An American flag is displayed on the outside of the New York Stock Exchange in New York, Wednesday, Feb. 26, 2025. (AP/Seth Wenig)

- Wall Street steadies after a 1.8% gain, fueled by hopes that Trump’s tariffs may be more targeted.

- Consumer confidence plunges to a 12-year low, signaling concerns about future economic conditions and recession fears.

- Tesla faces declining European sales, impacted by both competition and controversies surrounding CEO Elon Musk.

Share

|

Getting your Trinity Audio player ready...

|

NEW YORK — Wall Street is holding steadier Tuesday after roaring the day before on hopes that President Donald Trump’s tariffs may not be as sweeping as earlier feared.

The S&P 500 was 0.2% higher in morning trading after jumping 1.8% on Monday. The Dow Jones Industrial Average was up 50 points, or 0.1%, as of 10:30 a.m. Eastern time, and the Nasdaq composite was 0.2% higher.

U.S. stocks have recovered a chunk of their losses since falling 10% below their all-time high earlier this month, for their first “correction” since 2023. The S&P 500 is now down roughly 6% from its record, and that drop has left the market looking less expensive than before, which had been a major criticism following its euphoric rise in earlier years.

But strategists along Wall Street warn that more sharp swings are still likely on the way with an April 2 deadline looming. That’s what Trump has called “Liberation Day,” when he will begin a global set of tariffs on trading partners that will roughly equal what he sees as the burden each puts on the United States. Monday’s spurt for Wall Street came on hopes that Trump’s “reciprocal” tariffs may be more targeted than had been feared.

“We think markets are underplaying the risk of a tariff shock in early April,” according to Ajay Rajadhyaksha, global head of research at Barclays. He points to not only traders’ expectations for upcoming volatility in the stock market but also the values of the Mexican peso and Canadian dollar, which haven’t weakened substantially from the last postponement of tariffs.

Trump Tariffs Soured US Confidence

Even if Trump’s tariffs do end up being less painful for the global economy than feared, all the dizzying talk about them has already soured confidence among U.S. households and businesses. The fear is that could lead them to cut back on their spending and freeze the economy.

A report on Tuesday showed that pessimism among U.S. households is only worsening. The Conference Board’s measure of consumer confidence fell by more than expected, mostly because of a tumble for expectations about upcoming conditions in the short term. That dropped to its lowest level in 12 years and is sitting “well below the threshold of 80 that usually signals a recession ahead.”

Like other recent surveys, the data showed U.S. households are much more concerned about where the economy is heading than where it is currently. So far, actual economic activity and the job market seem to be holding up despite the worsening moods of U.S. companies and consumers.

On Wall Street, Trump Media & Technology Group jumped 8.8% after the company behind the president’s Truth Social platform said it had reached an agreement with Crypto.com to offer a suite of “America-First” investment funds.

The exchange-traded funds will hold bitcoin and other digital assets, along with what TMTG called “securities with a Made in America focus spanning diverse industries such as energy.” Crypto.com will support the backend technology, provide custody, and supply the cryptocurrencies for the ETFs, which will operate under TMTG’s Truth.Fi brand.

Homebuilder KB Home Dropped

Homebuilder KB Home dropped 4.2% after reporting weaker profit and revenue for the latest quarter than analysts expected. Already mired in a slump, homebuilders may face potentially rising costs due to tariffs, which they will have to pass on to buyers. A report on Tuesday morning said U.S. sales of new homes last month were slightly weaker than economists expected.

Spice seller McCormick also slipped following a weaker-than-expected profit report. It fell 0.2% as it said it’s dealing with “current uncertainty of the consumer and macro environment.”

Tesla was drifting between modest gains and losses and was most recently down 0.6% following more grim sales figures from Europe.

European sales of Tesla’s electric vehicles dropped by nearly half during the first two months of the year, compared with a year earlier, even as the overall market for battery-powered cars grew, according to the European Automobile Manufacturers Association.

In addition to an aging model line, drops in sales may be due in part to CEO Elon Elon Musk’s endorsement of Germany’s far-right party in last month’s national election, his embrace of fringe political movements, and a gesture during a Trump event in January that many saw as a Nazi salute. Tesla is also facing increasing competition from Chinese carmakers such as BYD.

In stock markets abroad, indexes rose in much of Europe following a mixed finish in Asia.

In the bond market, Treasury yields eased a bit. The yield on the 10-year Treasury slipped to 4.32% from 4.34% late Monday.

RELATED TOPICS:

Categories

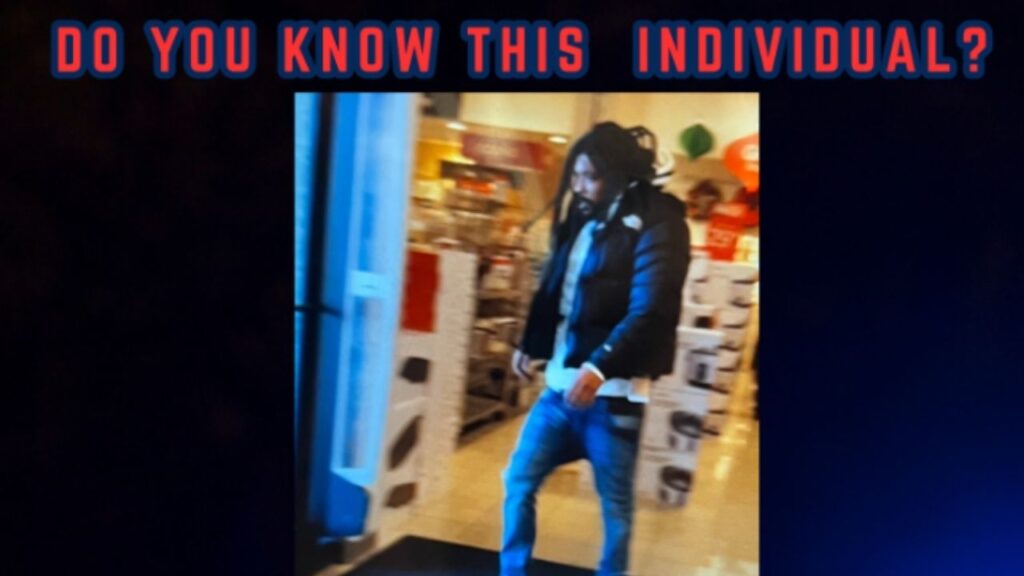

Merced Police Seek Suspect in Shoe Palace Robbery