Share

|

Getting your Trinity Audio player ready...

|

![]()

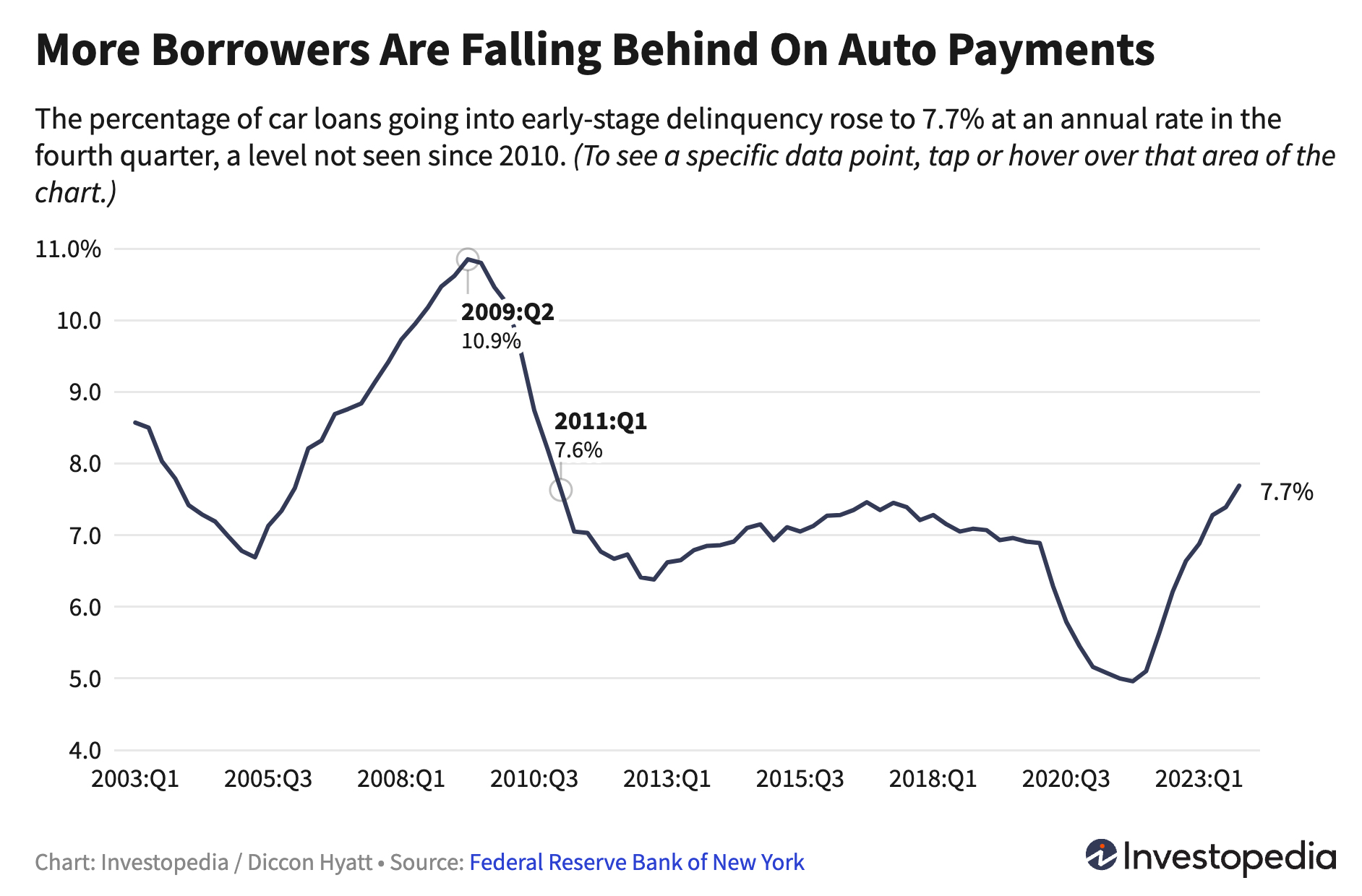

■7.7% of auto loans are in early-stage delinquency, a level not seen since 2010

■Federal Reserve economists think higher interest rates and car prices make keeping up with payments difficult.

■More people have monthly car payments of about $1,000.

Drivers are falling behind on their car payments as auto loan delinquencies have reached levels not experienced since the Great Recession.

The rates come as people pay more than ever before for cars, SUVS, and trucks. But consumer debt isn’t limited to the car market. The Federal Reserve finds debt of all kinds has risen to record amounts.

Fresno bankruptcy attorney Stephen Labiak, the owner of Law Offices of Stephen Labiak, says that in the 15 years of his practice, he’s never been busier. He hears people telling him they’re losing hours, or they lost their job entirely. One client said that after 30 years in the recording industry, his business has gone completely silent.

“They’re just overwhelmed. It’s a combination of things: A lot of people spent too much on cars over the last couple of years, and then with the price increases in food and everything, it’s just finally caught up to everybody,” Labiak said.

People Paying More, Longer for Their Cars

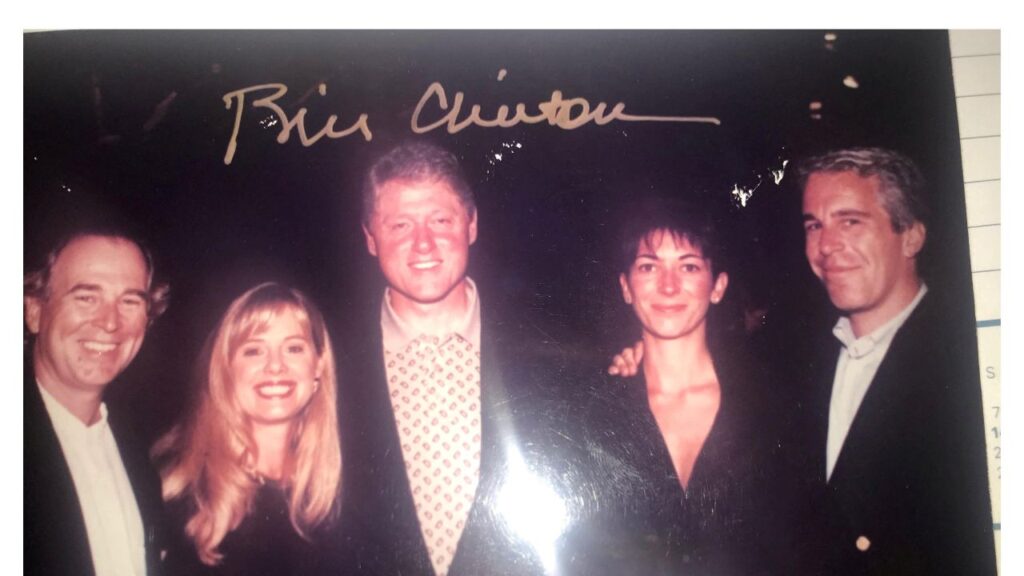

Economists have not seen the 7.7% auto loan delinquency rate since 2010 during the Great Recession. In the second quarter of 2009, 10.9% of borrowers fell behind on their car payments.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

Despite declining car prices, people are paying more than ever on their loans, with the average monthly payment reaching $623, according to Investopedia. Nearly 18% of auto loans require monthly payments of more than $1,000. Many of those have long life spans. Nearly 65% of auto loans with monthly payments over $1,000 have terms between 67 and 84 months.

Tracking incomes, those in the poorest zip codes carried the second-highest average monthly auto payment throughout 2023 —trailing only those in the highest-income zip codes.

For the lowest-income people, the average monthly payment reached $564 by the end of the year, compared to $623 for the highest-income car buyer.

“Delinquency transition rates have pushed past pre-pandemic levels, and the worsening appears to be broad-based,” researchers at the New York Fed wrote in a blog post. “Loans opened during 2022 and 2023 are, so far, performing worse than loans opened in earlier years, perhaps because buyers during these years faced higher car prices and may have been pressed to borrow more, and at higher interest rates.”

Bankruptcy Attorney Says He’s Never Seen So Many Requests for Help

Labiak predicts the number of bankruptcies to spike in the next six months.

While unemployment rates have been rising, the problem goes beyond job losses, Labiak said. The reason to file bankruptcy is if you have something to protect.

“If you have no income, you have no reason to file bankruptcy,” Labiak said.

Even for medical debt, Labiak said he can count on one hand the number of people who have filed bankruptcy for hospital bills.

What Labiak sees is the accumulation of small debts.

“You’re short $100 this month, you’re short $200 this month, so you borrow on the credit card, well now the credit card payment goes up 20 bucks because you borrowed last month,” Labiak said.

America’s Growing Personal Debt

The Federal Reserve found household debt of all kinds grew by $212 billion in the last quarter of 2023. While growth had been across most loan types, Fed economists called the expansion “moderate compared to the fourth-quarter changes seen in the past few years.”

Credit card debt grew $50 billion in Q4 2023 from the previous quarter and $143 billion year-over-year. The percentage of credit card borrowers now considered in serious delinquency — 90 days or more late — increased to 6.36% in Q4 2023 from 4.01% in Q4 2022.

Mortgage balances grew by $112 billion.

With interest rates higher than during the heights of the pandemic, homeowners are tapping into their home equity lines of credit in lieu of refinancing first mortgages, according to the Fed.

Over the past two years, home equity credit line balances have increased, breaking a 10-year-long trend. Balances grew $24 billion year-over-year in Q4 2023 and $11 billion from the previous quarter.

In the case of cars, those monthly payments have always worn on people struggling with debt, Labiak said.

“It’s just more pronounced because a bad car payment used to be 600 bucks,” Labiak said. “Now that number is a thousand, 1,200 bucks.”