President Donald Trump applauds at the "Winning the AI Race" Summit in Washington D.C., U.S., July 23, 2025. (Reuters File)

Share

|

Getting your Trinity Audio player ready...

|

As if the Federal Reserve’s decision about interest rates this week was not complicated enough, it is happening against the backdrop of an active search to replace the chair of the central bank, Jerome Powell.

President Donald Trump is potentially weeks away from naming his pick to lead the institution next year, after Powell’s term as chair ends in May. Replacing Powell will be Trump’s biggest opportunity yet to reshape the central bank, which he has attacked for months over its refusal to significantly slash borrowing costs.

Trump has not shied away from sharing that his top priority is having someone who will immediately push through lower interest rates. He affirmed that as his litmus test as recently as Tuesday.

Trump appears to have found that person in Kevin Hassett, a longtime loyalist of the president who is now director of the White House’s National Economic Council. Hassett is widely seen as the front-runner, which Trump all but confirmed recently.

But the process is not entirely over. Final interviews with the other top candidates are poised to begin Wednesday, according to people familiar with the matter. Interviews planned with Vice President JD Vance and Susie Wiles, the White House chief of staff, were canceled this month.

Other candidates under consideration include Kevin Warsh, a former Fed governor; Christopher Waller, a sitting governor; and Rick Rieder of BlackRock, the asset management giant.

As the waiting game stretches on, Hassett has been vocal about what he thinks the Fed should be doing. On Tuesday, he reiterated his support for lower interest rates and said that the Fed had “plenty of room” to cut in the months ahead. He also hinted that he saw scope for the central bank to make bigger moves than the quarter-point cuts it has stuck to this year.

Hassett added that if he was selected as chair, he would rely on his own “judgment, which I think the president trusts,” and would uphold a “firm commitment to not being partisan.”

A day before, he said that providing an extended forecast for interest rates was “irresponsible.”

“The Fed chair’s job is to watch the data and to adjust and to explain why they’re doing what they’re doing,” Hassett told CNBC on Monday.

Hassett has previously faulted the Fed’s staff and accused officials of injecting politics into their policy decision-making. At one point, he also questioned whether Powell should be fired over his handling of renovations to the Fed’s Washington headquarters after the costs attracted the president’s ire.

Whoever is selected to lead the Fed will inherit many of the challenges that Powell is dealing with. For one, the next chair may struggle to deliver the interest rate cuts that Trump so desperately wants, given the split among voting members.

Even Treasury Secretary Scott Bessent, who is leading the search, acknowledged recently that the Fed chair’s ability to secure a certain interest rate move had limitations.

“At the end of the day, he or she is one vote,” he said last week at The New York Times DealBook Conference. Next year, many of the regional presidents who are most vocally opposed to further rate cuts will also be voting members of the policy committee, suggesting a higher bar for reducing borrowing costs.

—

This article originally appeared in The New York Times.

By Colby Smith

c. 2025 The New York Times Company

RELATED TOPICS:

Categories

Oil Prices Jump on Possible Iranian Supply Disruption

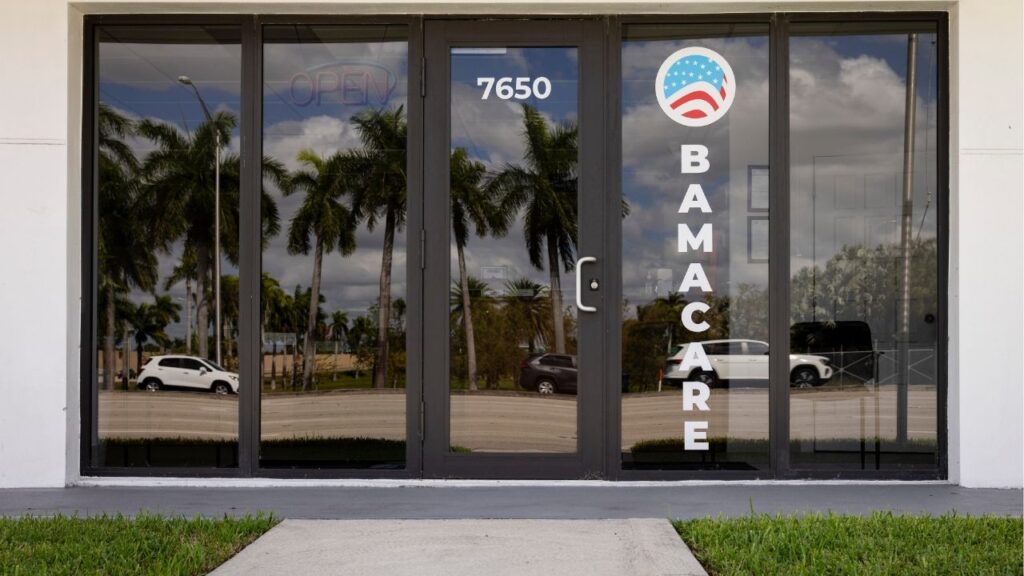

Initial Obamacare Enrollment Drops by 1.4 Million