A coalition of 56 trade groups came together to petition the U.S. government for economic relief after they say higher costs and lower returns threaten U.S. food. (GV Wire Composite)

- U.S. specialty crop growers petitioned the government for $5 billion to stave off coming bankruptcies among the 220,000 farmers nationwide.

- Rising costs coupled with lower returns have farmers facing a "perfect storm'"of dire economic conditions, said the National Potato Council.

- More farm bankruptcies open the door for more foreign food imports, threatening food security and future U.S. ag, growers say.

Share

|

Getting your Trinity Audio player ready...

|

In a desperate plea, growers of the nation’s fruits, vegetables, nuts, and flowers came to together to say they face the same existential threats and the federal government needs to step in before it’s too late.

“Ultimately, if you’ve got farms going bankrupt, that’s all going to hit this affordability issue. It’s going to create volatility in terms of our food security and come back and hit consumers. This isn’t just an issue for the growers, it’s the entire supply chain.” — Kam Quarles, CEO, National Potato Council

Fifty-six trade groups co-signed a letter to U.S. congressmembers saying that while “significant investments” in the One Big Beautiful Bill provide much needed financial relief, the execution of those programs in late 2026 won’t be soon enough to stave off the consequences of record-high input costs, constricting foreign markets, and historically low prices.

Those groups include regional associations such as Western Growers, California Fresh Fruit Association, the Georgia Fruit and Vegetable Growers Association, and crop groups such as the American Cotton Producers, the North American Blueberry Council, and the U.S. Rice Producers Association.

Even staple commodity groups such as American Soybean Alliance and National Association of Wheat Growers signed the letter.

“America’s farmers, ranchers, and growers are facing extreme economic pressures that threaten the long-term viability of the U.S. agriculture sector,” the letter states. “An alarming number of farmers are financially underwater, farm bankruptcies continue to climb, and many farmers may have difficulty securing financing to grow their next crop.”

Kam Quarles, CEO of the National Potato Council, said growers of the nation’s 300 different commodities need $5 billion injected to prevent widespread bankruptcies that will occur before relief comes through.

“If you go bankrupt in the interim, then it just doesn’t really matter for your farm,” Quarles said. “Ultimately, if you’ve got farms going bankrupt, that’s all going to hit this affordability issue. It’s going to create volatility in terms of our food security and come back and hit consumers. This isn’t just an issue for the growers, it’s the entire supply chain.”

Higher Costs, Lower Demand Collapsing Farm Incomes

Rising costs over the last four years coupled with low commodity prices have caused many growers to operate on negative margins, with cumulative industry losses from 2023 to 2026 predicted to be $100 billion nationwide, the letter stated.

Recognizing the threat, the U.S. Department of Agriculture scraped together $12 billion from the Farmer Bridge Assistance Program to support farmers. Of that money, however, $11 billion goes to the nation’s program crops; corn, soy, and wheat, leaving only $1 billion to be divided amongst the nation’s roughly 220,000 specialty crop farms.

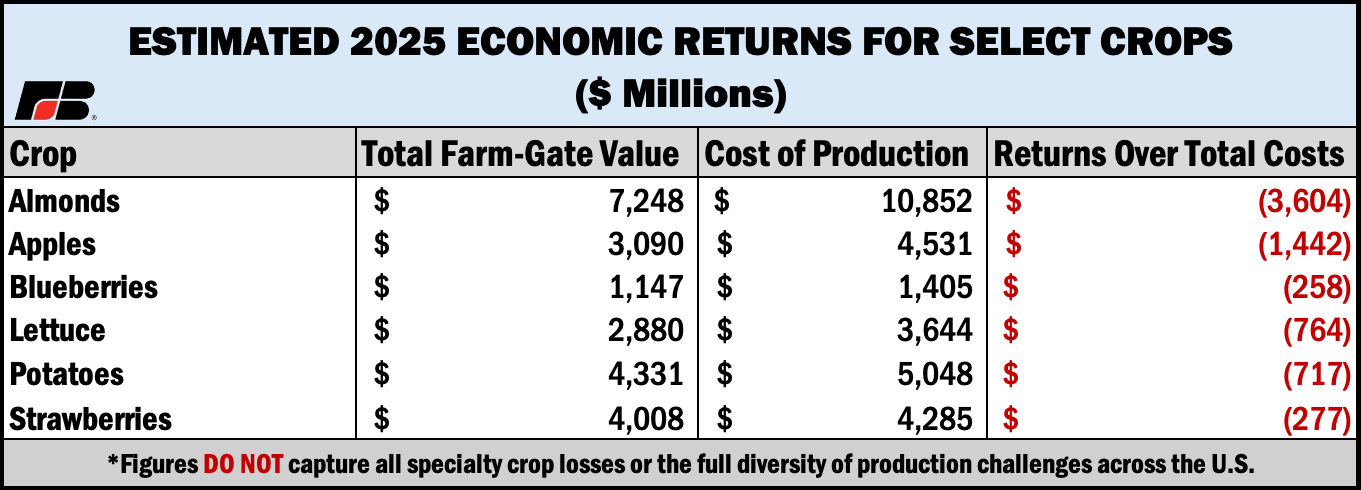

In a market study published Jan. 6, the American Farm Bureau said specialty crop growers don’t have the same safety net as other farmers.

“Despite generating more than $75 billion in annual farm-gate value – over one-third of all U.S. crop sales – specialty crop producers operate with far fewer risk-management and safety-net tools than other farmers,” the study reported. “The result is a widening cost-to-revenue gap that is placing broad swaths of the specialty crop economy under severe financial strain.”

A deep look at six crops — almonds, apples, blueberries, lettuce, potatoes, and strawberries — showed negative margins totaling $6.8 billion amongst those six.

Quarles called what’s happening to potatoes a “perfect storm” for growers. Foreign purchasers of American potatoes have pulled back buying due to volatile economic conditions both here and in those countries. That comes as input costs for fertilizers and pesticides have skyrocketed with inflation. Finally, add in “near-perfect” growing conditions, and farmers have in their warehouses masses of expensive potatoes that fewer places to sell, Quarles said.

Potatoes will normally sell for about $11.75 per hundredweight, according to the Farm Bureau study. More recently, that price has dropped to between $3 and $6.

“You have a larger crop that was very expensive to produce, and you’ve got your buyers on the other side pulling back, they’re being more conservative, which reduces demand,” Quarles said. “All of that to say that just for the russet variety of potatoes, which is the largest variety… we’re looking at grower losses this year of more than $500 million.”

Farm Bankruptcies Open Door for Foreign Ag Imports

Many growers don’t have the money for this year’s plantings, he said.

The coalition of farming groups estimate $5 billion would sustain growers until relief comes in at the end of the year from the President Donald Trump’s One Big Beautiful Bill, Quarles said. Even though Congress has not passed a new Farm Bill — meaning growers have to rely on outdated programs — the 2025 reconciliation refunded many of those programs.

The problem, though, is that Congress is trying to close out its fiscal year 2026 spending bills, the remainder from the government shutdown. Legislators did not include the $5 billion into any of those bills so the prospects of getting that $5 billion have become dim, Quarles said.

Farm bankruptcies in recent years have levels not seen in decades, and once those farms shut down, it sends a ripple effect into consumer prices. That encourages more foreign imports of agricultural goods, “which is exactly counter to what the administration is seeking to do,” Quarles said.

The increased market share of foreign goods makes it even harder for those shuttered farming operations to reopen.

One bright note for Quarles, however, is the unity among specialty growers.

“It’s been gratifying that the U.S. specialty crop industry has so unified and is able to work effectively together to get big things done for growers,” Quarles said. “If that’s one bright spot that’s coming out of this, it’s driving us more toward everyone working together.”

RELATED TOPICS:

Categories

Arambula No-Shows at News Conference After Rehab Stay Revealed