Share

WASHINGTON — The nation’s economy expanded at a robust 4.9% annual rate from July through September as Americans defied higher prices, rising interest rates and widespread forecasts of a recession to spend at a brisk pace.

The Commerce Department said the economy expanded last quarter at the fastest pace in nearly two years — and more than twice the 2.1% annual rate of the previous quarter.

Thursday’s report on the nation’s gross domestic product — the economy’s total output of goods and services — showed that consumers drove the acceleration, ramping up their spending on everything from cars to restaurant meals. Even though the painful inflation of the past two years has soured many people’s view of the economy, millions have remained willing to splurge on vacations, concert tickets and sports events.

Last quarter’s robust growth, though, may prove to be a high-water mark for the economy before a steady slowdown begins in the current October-December quarter and extends into 2024. The breakneck pace is expected to ease as higher long-term borrowing rates, on top of the Federal Reserve’s short-term rate hikes, cool spending by businesses and consumers.

The growth figures for the third quarter revealed that federal, state, and local governments ramped up their spending, and businesses built up their stockpiles of goods in warehouses and on shelves, which helped drive growth higher. The increase in inventories, which accounted for about a quarter of the July-September growth, isn’t likely to be repeated in the coming months, economists say.

The economy managed to accelerate last quarter despite the Fed’s strenuous efforts to slow growth and inflation by raising its benchmark short-term interest rate to about 5.4%, its highest level in 22 years.

Several Fed officials acknowledged in speeches last week that the most recent economic data showed growth picking up by more than they had expected. Still, most of the policymakers signaled that they will likely keep their key rate, which affects many consumer and business loans, unchanged when they meet next week.

Worker Pay Starting to Outpace Inflation

A range of factors are helping fuel consumer spending, which accounts for the bulk of the economy’s growth. Though many Americans are still feeling under pressure from two years of high inflation, average pay is starting to outpace price increases and enhance people’s ability to spend.

During the July-September quarter, Thursday’s report showed, consumers spent lavishly on both goods and services. There were some one-time factors that boosted spending, such as blockbuster concert tours by Taylor Swift and Beyonce. Fans spent an average of $1,400 on air fares, hotel rooms, and concert tickets to see Swift’s shows, and an average of $1,800 for Beyonce, according to calculations by Sarah Wolfe, U.S. economist at Morgan Stanley.

Wages and salaries in the April-June quarter, the latest period for which data is available, rose 1.7% from a year earlier, after adjusting for inflation, according to the Labor Department. That was the fastest quarterly increase in three years.

Americans, as a whole, also began the year on healthy financial footing, according to a report last week from the Fed. The net worth of a typical household jumped 37% from 2019 through 2022. Home prices shot higher, and the stock market rose in the biggest surge on records dating back more than 30 years.

At the same time, families benefited from the unusually low interest rates that lasted from the pandemic recession of 2020 until late last year. The typical household — the one midway between the richest and poorest — paid 13.4% of its income to cover interest on debts, the lowest such proportion on record, the Fed report said.

Still, consumers are likely reining in their spending in the final three months of the year, and the sluggish housing market is dragging on the economy as well. This month, nearly 30 million people began repaying several hundred dollars a month in student loans, which could slow their ability to spend. Those loan repayments had been suspended when the pandemic struck three years ago.

The economy faces other challenges as well, including the prospect of a government shutdown next month and a spike in longer-term interest rates since July. The average 30-year mortgage rate is approaching 8%, a 23-year high, putting home buying out of reach for many more Americans.

Fed Chair Jerome Powell, in a discussion last week, said he was generally pleased with how the economy was evolving: Inflation has slowed to an annual rate of 3.7% from a four-decade high of 9.1% in June 2022. At the same time, steady growth and hiring have forestalled a recession, which was widely predicted at the end of last year.

If those trends continue, it could allow the Fed to achieve a highly sought-after “soft landing,” in which it would manage to slow inflation to its 2% target without causing a deep recession.

Still, Fed officials were surprised by a strong government report last week on retail sales, which showed that spending at stores and restaurants jumped last month by much more than expected. Powell has since acknowledged that if the economy were to keep growing robustly, the Fed might have to raise rates further. Its benchmark short-term rate is now about 5.4%, a 22-year high.

With inflation generally easing, the Fed is expected to keep its short-term rate unchanged when it meets next week. Many economists increasingly expect the central bank’s policymakers to keep rates on hold when they meet in December as well.

Powell will hold a news conference Wednesday that will be scrutinized for any hints about the Fed’s next moves.

RELATED TOPICS:

Categories

Kazakhstan to Join Abraham Accords, Trump Says

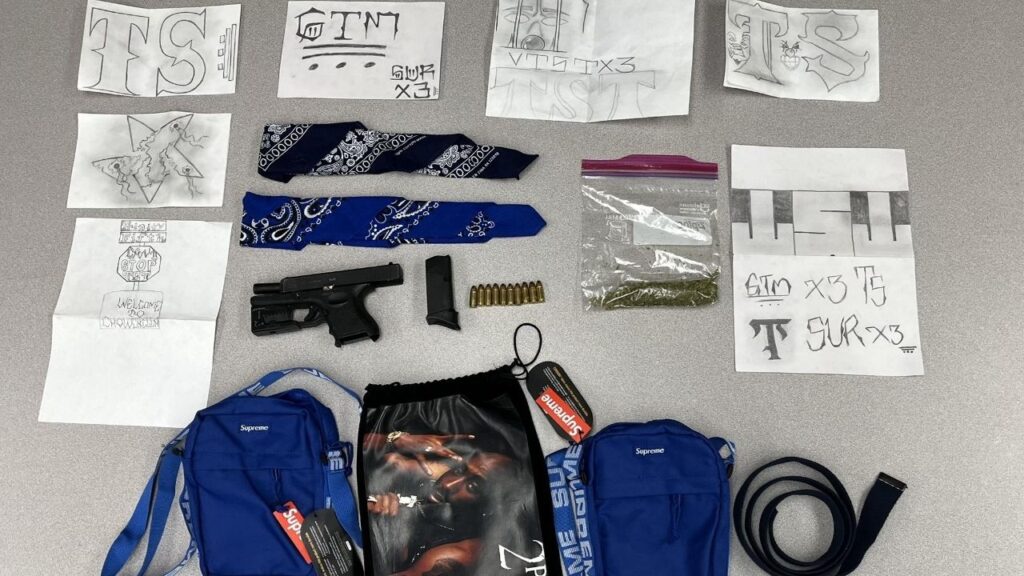

Chowchilla Police Arrest Two in Connection With Shooting

Who Will Replace Pelosi in Congress?