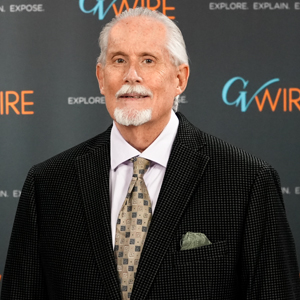

Jake Soberal (left) and Irma Olguin, Jr. plead guilty to one count of wire fraud, and one wire fraud conspiracy count on Wednesday, July 17, 2024. (GV Wire Composite/Paul Marshall)

- The Department of Justice spells out the key elements in the $115 million fraud hatched by Bitwise's former CEOs.

- With Bitwise collapsing, Irma Olguin, Jr. and Jake Soberal lied to investors and altered financial documents.

- In March 2023, Soberal convinced a Bitwise employee to make a significant loan to the company based on false representations.

Share

|

Getting your Trinity Audio player ready...

|

After the former CEOs of Bitwise Industries entered guilty pleas to wire fraud and conspiracy on Wednesday morning at Fresno’s federal courthouse, the Department of Justice issued a news release outlining key elements of their $115 million fraud scheme.

In a nutshell, Bitwise was a financial house of cards and in an effort to prop it up, then CEOs Irma Olguin, Jr. and Jake Soberal presented fake documents to potential investors and lied repeatedly about the company’s collapsing financial condition to its board of directors, potential investors, the Fresno community at large, and company employees.

Related Story: Former Bitwise CEOs Answer ‘Guilty’ to Fraud Charges in Federal ...

“Olguin, Jr. and Soberal admitted that they used their positions as Bitwise’s co-Chief Executive Officers to conceal their fraud from the company’s board of directors and others at the company. They also admitted to using sophisticated means to deceive and cheat investors and lenders out of their money,” the Department of Justice said.

“They fabricated financial information in investor materials and altered and forged other financial records to inflate the company’s revenues, cash balances, and other financial markers.”

Key Elements of the Fraud

Here are some examples of criminal conduct by the co-conspirators that FBI agents and IRS investigators uncovered for the case being prosecuted by Assistant U.S. Attorneys Joseph Barton and Henry Carbajal III:

— In a February 2022 presentation and July 2022 prospectus circulated to investors, Olguin, Jr. and Soberal represented that Bitwise’s cash balance was more than $44 million at the close of 2021. They also represented company revenue exceeding $58 million. The company’s cash balance actually was less than $12 million and its revenue was minimal.

— In June and July 2022, Olguin, Jr. and Soberal falsely represented to a California-based investment firm that Bitwise had secured a $150 million from a London-based investment firm. This was done to convince a California-based investment firm to purchase several buildings that Bitwise owned. Several months later, Soberal falsely represented to another lender that Bitwise still owned those buildings to get the lender to loan Bitwise millions more dollars.

— Also in March 2023, Olguin, Jr. and Soberal provided an investor with an altered version of an audit of Bitwise that was previously conducted by an international audit firm. They altered the audit to make it appear Bitwise’s revenue was 300% higher than it was.

— Also in March 2023, Soberal represented to a long-time Bitwise employee that the company had sufficient resources on-hand to convince the employee to make a significant loan to the company.

This pattern continued until the end of May 2023 when Bitwise ran out of money and the company collapsed, prosecutors said.