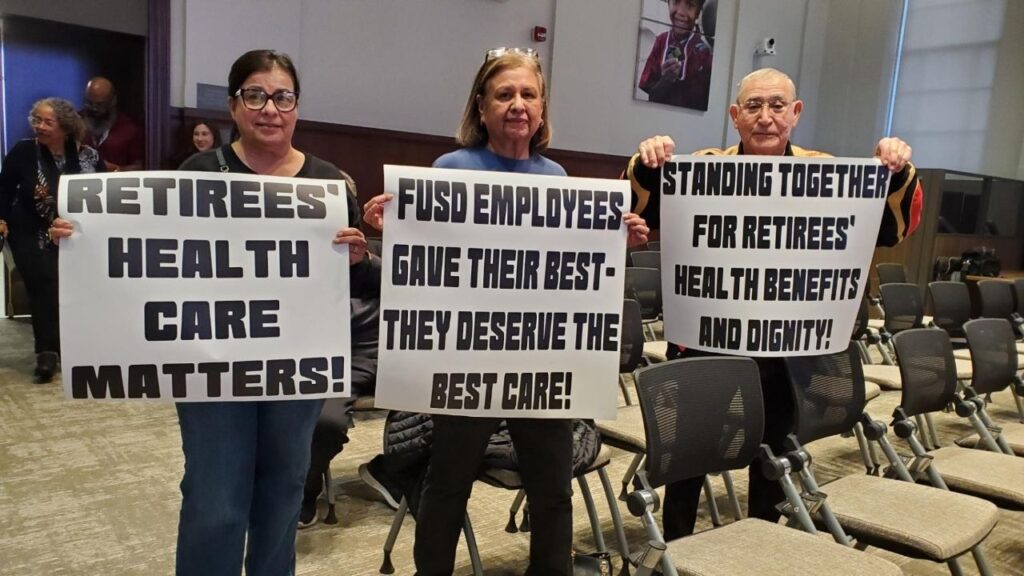

A class-action lawsuit filed by former employees against bankrupt Bitwise Industries is nearing settlement for $20 million, says Fresno attorney Roger Bonakdar. (GV Wire Composite/Paul Marshall)

- What is left of Bitwise Industries agreed to a $20 million class-action settlement with former employees.

- An attorney estimates that could net $15,000 per employee.

- The money could come by the end of the year.

Share

|

Getting your Trinity Audio player ready...

|

It could be a happy holiday for nearly 700 former Bitwise Industries employees. The bankrupt company preliminarily has settled a class action lawsuit for $20 million.

“I’d like to see these folks get that money before Christmas. That might be a bit ambitious. But we’re going to be at the mercy of the Delaware bankruptcy court and its timelines.” — Attorney Roger. Bonakdar, who represents former Bitwise employees in a class action lawsuit

Attorney Roger Bonakdar of Fresno estimates the settlement will mean about $15,000 for each employee, which could be paid by the end of the year.

“This is huge. It’s an incredible development, for these employees who’ve been shorted and stolen from. And we’re really proud to get them some relief,” Bonakdar told GV Wire.

According to the court documents, “Any awarded Service Payments shall be characterized as non-employee compensation to the Class Representatives and shall be reported to the Taxing Authorities on behalf of each Class Representative on an IRS Form 1099.”

The remainder of the money, according to court documents, will go toward the bankruptcy administrators and attorneys — who are entitled to up to one-third of the settlement amount.

The settlement applies just to employees and not other creditors. Bonakdar said the former employees have priority to collect.

Court documents said fighting for a full settlement in court would be difficult. The trustee investigated 1.4 million documents.

“When weighed against the risks of an adverse outcome, with respect to both liability and to damages, the $20 million that will be realized under the Settlement Agreement … is a very favorable recovery,” attorneys for interim bankruptcy trustee Jeoffrey Burtch said in court documents.

Related Story: Former Bitwise CEOs Answer ‘Guilty’ to Fraud Charges in Federal ...

Preliminary Settlement Filed

The Delaware-based bankruptcy trustee filed the preliminary agreement in bankruptcy court on Monday. Any objection among the parties must be filed by Aug. 14, with a potential hearing on Aug. 21.

Bitwise, the once shining Fresno technology and real estate company, failed on Memorial Day 2023. All employees were furloughed and eventually laid off. The company had been experiencing financial hardship, failing to pay property taxes and having payroll issues.

Court documents said Bitwise’s payroll at the time of its demise was $6 million, when revenues may have been only $3 million. By June 2023, the company had $73 million in outstanding private loans, and liabilities of more than $100 million.

The company filed for bankruptcy in June 28, 2023, weeks after the board fired co-CEOs and company founders Jake Soberal and Irma Olguin Jr.

The federal government charged Soberal and Olguin on two fraud counts, alleging they lied to investors and lenders, and altered financial documents in an attempt to save the company.

Soberal and Olguin pleaded guilty earlier this month, and will be sentenced Nov. 6. Sentencing guidelines indicate a penalty of 12 to 15 years in prison. The plea agreement also requires the defendants to pay $115 million in restitution to the investors and lenders they ripped off.

Related Story: Community Reacts to Social Media Apology From Guilty Bitwise CEOs

Employee: Layoff a Struggle

Two separate groups of employees filed lawsuits, one in the Fresno County Superior Court — the Garza case, represented by Bonakdar, who is also running for Fresno City Council in November — and one in the Fresno-based federal court, the Nunn case.

Victor Carranza worked as a Salesforce administrator at Bitwise for three years. He was a plaintiff in the Garza case.

“It definitely provides some closure,” Carranza says. “It does help.”

Carranza said it was a “struggle” finding work.

“Being able to find work, at a time where a lot of tech companies were going through layoffs, specifically in my space … and since then, it was until about nine months, I found a new role with the new company,” Carranza said.

He said he is “loving” is new company.

Former Employees to Receive Notice

Negotiations started in January among the parties.

Bonakdar said the process is complex, with several more court hearings before the settlement is final.

“We’ve done all the work. We’ve done the heavy lifting. Everyone will start to get notices in the mail in several months from the court. And, the process is moving forward,” Bonakdar said.

Court documents said debtors had a claim against the board of directors — consisting at the time of the company’s collapse of Ollen Douglass, Paula Pretlow, Joseph Proietti, and Mitchell Kapor — “based primarily on an alleged failure to exercise oversight.”

Former Bitwise president Bethany Mily was also part of the defendants settling.

Related Story: Stacks of Lies and Fake Documents: Prosecutors Detail the Fraud Hatched by ...

“I’d like to see these folks get that get money before Christmas. That might be a bit ambitious. But we’re going to be at the mercy of the Delaware bankruptcy court and its timelines,” Bonakdar said.

In both parties’ lawsuits, they claimed Bitwise violated state and federal laws requiring advance notice of layoffs. The plaintiffs will dismiss those claims — as well as any other claim — as part of the settlement.

Potential members of the class action could opt out of the settlement by Nov. 8.

Who Owes What

The settlement money comes from various insurance polices, and members of the Bitwise board of directors or their affiliates.

Court documents specified which party owes how much:

- Hanover Insurance Company: $2 million

- Scottsdale Insurance Company: $4.5 million

- Great American E & S Insurance Company: $5 million

- Director Mitchell Kapor, as part of his preference claim: $5 million

- Motley Fool Ventures (associated with Director Douglass): $75,000

- Kapor and Kapor-related entities: approximately $3.425 million

RELATED TOPICS:

Categories

Fresno Police Seek Public’s Help Finding Missing 61-Year-Old Man