Share

|

Getting your Trinity Audio player ready...

|

A Fresno woman pleaded guilty on Monday morning to stealing more than $70,000 from customer accounts at Fresno-based BANK ONE.

According to the FBI’s criminal complaint, an agent reviewed the bank’s call logs and ATM surveillance video in making the case against Lladira Hernandez, 23.

The FBI took up the case after being contacted by the bank, documents stated.

In one instance, a customer died the day after talking to Hernandez and she stole $7,000 from the customer’s account shortly thereafter.

Funds stolen by Hernandez were returned to the customers, the criminal complaint said.

Stolen Funds Used for Mortgage, Other Bills

According to court documents, the banked hired Hernandez in April 2022 as a customer service representative. She began stealing the account information for customers she helped over the phone and used it to pay bills for herself and her associates.

This included mortgage payments, car payments, and phone bills. In August 2022, Hernandez transferred more than $45,000 from two customers’ accounts into her own account and abruptly quit her job at the bank. She proceeded to withdraw that money from her account and was captured doing so on surveillance video.

After quitting her job at the bank, Hernandez worked as a teller at a local credit union before a warrant for her arrest was issued.

Assistant U.S. Attorney Joseph Barton is prosecuting the case.

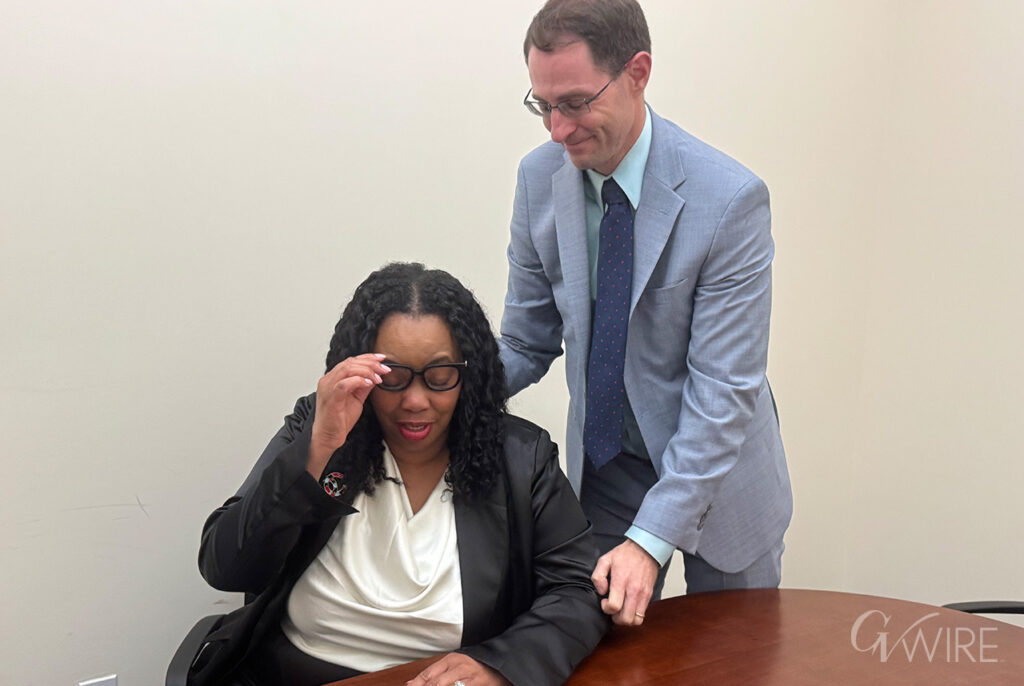

Hernandez is scheduled for sentencing by U.S. District Judge Ana de Alba on Sept. 5.