Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., January 26, 2026. (Reuters/Brendan McDermid)

Share

|

Getting your Trinity Audio player ready...

|

The S&P 500 breached the 7,000-point mark for the first time on Wednesday, driven by unrelenting optimism over artificial intelligence and expectations of strong Big Tech earnings as well as monetary policy easing.

The benchmark index’s ascent between successive 1,000-point additions has quickened in recent years, reflecting mounting investor confidence in the U.S. economy and corporate America.

It took about three years for the S&P 500 to rise to 5,000 points from 4,000, but only about nine months to jump from 5,000 to 6,000, which it reached in November 2024.

The index was last up 0.3% at 6,999.71 points, and headed for its sixth consecutive day of gains, its longest winning streak since October.

“You could definitely have a continuation on the rally in equities if the earnings season shows that AI expenditure is bringing in revenues,” said Jeff Leschen, managing director at Bramshill Investments.

“Expected rate cuts by the Fed could also be a tailwind,” he added.

AI Hype Boosts Stocks

AI-linked optimism has been one of the key drivers of U.S. markets, pushing tech giants including Nvidia, Microsoft and Alphabet higher. Technology stocks account for nearly 50% of the S&P 500.

Expectations of interest rate cuts by the U.S. Federal Reserve have also buoyed risk appetite, with traders betting on two 25-basis point reductions in 2026 after the central bank lowered interest rates thrice last year.

The Fed is, however, widely expected to hold interest rates at its meeting later in the day.

Markets have rebounded to record highs following bouts of selloff earlier this month on worries related to the U.S.–NATO friction over Greenland, tariff uncertainty and doubts over the U.S. central bank’s independence.

Analysts expect profit for S&P 500 companies to increase 15.5% in 2026, an improvement from a 13.2% growth forecast for 2025, according to data compiled by LSEG.

Tech earnings, powered by AI boom, are largely expected to drive U.S. corporate growth in the fourth quarter, with the sector’s profit projected to rise about 27%, compared with an estimate of a 9.2% increase overall for S&P 500 companies, LSEG data showed.

Revenue growth from the tech sector in the quarter was pegged at about 18%, compared with the estimate of a 7.3% rise for the S&P 500, the data showed.

The S&P 500 has rebounded nearly 45% from its lows in April 2025, when U.S. President Donald Trump’s tariffs had roiled global markets.

—

(Reporting by Shashwat Chauhan, Niket Nishant and Twesha Dixit in Bengaluru; Editing by Shinjini Ganguli)

RELATED TOPICS:

Categories

Dozens Arrested After Anti-ICE Protest at a Manhattan Hilton

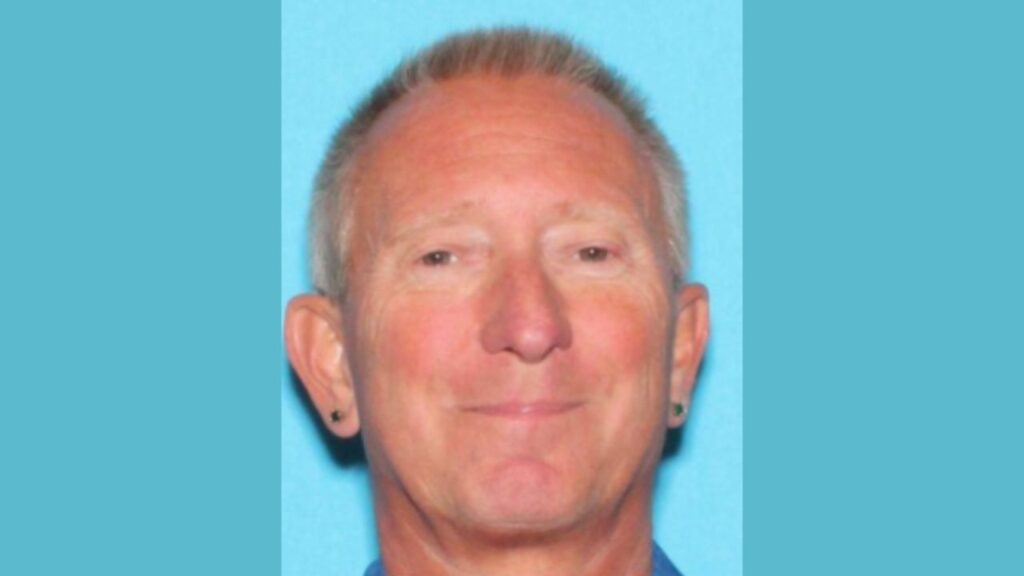

Madera County Sheriff Seeks Help Locating Family of Deceased Man