Wall Street closes out a milestone year with major indexes poised for substantial gains despite late-year slump. (AP File)

- S&P 500 set 57 record highs in 2024, up about 24% for the year, marking back-to-back annual gains over 20%.

- AI-related stocks like Nvidia and Super Micro Computer helped drive market to new heights amid strong economy.

- Bitcoin surpassed $100,000 for the first time, while gold shattered records with a 26% gain for the year.

Share

NEW YORK – U.S. stock indexes are drifting lower in morning trading Tuesday as Wall Street closes out another milestone-shattering year of gains.

The S&P 500 gave up an early gain and was down less than 0.1%. The benchmark index is coming off back-to-back declines of more than 1%.

The Dow Jones Industrial Average was down 3 points, or less than 0.1%, as of 11:05 a.m. Eastern time. The Nasdaq composite was down 0.3%.

Still, about 80% of the stocks in the S&P 500 were higher. Gains in energy, financial and other sectors tempered declines in technology and other stocks. Exxon Mobil rose 1.5% and Visa was up 0.5%.

VeriSign rose 0.9% after Warren Buffett’s Berkshire Hathaway disclosed it had increased its stake in the internet domain registry services company.

Related Story: Survey: Small Businesses Are Feeling More Optimistic About the Economy After ...

Bond Yields and Oil Prices

Bond yields mostly fell. The yield on the 10-year Treasury held steady at 4.54%. The yield on the two-year Treasury slipped to 4.23% from 4.24% late Monday.

Crude oil prices rose 0.9%.

Indexes in Europe mostly rose. Asian markets were mixed, with exchanges in Tokyo and Seoul closed for New Year holidays.

Strong Market Performance in 2024

Despite a mini post-Christmas slump, the major U.S. stock indexes are on pace to finish the year with strong gains.

The S&P 500, which set 57 record highs in 2024, is up about 24% for the year, it’s first back-to-back annual gains of more than 20% since 1998.

The Nasdaq is up about 30% and the Dow has gained about 13%.

U.S. markets’ stellar run this year has been driven by a growing economy, solid consumer spending and a strong jobs market.

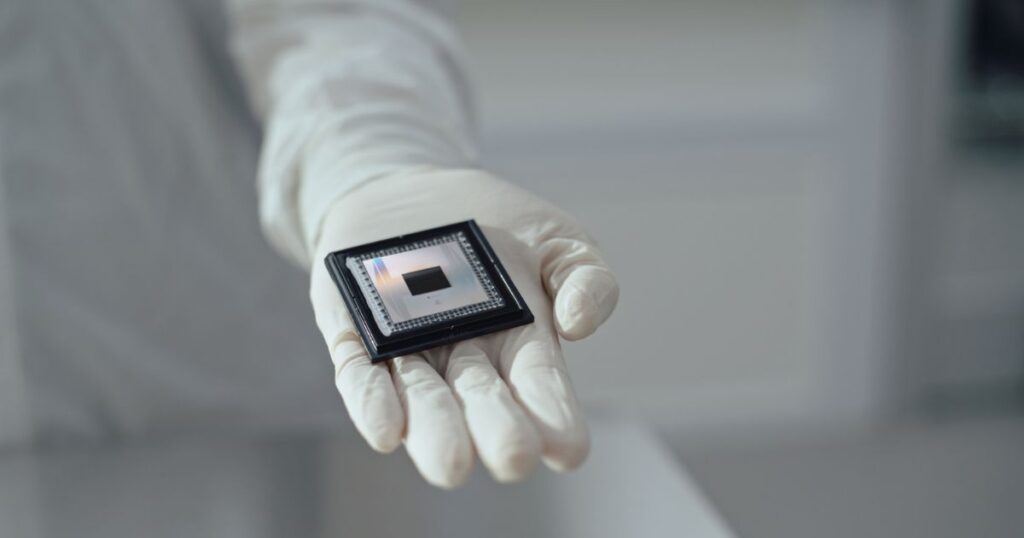

Skyrocketing prices for companies in the artificial-intelligence business, such as Nvidia and Super Micro Computer, helped lift the market to new heights.

Related Story: Retail Sales Rose at Healthy Pace Last Month in Latest Sign of US ...

Economic Factors and Future Outlook

Solid corporate earnings growth also helped. Wall Street expects companies in the S&P 500 to report broad earnings growth of more than 9% for the year, according to FactSet. The final figures will be tallied following fourth-quarter reports that start in a few weeks.

Another boost for the market: The economy avoided a recession that many on Wall Street worried was inevitable after the Federal Reserve hiked its main interest rate to a two-decade high in hopes of slowing the economy to beat high inflation.

Receding inflation, which has gotten closer to the Fed’s 2% target, helped energize Wall Street, raising hopes that the central bank would deliver multiple interest rate cuts into next year, which would ease borrowing costs and fuel more economic growth.

Still, after three interest rate cuts in 2024, the Fed has signaled a more cautious approach heading into 2025 with inflation remaining sticky as the country prepares for President-elect Donald Trump to transition into the White House. Trump’s threats to hike tariffs on imported goods have raised anxiety that inflation could be reignited as companies pass along the higher costs from tariffs.

Related Story: Stock Market Today: Wall Street Slips in Final Days of a Banner Year for US ...

Cryptocurrency and Gold Performance

This year’s market rally went beyond stocks. Bitcoin, which was below $17,000 just two years ago, climbed above $100,000 for the first time. And gold also shattered records on its way to a more than 26% gain for the year.

Markets will be closed on Wednesday for the New Year’s Day holiday. On Thursday, investors will get an updated snapshot of U.S. construction spending for November. On Friday, Wall Street will receive an update on manufacturing for December.

RELATED TOPICS:

Categories

UAE Royal Bought Stake in Trump Crypto Firm Before AI Chip Deal

Fresno Police Report 12 DUI Arrests During Weekend Operation

Trump Warns Iran With Military Muscle, but Risks a Regional War