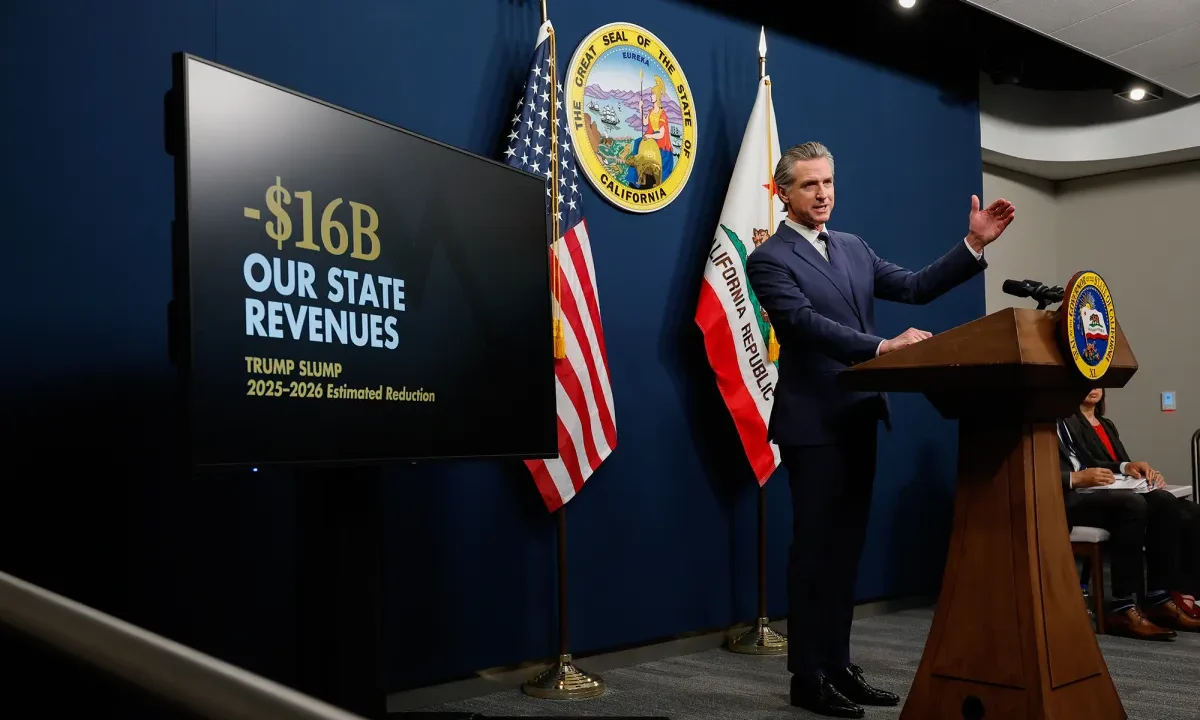

Gov. Gavin Newsom talks about his revised budget proposal in Sacramento, May 14, 2025. (CalMatters/Fred Greaves)

- California Gov. Gavin Newsom relies on accounting tricks to cover up the state's chronic budget deficit.

- The state's ongoing "structural deficit" in future years will be between $10 billion and $20 billion.

- Newsom and state lawmakers are like the family who buys lottery tickets in hopes of avoiding bankruptcy.

Share

|

Getting your Trinity Audio player ready...

|

This commentary was originally published by CalMatters. Sign up for their newsletters.

When Gov. Gavin Newsom and legislative leaders were drafting a more-or-less final 2025-26 state budget last month, they were closing what they described as a $12 billion deficit, a number that the state’s media repeatedly cited.

It was the wrong number; it minimizes the state’s chronic gap between income and outgo, as the state’s official budget summary released this week confirms.

The budget projects that the state will receive $208.6 billion in general fund revenues during the fiscal year that began on July 1, but it will spend $228.4 billion, a gap just shy of $20 billion.

The $12 billion figure stems from counting a $7.1 billion diversion from one of the state’s reserve accounts as revenue — an assumption that violates common sense as well as any legitimate accounting scenario.

State Will Have $10 Billion to $20 Billion Deficit Yearly

The more accurate figure of $20 billion is important because it squares with projections by Newsom’s Department of Finance and the Legislative Analyst’s Office that California has what’s called a “structural deficit” in the range of $10 billion to $20 billion a year.

In other words financing all of the programs and services now in state law will indefinitely cost that much more each year than the state is likely to receive in revenues.

The budget closes about a third of the $20 billion gap with an aforementioned $7.1 billion shift from the emergency reserve — money that’s supposed to be used to cushion the impact of an economic downturn or calamities such as the wildfires that devastated Los Angeles, earthquakes or destructive storms.

The deficit isn’t a genuine emergency because it resulted from irresponsible political decisions, particularly Newsom’s declaration in 2022 that the state had a $97.5 billion budget surplus and thus could afford a sharp increase in spending.

Big Surplus Was a Mirage

The surplus was a mirage, based on assumptions of a $40 billion annual increase in revenues that never happened. Last year, the Department of Finance acknowledged that revenues over four years would fall short of expectations by $165 billion.

However, much of the phantom money was already spent, thereby creating the structural deficit that Newsom and the Legislature basically ignored in putting together the current budget.

The $12 billion gap left after the reserve fund shift was mostly papered over with on- and off-budget loans from special funds, shifting some spending into future years and using accounting gimmicks, such as shifting some current year spending, the June 2026 state payroll for instance, into the next fiscal year.

One could liken the state budget to a family that takes out loans on its credit cards to finance a lavish lifestyle, or a city that provides pension benefits it cannot afford.

Sooner or later, the debts pile so high that they can no longer be ignored and the day of reckoning arrives. That’s one reason why more than 30,000 Californians file for bankruptcy each year and why several California cities have gone bankrupt in recent years.

States cannot file for bankruptcy, no matter how distorted their finances. If they could, California would not qualify because of its almost unlimited ability to borrow money from special funds.

However, there will be a day of judgment if California’s spending continues to outpace its revenues, particularly if the state’s economy continues its sluggish performance.

Newsom and legislators implicitly assume that at some point revenues will increase enough to cover their spending and pay off their debts — just as a debt-ridden family buys lottery tickets in hopes of avoiding bankruptcy.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to bmcewen@gvwire.com for consideration.

This article was originally published on CalMatters and was republished under the Creative Commons Attribution-NonCommercial-NoDerivatives license.