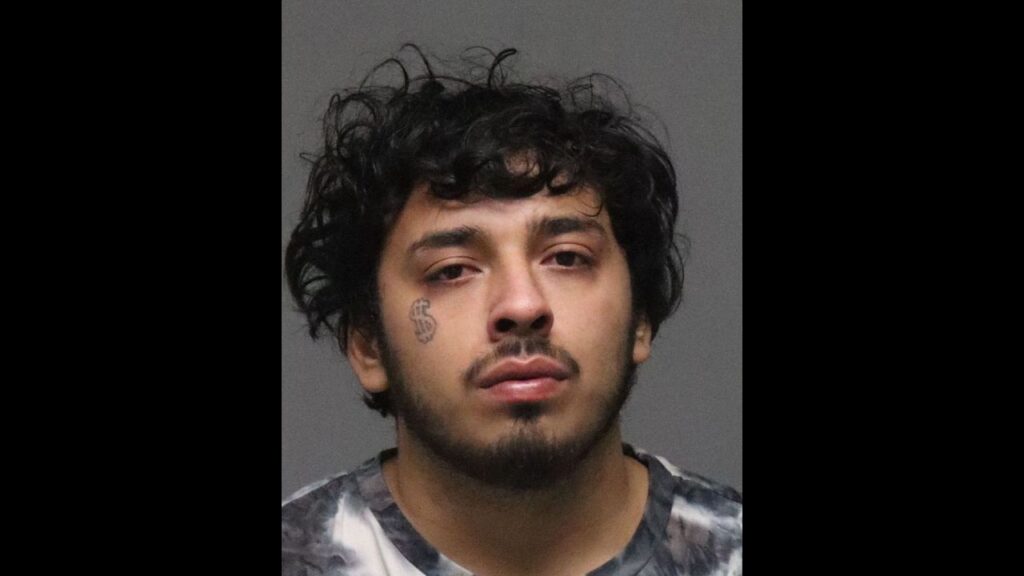

Workers move an electrolyzer, which generates hydrogen from water using electricity, at a storage facility in Delta, Utah on Oct. 5, 2023. The Biden administration on Jan. 3, 2025 made final its long-awaited plan to offer billions of dollars in tax credits to companies that make hydrogen, in the hopes of building up a new industry that might help fight climate change. (Nina Riggio/The New York Times)

- Biden administration finalizes tax credits to boost clean hydrogen, aiming to decarbonize industries and fight climate change effectively.

- New rules ease strict conditions for hydrogen subsidies, granting extra flexibility for producers using low-carbon electricity and nuclear reactors.

- Clean hydrogen industry poised for growth; credits worth billions aim to close cost gaps and encourage sustainable production methods.

Share

|

Getting your Trinity Audio player ready...

|

WASHINGTON — The Biden administration on Friday made final its long-awaited plan to offer billions of dollars in tax credits to companies that make hydrogen, in the hopes of building up a new industry that might help fight climate change.

When burned, hydrogen mainly emits water vapor, and it could be used instead of fossil fuels to make steel or fertilizer or to power large trucks or ships.

But whether or not hydrogen is good for the climate depends on how it is made. Today, most hydrogen is produced from natural gas in a process that emits a lot of planet-warming carbon dioxide. The Biden administration wants to encourage companies to make so-called clean hydrogen by using wind, solar or other low-emission sources of electricity.

Congress Approved Tax Credit for Companies Making Clean Hydrogen

In 2022, Congress approved a lucrative tax credit for companies that make clean hydrogen. But the Treasury Department needed to issue rules to clarify what, exactly, companies had to do to claim that credit. The agency released proposed guidance in 2023 but many businesses have been waiting for the final rules before making investments.

The final guidelines that were released Friday followed months of intense lobbying from lawmakers, industry representatives and environmental groups and roughly 30,000 public comments. They include changes that make it somewhat easier for hydrogen producers to claim the tax credits, which could total tens of billions of dollars over the next decade.

“Clean hydrogen can play a critical role decarbonizing multiple sectors across our economy, from industry to transportation, from energy storage to much more,” said David Turk, the deputy secretary of energy. “The final rules announced today set us on a path to accelerate deployment.”

Initially, Treasury had imposed strict conditions on hydrogen subsidies: Companies could claim the tax credit if they used low-carbon electricity from newly built sources like wind or solar power to run a machine called an electrolyzer that can split water into hydrogen and oxygen. Starting in 2028, those electrolyzers would have to run during the same hours that the wind or solar farms were operating.

Without those conditions, researchers had warned, electrolyzers might draw vast amounts of power from existing electric grids and drive a spike in greenhouse gas emissions if coal- or gas-fired power plants had to run more often to meet the demand.

Yet many industry groups and lawmakers in Congress complained that the proposed rules were so stringent, they could throttle America’s nascent hydrogen industry before it even got going.

Hydrogen Production Is Still in its Infancy

Among the concerns: The technology to match hydrogen production with hourly fluctuations in wind and solar power is still in its infancy. Owners of nuclear reactors also said that they had been left out.

So the final rules contain several significant tweaks:

— Hydrogen producers will get two extra years — until 2030 — before they are required to buy clean electricity on an hourly basis to match their output. Until then, they can use a looser annual standard and still claim the tax credit.

— In certain states that require utilities to use more low-carbon electricity each year, hydrogen producers will now have an easier time claiming the credit, on the theory that those laws will prevent a spike in emissions. For now, Treasury said, only California and Washington meet this criterion, but other states could qualify in the future.

— Under certain conditions, companies that own nuclear reactors that are set to be retired for economic reasons can now claim the credit to produce hydrogen if it would help the plants stay open. Existing reactors that are profitable would not be able to claim the credit.

— The final rules also lay out criteria under which companies could use methane gas from landfills, farms or coal mines to produce hydrogen — if, for instance, the methane would have otherwise been emitted into the atmosphere.

The guidelines “incorporate helpful feedback from companies planning investments,” said Wally Adeyemo, the deputy Treasury secretary.

Some hydrogen producers said that many, though not all, of their biggest concerns had been addressed in the final guidance, which runs nearly 400 pages.

“There’s a degree of relief that the rules are, on balance, an improvement from the original draft,” said Frank Wolak, CEO of the Fuel Cell and Hydrogen Energy Association, a trade group. “But there’s a lot in the details that needs to be evaluated.”

The lack of clear guidance had been holding up investment, said Jacob Susman, CEO of Ambient Fuels, a clean hydrogen developer that is planning roughly $3 billion in projects across the United States. “Now that we actually have something solid, we can get down to the business of building,” he said.

Environmentalists Say Safeguards Are in Place

Environmentalists said most of the safeguards in the original proposal to prevent emissions from surging had been kept in place.

“The extra flexibilities granted to the green hydrogen industry are not perfect from a climate perspective,” said Erik Kamrath at the Natural Resources Defense Council. “But the rule maintains key protections that minimize dangerous air and climate pollution from electrolytic hydrogen production.”

The Energy Department estimates that the use of cleaner forms of hydrogen could grow to 10 million tons per year by 2030, up from virtually nothing today.

But political uncertainty looms. A new Congress could repeal the tax credits, although hydrogen generally enjoys support from both Democrats and Republicans and a number of oil and gas companies have invested in hydrogen technologies. The Trump administration could also revise the rules around the credits, although that could take years.

Economics are another hurdle. Producing cleaner hydrogen still costs $3 to $11 per kilogram, according to data from BloombergNEF. By contrast, it costs about $1 to $2 per kilogram to make hydrogen from natural gas.

The new tax credit will be worth up to $3 per kilogram, which could bridge the gap in some cases but not all. Technology costs would have to decline sharply.

—

This article originally appeared in The New York Times.

By Brad Plumer/Nina Riggio

c. 2024 The New York Times Company