A view shows an oil pump jack outside Almetyevsk, in the Republic of Tatarstan, Russia July 14, 2025. (Reuters File)

Share

|

Getting your Trinity Audio player ready...

|

Oil prices settled down around 4% on Thursday ending a five-day streak of gains after U.S. President Donald Trump said the crackdown on protesters in Iran was easing, allaying concerns over potential military action against Iran and oil supply disruptions.

Brent futures settled down $2.76 or 4.15%, at $63.76 a barrel. U.S. West Texas Intermediate crude fell $2.83, or 4.56%, to $59.19.

Both contracts had risen to multi-month highs over the last few sessions.

Trump said he had been told that killings during Iran’s crackdown on protests were easing and he believed there was no current plan for large-scale executions, adopting a wait‑and‑see posture after earlier threatening intervention.

Risk Premium Reduced

The comments reduced the risk premium that had built up in recent days, analysts said. On Wednesday, Brent reached a high of $66.82, its highest since September.

“We went from a high likelihood that Trump was going to hit Iran to a low likelihood, and that is the bulk of the downward pressure today on prices,” said Phil Flynn, senior analyst with Price Futures Group.

The U.s. is withdrawing some personnel from military bases in the Middle East, a U.S. official said on Wednesday, after a senior Iranian official said Tehran had told neighbors it would hit American bases if Washington strikes.

Further weighing on prices, U.S. crude and gasoline inventories rose last week by more than analysts had estimated, the Energy Information Administration said on Wednesday.

Elsewhere, Venezuela has begun reversing oil production cuts made under a U.S. embargo, with crude exports also resuming, three sources said.

Analysts pointed to further bearish market sentiment following a positive phone call between Trump and Venezuela’s acting President Delcy Rodriguez on Wednesday, with expectations of stability in the short term leading to more oil leaving Venezuela in the coming weeks.

“That will keep prices anchored,” Flynn said.

On the demand side, OPEC said on Wednesday that 2027 oil demand was likely to rise at a similar pace to this year and published data indicating a near balance between supply and demand in 2026, contrasting with other forecasts of a glut.

China’s crude oil imports in December rose 17% from a year earlier, while total imports in 2025 were up 4.4%, government data showed, with daily crude import volumes hitting record highs.

—

(Reporting by Georgina McCartney in Houston, Enes Tunagur; Additional reporting by Ahmad Ghaddar in London, Mohi Narayan in New Delhi, and Yuka Obayashi in Tokyo; Editing by David Goodman, Bernadette Baum, Rod Nickel and David Gregorio)

RELATED TOPICS:

Categories

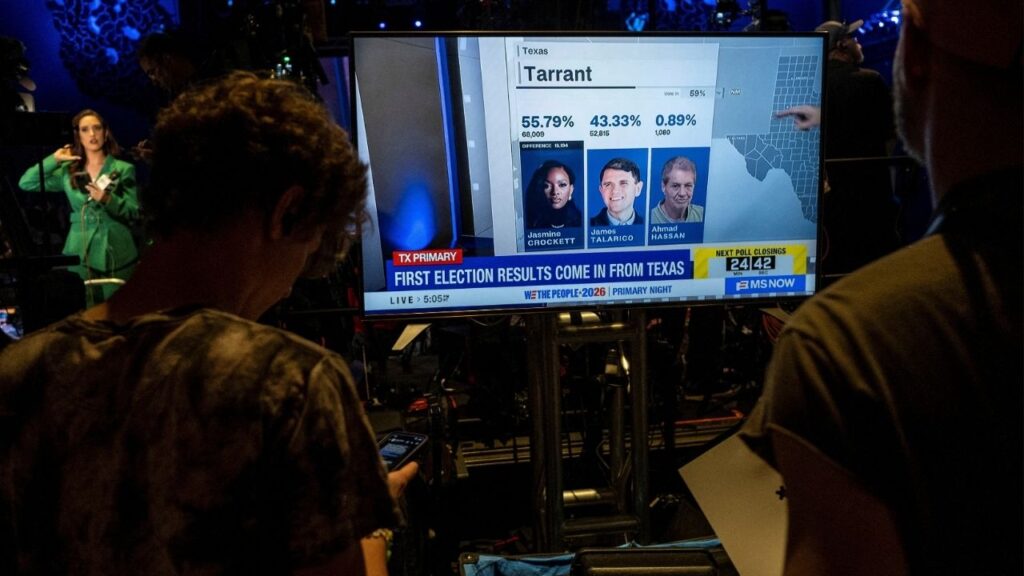

Eight US Senate Races to Watch in the 2026 Midterm Elections

US Kills Iranian Leader of Trump Assassination Plot, Pentagon Says

Four Takeaways From the First Primaries of 2026 US Midterm Elections

US Sub Sinks Iranian Warship off Sri Lanka, at Least 80 Dead