Opinion | Fresno’s new VMT tax raises home prices using outdated data and poor planning, undermining affordability and long-term community growth. (GV Wire Composite/Paul Marshall)

- Fresno’s new VMT tax could add over $12,000 to homes, hurting middle-class families’ affordability.

- City relied on outdated traffic data, ignoring modern commuting patterns, mixed-use solutions, and walkable community design.

- Homebuyers pay more for projects not reducing driving, while policy decisions lack transparency and long-term planning.

Share

|

Getting your Trinity Audio player ready...

|

Home price inflation is the engine of wealth inequality in America. Nowhere is this more evident than in California, where roughly 30% of household income goes toward housing. When adjusted for cost of living, California holds the highest poverty rate in the nation. Nearly one in five Fresno County households spend more than half of their income on housing. Our state’s housing shortage and the policies that worsen it are not abstract political debates; they shape whether working families can ever afford a place to call home.

Darius Assemi

Opinion

The sign of economic growth of a community is not its GDP – it’s the housing affordability. Today the average age of a first-time home buyer is 40! This compares to an average age in the high 20s a few decades ago.

A recent study by Abundance Network revealed that fifteen major philanthropic foundations — together directing more than $260 million — fund nonprofits that oppose pro-housing legislation. That influence helps explain why well-intentioned laws like SB 743, the directive to local governments to reduce Vehicle Miles Traveled (VMT) and overall traffic, and protect the environment, often morph into costly, unevenly applied mandates that raise the price of every new home built. In this case, it is a money grab for the city of Fresno.

SB 743 gives cities flexibility in implementing its mandates. Some cities, like Roseville, use that flexibility to reduce a project’s impacts with a list of clean-air initiatives. Others use it to impose new fees and requirements that make homes even more expensive. Unfortunately, Fresno chose the latter path.

Fresno’s VMT Tax Could Add More Than $12,000 to Home Costs

On a 4–2 vote, Fresno’s City Council approved its approach to implement SB 743. What they adopted was a policy that could increase the price of a new home by more than $12,000. That council action is one of the largest tax increases ever imposed on new homebuyers in Fresno.

Related Story: Fresno Approves Tax on New Homes and Shopping. Even Experts Don’t Know ...

Why I Oppose This Tax — Even When Other Developers Won’t

Many home builders decided to support this tax, not because the tax is good policy, but because they were told it would help the City speed up project approvals. The tax is supposed to spare the City from having to undertake lengthy studies to determine how the new neighborhoods we build can reduce the City’s overall VMT. The City wanted to be relieved of that burden by simply passing a new tax to be imposed on new homebuyers. But the knee-jerk quick and easy adoption of a new tax is not a substitute for sound policy.

I oppose the City’s approach because it artificially increases home prices with a tax that has little to no benefit to the homebuyer. Twelve thousand dollars may not be a lot of money to some of our politicians, but it is a lot of money for a family or individual buying their first home! In the long run this tax will damage the future of Fresno by making it less affordable, especially to the middle-income working-class homebuyers. They will move to other cities that offer better value for their money. Fresno will lose property taxes and ultimately may be put in a position of needing to further raise taxes for basic services such as police and fire. It will further export Fresno workers to other cities because of less burdensome taxes and regulations, therefore significantly increasing VMT.

The City used a flawed approach in evaluating the policy options. As a result, the new VMT tax is based on old data, flawed assumptions, rigid rules, and ignores the flexible mixed-use solutions that reduce driving and create vibrant, livable communities.

There was no public workshop outside of the Council chambers — no opportunity for everyday residents, future homebuyers, or home builders to ask questions, understand the data, or offer alternatives. As stated by councilmember Nick Richardson, “The level of information to the public isn’t there based on what I’ve heard.”

Even City Attorney Andrew Janz cautioned that parts of the plan had not been fully reviewed for legal or financial impact as he responded on the dais. “I think we need more detail to answer your legal question and I’m reluctant to do this on the fly. We have tried our best to provide a legal memo in advance but there is a lot going on and this is dense stuff,” he said.

When your own attorney has to pause to address legal questions moments before the vote, you should probably slow down.

The City also relied on traffic and travel patterns from 2010 — a world before Uber, remote work, modern shopping patterns, and post-pandemic shifts in commuting. Using outdated assumptions inevitably inflates the amount of VMT reduction our City must obtain, which thereby increases the VMT Tax the City intends to impose to accomplish that reduction.

Developers are denied flexibility to reduce travel distances with better mixed-use neighborhood design — despite the fact that adding nearby grocery stores, medical offices, child-care centers, coffee shops, and other retail is proven to reduce driving and is exactly what buyers want in a walkable community.

I used such a mixed-use neighborhood design in the Copper River development, where residents live, shop, dine, and work in close proximity. It works. But the City’s implementation of SB 743 gives almost no credit for planning and developing a mixed-use and walkable community project.

Where Will Our Tax Money Go? Not to Reducing Driving

The Mayor and Councilmembers Nelson Esparza, Annalisa Perea, Brandon Vang, and Tyler Maxwell — the four votes in support of this new tax — plan to direct the revenue toward:

- More buses on existing routes

- Marketing campaigns and signage

- Projects already fully funded, like the Blackstone lane reduction (shrinking a six-lane major arterial to four lanes), beginning next spring

Yet the City itself admits that SOME OF these investments do not reduce vehicle miles traveled —the very metric used to justify the tax.

As a result, Fresno homebuyers will pay thousands more for a new home, only to fund projects already on the books or initiatives that do not meet the stated purpose of the tax.

Policymakers come and go. Homebuyers, families, and long-term investors like me — people who help build this city for the long-term — remain. We live with the consequences of these decisions for decades.

We’ve Seen the Impact of Poor Planning Before

Fresno is AND WILL BE dealing with the fallout of:

- The 1983 property tax reallocation, which continues to starve the city’s budget by absorbing infrastructure and public-safety costs in annexed areas without the benefit of receiving proportionate tax revenue.

- The 2016 decision by Mayor Ashley Swearengin and the city council to give away Fresno’s water credits on the perimeter, dramatically increasing costs for new homebuyers.

- The 2019 city council vote to reduce Blackstone Avenue from six lanes to four — at a cost exceeding $50 million. Replacing a traffic lane in each direction with a bike lane along one of the busiest, most polluted corridors in Fresno is not just questionable planning, it’s unsafe. As a cyclist, I would never choose to ride on Blackstone.

With this new tax, we risk repeating the same pattern: Policy decisions made without economic grounding, without long-term vision, and without realistic understanding of how families live, commute, and choose where to buy a home.

Fresno Needs Growth, Affordability, and Common Sense

Our city deserves housing policy rooted in data, transparency, community engagement, and economic reality. We need to make Fresno more affordable especially for our working class. We need to encourage mixed-use, walkable neighborhoods — not make them unnecessarily more costly.

Above all, we need policies that actually reduce driving, instead of policies that simply raise taxes under the appearance of environmental compliance.

As stated by Council President Mike Karbassi, “We have a responsibility to advocate for good policy. It is clear this policy is not ready. If you want to do it and give in, I will respect that and move on. I will be the lone no vote. I will stand on principle.”

Fresno can grow responsibly. But we cannot tax our way to affordability, and we cannot regulate our way into prosperity.

If we want a future where young families can buy homes, where teachers, police officers, and nurses can live in the communities they serve, and where Fresno remains a place of opportunity, then we must demand housing policies that reflect common sense — not outdated analysis or short-term politics.

That is why I sent a request to city leaders, to ask that they re-analyze the metrics they used, to update their data, and to reward smart planning that actually works, and which creates neighborhoods desired by home buyers. That approach will reduce the supposed need for this new tax. Reducing the VMT tax will help reduce the challenges we face in improving the affordability of our city’s housing.

The decisions made today will define Fresno for the next half-century. Let us spend the time to do the analysis to get them right.

About the Author

Darius Assemi is the publisher of GV Wire and the CEO/president of Granville Homes.

RELATED TOPICS:

Categories

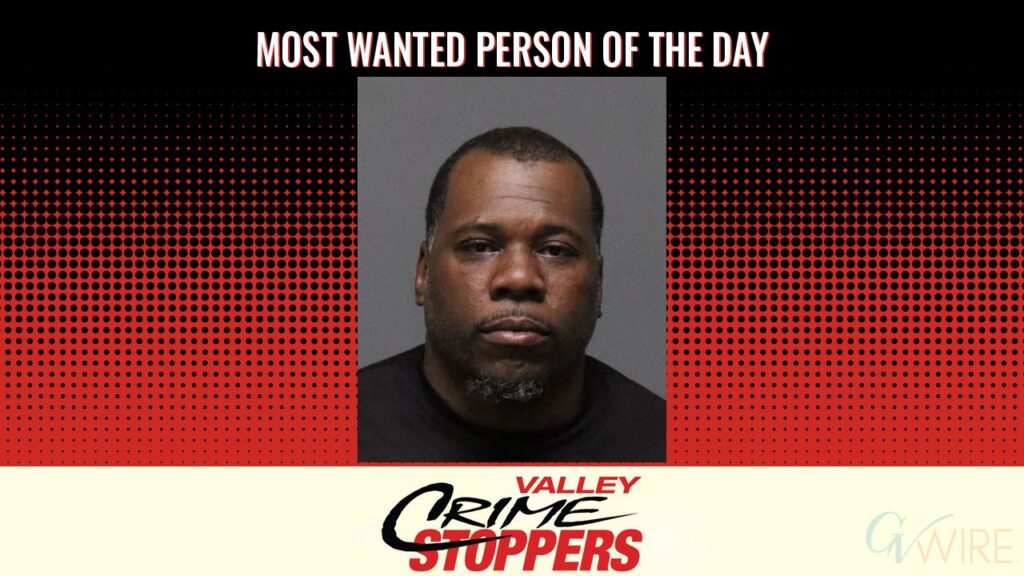

Valley Crime Stoppers Seeks Domestic Violence Suspect

US Consumer Confidence Improves in February

Pentagon Races to Spend $153 Billion in Added Funds for Military