cancellations resulting from the shutdown could hit jet fuel demand.

Airlines canceled more than 2,800 U.S. flights and delayed more than 10,200 on Sunday in the worst day for disruptions since the start of the shutdown.

Still, the potential hit to fuel demand from U.S. flight disruptions is not expected to be long enough to affect crude oil prices, said John Coleman, crude oil analyst at Sparta Commodities.

“Even that 10% reduction in U.S. air traffic looks like a short-term blip. Not likely to materially change the demand backdrop here,” Coleman said.

—

(Reporting by Shariq Khan, Enes Tunagur and Florence Tan; Editing by Christian Schmollinger, Joe Bavier, Aidan Lewis, Conor Humphries and David Gregorio)

RELATED TOPICS:

Oil Prices See-Saw as Oversupply Concerns Persist

US Military Kills 6 in Strikes on Suspected Drug Boats, Hegseth Says