Futures-options traders work on the floor at the New York Stock Exchange's NYSE American (AMEX) in New York City, U.S., January 7, 2026. (Reuters/Brendan McDermid)

Share

|

Getting your Trinity Audio player ready...

|

Oil prices fell on Wednesday as U.S. President Donald Trump’s plan to refine and sell Venezuelan crude oil raised concerns about the long-term impact of U.S. actions, while major stock indexes were mostly lower after hitting record highs this week.

U.S. data on Wednesday showed job openings fell more than expected in November while hiring eased, but investors were keen to see Friday’s U.S. employment report for December.

Investors said it was difficult to translate the implications of Trump’s capture of Venezuelan President Nicolas Maduro over the weekend. The potential for his move on Caracas to unsettle China, as he also ratchets up rhetoric about acquiring Greenland, meant global trade tensions could rise, making market turbulence more likely.

The United States said on Wednesday it has seized a Russian-flagged, Venezuela-linked tanker, as Trump pushes to dictate oil flows in the Americas and force Caracas’ socialist government to become its ally.

On Wall Street, the Dow eased along with the S&P 500, but the Nasdaq was higher. Stock indexes around the world have hit record highs this week even after the U.S. intervention in Venezuela.

For stocks, “the market like usual is writing off anything Trump-related,” said Jake Dollarhide, chief executive officer of Longbow Asset Management in Tulsa, Oklahoma.

“This week is all about the jobs report,” Dollarhide said, noting that weaker jobs data could underpin expectations for rate cuts this year by the Federal Reserve.

The Dow Jones Industrial Average fell 385.06 points, or 0.78%, to 49,077.02, the S&P 500 fell 12.68 points, or 0.18%, to 6,932.14 and the Nasdaq Composite rose 78.85 points, or 0.34%, to 23,626.02.

The U.S. earnings season kicks off next week, with results from some of the largest U.S. banks. They are expected to report higher fourth-quarter profits, helped by a rise in investment banking revenue as dealmaking accelerates.

MSCI’s gauge of stocks across the globe fell 2.77 points, or 0.27%, to 1,032.38.

European stocks snapped a run of record closes as investors paused to digest the latest U.S.-Venezuela developments and assessed economic data. The pan-European STOXX 600 index ended down 0.05%.

The latest euro zone inflation report showed price increases had slowed to a year-on-year rate of 2% in December, in line with the European Central Bank’s target.

Investors began the year almost certain that the world economy was in a so-called Goldilocks phase, where recession and inflation risks were both low.

Copper Falls From Peak

Market reaction to Trump’s Venezuela moves has so far played out mostly in commodities.

China, which imported 389,000 barrels per day of Venezuelan oil in 2025, on Wednesday denounced Trump as a bully in response to his claim that he had convinced Caracas to divert crude supplies away from Beijing.

U.S. crude fell $1.14 to settle at $55.99 a barrel and Brent fell 74 cents to settle at $59.96.

Copper fell sharply from a record high in the previous session, while nickel tumbled from a 19-month peak as an early-year rally in industrial metals lost momentum.

Benchmark three-month copper on the London Metal Exchange dropped as much as 3% to $12,842.50 per metric ton. It hit an all-time high of $13,387.50 on Tuesday.

Industrial metals prices had firmed this week as investors switched out of highly priced gold and silver and bought up tangible commodities, which often rally when geopolitical tensions threaten supply-chain disruptions and shortages.

Gold prices fell as investors booked profits.

U.S. Treasury yields were lower on the day as traders evaluated economic data and awaited more news on the jobs front.

The yield on benchmark U.S. 10-year notes fell 4.1 basis points to 4.138%, from 4.179% late on Tuesday.

The dollar was up slightly against major currencies, including the yen and euro.

The dollar index, which measures the greenback against a basket of currencies, rose 0.07% to 98.68.

—

(Reporting by Caroline Valetkevitch in New York and Naomi Rovnick in London; Editing by Shri Navaratnam, Kirsten Donovan and Jane Merriman)

RELATED TOPICS:

Categories

Healthcare Subsidy Renewal Heads to Passage in US House

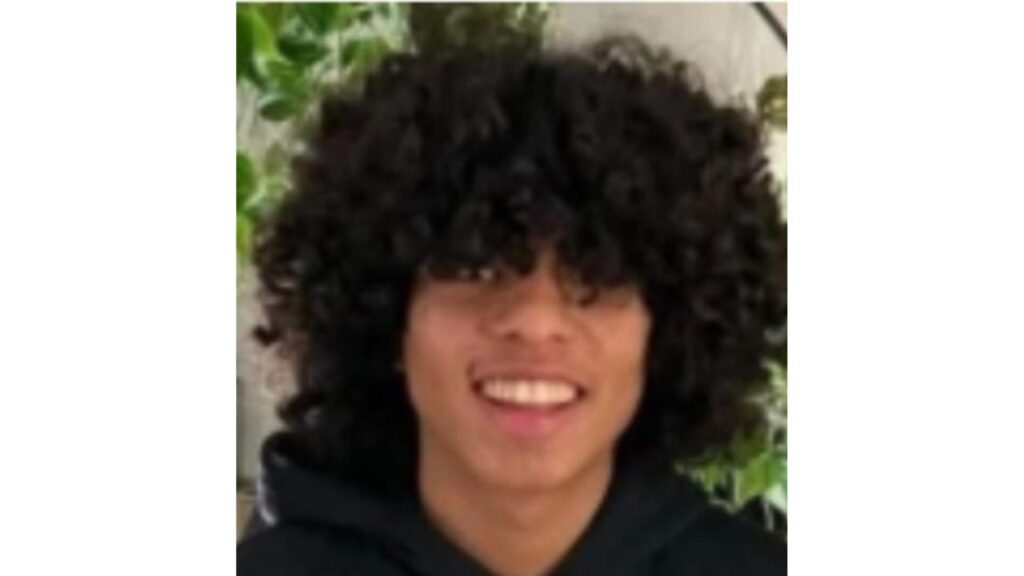

Fresno Police Seek Help Locating Missing 17-Year-Old

Wall Street Ends Mixed as Tech Dips, Defense Stocks Rally