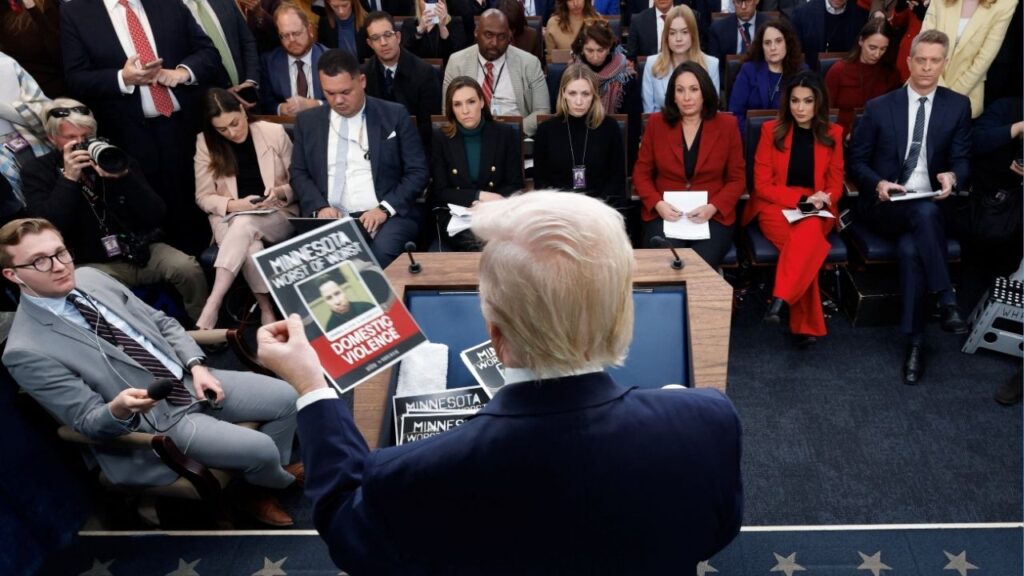

California's new insurance rules face a critical test as wildfires ravage Los Angeles County, causing billions in damages. (AP/Nic Coury)

- New insurance reforms require companies to maintain presence in high-risk areas proportional to statewide market share.

- Insurers can now use catastrophe models and factor in reinsurance costs, potentially leading to higher premiums.

- Experts warn that current fires could strain the new system, challenging California's insurance market stability.

Share

|

Getting your Trinity Audio player ready...

|

California’s new insurance rules face their first major test as devastating wildfires sweep through Los Angeles County. Two brush fires, one in Pacific Palisades and another near Pasadena, have destroyed over 1,000 structures and forced mass evacuations. The Palisades Fire alone could cause up to $10 billion in damages, according to J.P. Morgan.

These fires come on the heels of California’s recently unveiled insurance reforms, aimed at stabilizing a market that has been in crisis for years. Insurance Commissioner Ricardo Lara introduced rules requiring companies to maintain a presence in high-risk areas proportional to their statewide market share.

“This is a historic moment for California,” Lara said. “This reform balances protecting consumers with the need to strengthen our market against climate risks.”

Related Story: How to Help Those Affected by the California Wildfires

New Rules Allow for Forward-Looking Models

In exchange, insurers can now use forward-looking “catastrophe models” and factor in reinsurance costs when setting prices, potentially leading to higher premiums in fire-prone areas.

Some residents, like Jason Lloyd from Lake County, are concerned about potential price hikes. “I’m not optimistic that it will improve the experience of the consumer,” Lloyd said.

The insurance industry cautiously welcomed the changes. Rex Frazier, president of the Personal Insurance Federation of California, stated, “This addresses the major stumbling blocks that companies have been identifying for a decade, so that’s a positive.”

However, experts warn that the current fires could strain the new system. Joel Laucher, a former regulator, told Grist, “These are going to be major losses, certainly. Certain areas are definitely going to have new challenges.”

Frazier added that if California experiences more unprecedented fire seasons, “all bets are off” regarding the industry’s commitment to the state.

Related Story: Firefighters Battle Devastating Los Angeles Wildfires as Winds Calm Somewhat

California’s Approach as a Potential Blueprint

As other Western states face similar insurance challenges, California’s approach may serve as a blueprint for balancing coverage and risk assessment in an era of increasing climate-driven disasters.

Read more at Wired