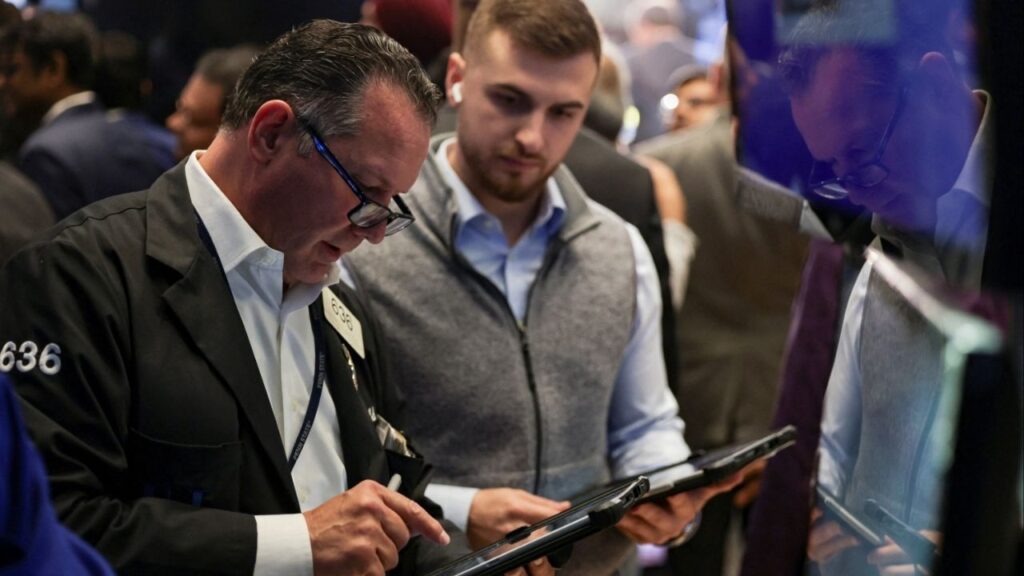

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., September 8, 2025. (Reuters/Jeenah Moon)

Share

|

Getting your Trinity Audio player ready...

|

Wall Street’s main indexes traded lower on Monday as investors stood on the sidelines, sifting through fresh economic data and bracing for a closely watched speech from Federal Reserve Chair Jerome Powell that could hint at this month’s policy decision.

U.S. manufacturing activity shrank for the ninth straight month in November, as factories reported weakening new orders and rising input costs driven in part by tariffs.

Powell is due to speak later in the day, and traders will comb through his remarks for fresh clues on the interest rate path.

While most policymakers have struck a cautious tone, dovish signals from a few key voting members, along with reports that White House economic adviser Kevin Hassett is a leading contender to succeed Powell, have stoked bets on further monetary easing in the months ahead.

Traders are pricing in an 87.6% chance for a 25-basis-point interest rate cut in December, roughly doubling the odds from late last month, according to CME Group’s FedWatch Tool.

Investors are also keenly awaiting a delayed September report on the Personal Consumption Expenditures Index, the Fed’s preferred inflation gauge, due on Friday.

The Fed is “worried about inflation without any kind of data. It’s hard to feel good about a rate cut, so it’s going to be a tough call,” said Robert Pavlik, senior portfolio manager at Dakota Wealth.

“But I think that he (Powell) will probably err on the side of protecting the overall economy by cutting rates and then holding off after that by being more hawkish when he makes his comments after the meeting.”

Main Markets Fall

At 10:03 a.m. the Dow Jones Industrial Average fell 121.38 points, or 0.25%, to 47,595.04, the S&P 500 lost 25.83 points, or 0.37%, to 6,823.45 and the Nasdaq Composite lost 127.65 points, or 0.55%, to 23,238.04.

A tick-up in sovereign bond yields also pressured stocks, with that on the 10-year benchmark up around six basis points. [US/]

Big-box retailers were in focus as Cyber Monday sales kicked off, with shoppers expected to spend $14.2 billion online, according to Adobe Analytics.

That follows a record $11.8 billion spent on Black Friday – up 9.1% from 2024 – on what is typically the biggest shopping day of the year. Shares of Walmart and Target edged higher, while Bath and Body Works jumped 5%.

U.S.-listed crypto stocks were big losers as bitcoin fell back below $90,000, extending losses after its steepest monthly decline since the 2021 crypto crash.

Strategy fell 6.7%, Coinbase lost 3% and Bitfarms dropped 5.2%.

Elon Musk’s Tesla was slightly lower after monthly registrations in key European markets including Norway, France and Sweden slumped from a year earlier.

Synopsys gained 4.9% after AI chip leader Nvidia said it had invested $2 billion in the semiconductor design software provider.

Declining issues outnumbered advancers by a 1.47-to-1 ratio on the NYSE and by a 1.8-to-1 ratio on the Nasdaq.

The S&P 500 posted nine new 52-week highs and one new low while the Nasdaq Composite recorded 37 new highs and 32 new lows.

—

(Reporting by Johann M Cherian and Pranav Kashyap in Bengaluru; Editing by Tasim Zahid and Shinjini Ganguli)

RELATED TOPICS:

Wall Street Edges Lower as Traders Await Fed Chair Speech

Visalia Police Arrest Suspect After Pursuit, Crashes

Appeals Court Says Alina Habba Is Unlawful US Attorney