Share

|

Getting your Trinity Audio player ready...

|

Seven years ago, Bitwise Industries had ambitious goals.

In a 2016 letter to the community, the Fresno-based technology and real estate company unveiled a vision of 1,000 tech companies employing 250,000 workers in downtown Fresno. A light-rail train would help speed workers from outlying communities to the tech hub.

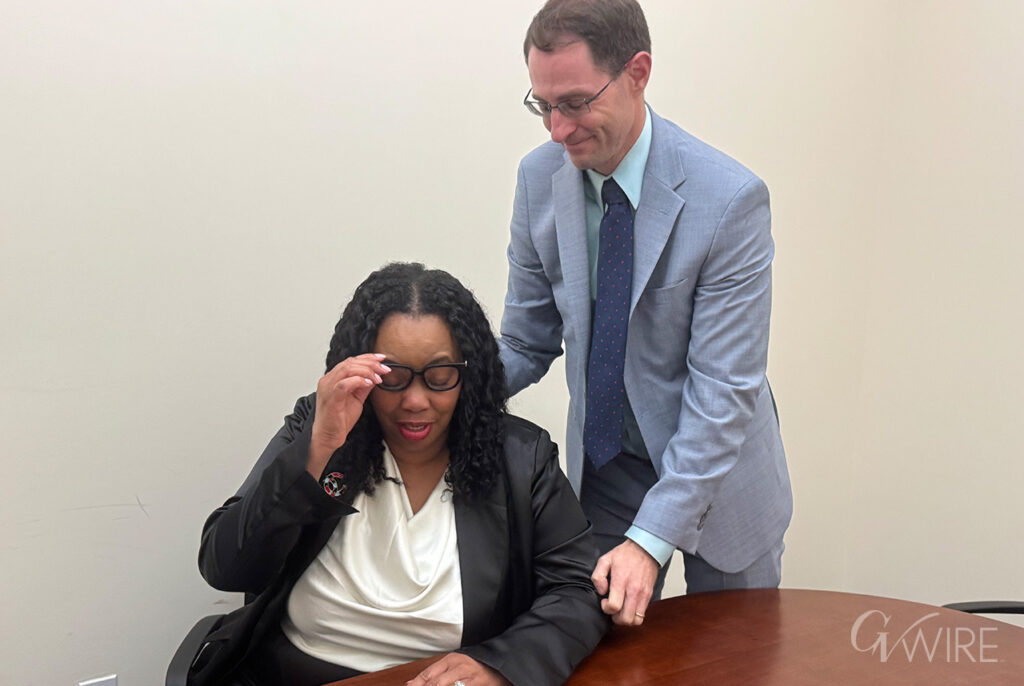

“I think our role is to try, to try audacious things,” Bitwise co-CEO Jake Soberal said Tuesday in an exclusive interview with GV Wire.

Goals aside, public records show Bitwise is late on paying its Fresno County property taxes.

Soberal, however, says his company is fine financially.

“I hope it’s good. We’re really excited about the future over here,” Soberal said.

“I want to be clear. I said that I was optimistic about the financial future for Bitwise. For anybody that’s listening, I would like more cash than I have, always. And we’re going to keep doing our best to do this well.”

Late on Taxes, Late on Rent

Records from the Fresno County Assessor’s office show that Bitwise has failed to pay its property taxes on four downtown Fresno buildings.

Bitwise has not made a payment of $122,000 that was due on April 10. The figure is the second installment for the 2022-23 tax rolls. The company was one month late paying the first installment, also for $122,000, due last December.

It is also delinquent on paying its landlord. A real estate source says Bitwise owes Baltara Enterprise LP $500,000 in unpaid rent for three of the buildings it leases in downtown Fresno.

“That’s news to me. I’m happy to check in on it,” Soberal said. “One of the unfortunate parts of running a company that’s growing really quickly is … things get missed. We’ve got a great finance team, but that’s not an issue that I’m directly read in on.”

Regarding the rent, Soberal believes Bitwise is up-to-date. He also says Bitwise is an “atypical” business for Fresno.

“The fast-growth technology company doesn’t operate like a 100-year-old company. We don’t have perpetually … the systems and processes necessary to stay up with where we are today. We’re always, always on the (general and administrative) side going to be catching up to our growth on the revenue side. And so it’s a bummer. It’s really hard.

“This is one of the hardest stretches of scale for me, but the infrastructure that is necessary to hold up a company of the size of Bitwise is something we still got a lot of building to do,” Soberal said.

Watch: GV Wire’s David Taub Interviews Bitwise co-CEO Jake Soberal

Soberal Mum on Specifics About Company Finances

Bitwise reported raising $157 million from investors over the last four years.

Soberal would not answer specifics about the conditions of the financing. For example, how much Bitwise stock investors own or who sits on the board.

Asked if he has solicited Fresno business leaders for short-term, high-interest loans, Soberal said he’s been doing so for the last 10 years.

“Bitwise is a large company. We are constantly doing both debt and equity transactions. But, as a private company, we don’t report out on those both for our confidentiality and those of our financial partners,” Soberal said.

Soberal was sidestepped answering whether he wants to take Bitwise public.

“I think we’re trying to get smart and be eager learners around the financial future that is going to suit the mission of Bitwise and its commercial objectives best. And I don’t know the answer to that question. I may be fired at some point because I’m not, you know, 12 steps ahead of us,” Soberal said.

Sources of the $157 Million in Capital

Last February, Bitwise announced it raised $80 million in funding to help expand to the southside of Chicago. The investment was “led by Kapor Center and Motley Fool with participation from the Growth Equity business within Goldman Sachs Asset Management and Citibank,” according to a company news release.

In 2021, Bitwise raised $50 million with its Series B financing, led by Kapor Capital, JPMorgan Chase, Motley Fool, and ProMedica. It raised $27 million in Series A funding in 2019.

Of its Bitwise investment, JPMorgan Chase said in a news release, “Providing low-cost, long-term capital and technical expertise to more underserved entrepreneurs in the U.S., including expanding the Entrepreneurs of Color Fund to new U.S. cities; making direct equity investments in early-stage businesses to help companies like Bitwise Industries, the firm’s initial direct equity investment, drive economic opportunity, including in Black and Latinx communities.”

JPMorgan said company officials were not available this week for an interview about Bitwise. Kapor did not respond to a request for comment.

Bitwise Industries also received a $2 million loan on its R Street building from Startop Investments in January, finance records show.

During the pandemic, ProPublica reported BW Industries receiving two federal Payment Protection Program loans, totaling $4.6 million to cover payroll costs. The loans were forgiven.

Lawsuit Over R Street Building

There appears to be activity at the refurbished warehouse on R and Inyo streets.

Several restaurants operate in a food court style on the first floor. The rest of the building is closed off. Soberal said not even his key works.

The company is in the process of moving in, but does not have a specific date, he said.

Bitwise Industries bought the building last year for $21 million to settle a lawsuit. The dispute, litigated in Fresno County Superior Court, alleged that Bitwise refused to move in or pay monthly rent of $150,000 when the building was occupant-ready in December 2021.

The case was settled out of court within six months.

“Unfortunately sometimes, some folks believe that a lawsuit is the right-fitting tool to solve a problem,” Soberal said. “It’s in the past and it’s not something I’m super interested in spending a ton of time on.”

Lawsuit Allegations

Real estate records show that BW Industries, Inc., through a company called 747 R Street LLC — both listed at Bitwise’s main campus on 700 Van Ness Avenue — bought 747 R Street from Bitwise at State Center LLC in July 2022. Despite the similar names, the two groups are separate — although Soberal is a manager in both groups.

Soberal’s partners in the State Center group include Fresno businessmen Will Dyck, Eric Wilkins, and Paul Quiring. The group is not affiliated with the State Center Community College District.

According to the lawsuit, landlord Bitwise at State Center LLC budgeted $3.2 million for tenant improvements. When change requests from the tenant put the project over budget, BW Industries, Inc. and Soberal were responsible for paying, and they didn’t. The tenant also refused to pay taxes, utilities, and fees as required by the lease, the lawsuit states.

In a legal response, BW Industries, Inc. and Soberal said:

“This case proves the old maxim that one should beware going into business with friends … Unfortunately, multiple missteps by certain of State Center’s members during the building’s planning stages exacerbated architect mistakes and impacts from the COVID-19 pandemic.”

The filing said the refurbished building “did not live up to Mr. Soberal’s vision nor BW Industries’ needs. State Center should own up to that reality and work with Defendants to salvage some value from this construction adventure.”

Bitwise Buildings up for Sale

Less than a year after its purchase, the building and two properties in Bakersfield are back on the market.

“We’ve engaged for years now in sale-leaseback transactions. So, as a technology company, when we think about things like going public, the market preference is for us to be what’s called ‘asset light’ and so not own the real estate, but be a long-term tenant of it. And so Bitwise isn’t going anywhere, but those assets will eventually all come off of our balance sheet,” Soberal said.

Bitwise Influence on Policy

Gov. Gavin Newsom recently announced $250 million in his May budget revise for downtown Fresno.

Soberal applauded the move, although he says he had no direct conversations with Newsom about the support.

“We want to be a finger on the scale in favor of our hometown and particularly its downtown,” Soberal said. “I hope that we were some evidence in favor.”

Newsom has visited Bitwise in the past. He appointed co-CEO Irma Olguin Jr. to the State Community College Board of Governors.

“I do hope that we’re influencing the state’s agenda and the governor’s agenda in a positive way that is accretive to our hometown with a relationship that we treasure. We are grateful for Governor Newsom’s leadership. We’re grateful for Mayor Jerry Dyer’s leadership. And so I hope that we’re influencing more dollars getting directed to our hometown,” Soberal said.

Achieving Those 2016 Goals

In the 2016 open letter to the community, Bitwise expressed hope of, within five years, achieving its goals of tech employment, 2.5 million square feet of space in downtown Fresno, and that light-rail train.

Soberal said the goal of 250,000 tech jobs is “hard to quantify.” Bitwise says that it has 300 employees in Fresno.

“I think we put a meaningful dent in those numbers,” Soberal said.

As far as the 2.5 million of tech space, Soberal said that among the four downtown Fresno buildings Bitwise operates and the spaces the company owns or leases in Bakersfield, Oakland, Merced, Ohio, and Texas, the company Bitwise is close to that number.

Soberal said that when the pandemic hit commercial real estate hard, Bitwise expanded its horizons.

“We got really ambitious around not just growing in Fresno but growing in other cities. And so that 2.5 million square feet maybe doesn’t just sit in Fresno, but sits around the country today. Or we’re working towards that,” Soberal said.

The optimistic Soberal acknowledges a loss on the other goal.

“I think that it’s fair to say that we have completely failed at building a train. But still think that it’s a worthy goal to chase.”