The U.S. national debt is forecasted to surpass $56 trillion by 2034, with looming legislative battles over taxes and spending exacerbating the fiscal challenges, though increased immigration is expected to provide some financial relief. (Tom Brenner/The New York Times)

- The U.S. national debt is projected to exceed $56 trillion by 2034.

- Legislative battles over tax cuts and spending, particularly the expiring 2017 Trump tax cuts.

- Immigration surges are projected to reduce deficits by adding nearly $1 trillion more in tax revenue than the government spends on benefits for immigrants.

Share

|

Getting your Trinity Audio player ready...

|

WASHINGTON — The United States is on pace to add trillions of dollars to its national debt over the next decade, borrowing money more quickly than previously expected, at a time when big legislative fights loom over taxes and spending.

U.S. National Debt Poised to Rise

The Congressional Budget Office said Tuesday that the U.S. national debt is poised to top $56 trillion by 2034, as rising spending and interest expenses outpace tax revenues. The mounting costs of Social Security and Medicare continue to weigh on the nation’s finances, along with rising interest rates, which have made it more costly for the federal government to borrow huge sums of money.

As a result, the United States is expected to continue running large budget deficits, which are the gap between what America spends and what it receives through taxes and other revenue. The budget deficit in 2024 is projected to be $1.9 trillion, up from a forecast earlier this year of $1.6 trillion. Over the next 10 years, the annual deficit is projected to swell to $2.9 trillion by 2034. As a share of the economy, debt held by the public in 2034 will be 122% of gross domestic product, up from 99% in 2024.

Related Story: Why Now Is a Crucial Time to Pay Off Credit Card Debt

The new projections come as lawmakers are gearing up for a big tax and spending battle. Most of the 2017 Trump tax cuts will expire in 2025, forcing lawmakers to decide whether to renew them and, if so, how to pay for them. The United States will also once again have to deal with a statutory cap on how much it can borrow. Congress agreed last year to suspend the debt limit and allow the federal government to keep borrowing until next January.

Those fights over tax and spending will be taking place at a time when the country’s fiscal backdrop is increasingly grim. An aging population continues to weigh on America’s old-age and retirement programs, which are facing long-term shortfalls that could ultimately result in reduced retirement and medical benefits.

Both Parties Express Concerns

Both Democrats and Republicans expressed concern about the national debt as inflation and interest rates soared over the last few years, but spending has been difficult to corral. The CBO report assumes that the 2017 tax cuts are not extended, but that is highly unlikely. President Joe Biden has said he will extend some of the tax cuts, including those for low- and middle-income earners; and former President Donald Trump has said that he will extend all of them if he wins in November. Fully extending the tax cuts could cost around about $5 trillion over 10 years.

The bigger projected deficits were largely driven by the Biden administration’s decision to cancel more than $100 billion in student loan debt, the cost of new aid packages for Ukraine and Israel, and higher-than-expected outlays for Medicaid.

Related Story: Powell Raises Alarm Over US Debt but Says Economy Is in Good Shape

The CBO also said that an agreement by lawmakers, which Republicans insisted upon, to claw back $20 billion from the IRS would reduce revenues from corporate and individual income taxes by about $32 billion through 2034. That assumption stems from an expectation that the IRS money would be used to crack down on tax cheats, resulting in more federal revenue.

The White House blamed the Trump tax cuts for the red ink and warned Tuesday that Republicans will only add to it if they control Washington.

“Republican officials are already plotting to grow the deficit even more in 2025 with tax handouts to the corporations who are keeping prices high even as inflation falls,” said Andrew Bates, a White House spokesperson.

High Interest Rates Are Making Debt Burdens Tougher

High interest rates are also making it harder for the U.S. to manage its debt burden. The budget office predicts that annual interest costs will rise to $1.7 trillion in 2034 from $892 billion this year. At that point, the U.S. would be spending about as much on interest payments as it does on Medicare.

“The harmful effects of higher interest rates fueling higher interest costs on a huge existing debt load are continuing, and leading to additional borrowing,” said Michael Peterson, CEO of the Peter G. Peterson Foundation, which promotes fiscal restraint. “It’s the definition of unsustainable.”

Related Story: How Will California Overcome High Living Costs, Poverty, and Debt?

Sen. Chuck Grassley of Iowa, the top Republican on the Senate Budget Committee, said that Biden was responsible for high borrowing costs and called for spending cuts.

“The Biden administration has saddled generations of Americans with inflationary conditions and astronomical interest rates,” Grassley said.

Surge in Immigration Helps Reduce Deficits

The budget office said that one change in the U.S. economy in recent years is actually helping to reduce deficits and debt over time: a surge in immigration. That’s because new immigrant workers are expected to pay nearly $1 trillion more in taxes than they will consume in government benefits.

The office said the United States is on pace to add about 8.7 million more immigrants from 2021 through 2026 than historical trends would predict. They are expected to pay taxes that add $1.2 trillion in federal revenues over the course of a decade while consuming about $300 billion in federal benefits — primarily in federal health insurance subsidies for adults and children.

The costs and benefits of immigration continue to be a contentious political issue in the U.S. The Biden administration Tuesday announced new protections for immigrants who have been living in the U.S. illegally but are married to American citizens, shielding them from deportation and giving them the ability to work legally.

–

This article originally appeared in The New York Times.

Alan Rappeport/Tom Brenner

c.2024 The New York Times Company

Distributed by The New York Times Licensing Group

RELATED TOPICS:

Categories

Blackstone Avenue Shelters Crush Fresno Dreams and Businesses

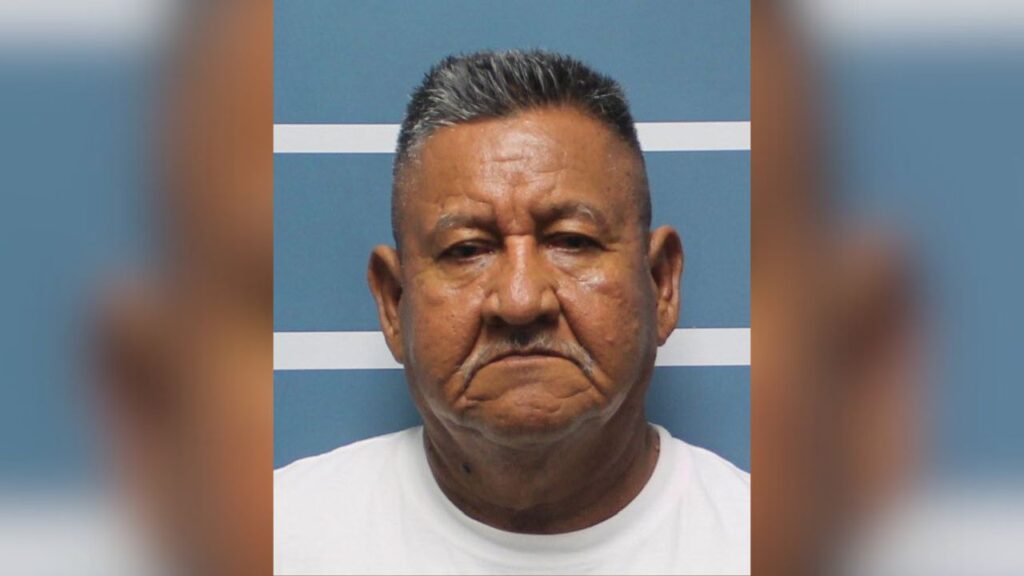

Tulare County Man Gets Life for Child Molestation